How much is the accidental death insurance market worth, and how is it expected to expand?

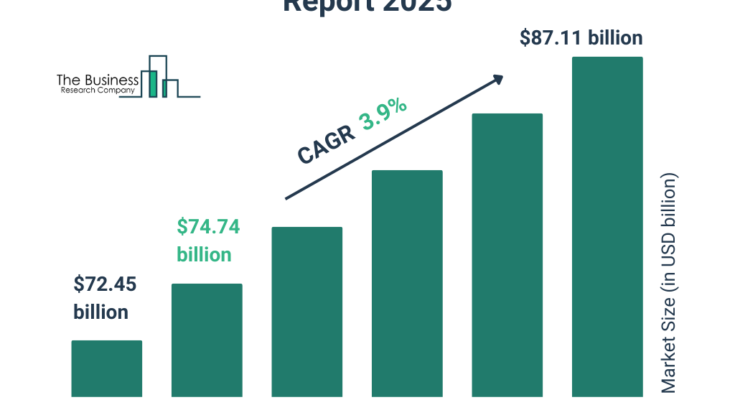

The accidental death insurance market size has grown steadily in recent years. It will grow from $72.45 billion in 2024 to $74.74 billion in 2025 at a compound annual growth rate (CAGR) of 3.2%. The growth in the historic period can be attributed to awareness and education, insurance market evolution, occupational hazards, and changing lifestyles.

The accidental death insurance market size is expected to see steady growth in the next few years. It will grow to $87.11 billion in 2029 at a compound annual growth rate (CAGR) of 3.9%. The growth in the forecast period can be attributed to risk management, digital platforms, health and wellness incentives, travel and adventure. Major trends in the forecast period include digital distribution, customized coverage, bundled insurance products, riders and add-ons.

Get Your Free Sample of The Global Accidental Death Insurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2451&type=smp

Which industry factors have accelerated the accidental death insurance market’s expansion?

The rising awareness of environmental issues is expected to drive the growth of the accidental death insurance market going forward. Environmental issues encompass concerns related to the natural world, including challenges such as pollution, climate change, deforestation, habitat destruction, and biodiversity loss, which impact the environment and ecosystems. The increasing frequency of natural disasters such as floods, hurricanes, and wildfires is expected to increase demand for accidental death insurance policies. For instance, in May 2024, according to reports published by the Ministry for the Environment, a New Zealand-based organization, environmental issues remain the fourth most significant concern for New Zealanders, following more pressing matters such as the cost of living, crime, and housing. Awareness of these issues rose notably from 20% in 2022 to 25%. Therefore, the rising awareness of environmental issues is expected to drive the growth of the accidental death insurance market.

What are the primary segments of the accidental death insurance market?

The accidental death insurance market covered in this report is segmented –

1) By Application: Personal, Enterprise

2) By Product: Personal Injury Claims, Road Traffic Accidents, Work Accidents, Other Products

3) By Distribution Channel: Direct marketing, Bancassurance, Agencies, E-commerce, Brokers

Subsegments:

1) By Personal: Individual Policies, Family Policies, Group Policies

2) By Enterprise: Employee Benefits, Corporate Policies, Business Continuity Plans

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/accidental-death-insurance-global-market-report

Which firms are leading the accidental death insurance market?

Major companies operating in the accidental death insurance market include Allianz SE, Assicurazioni Generali SpA, China Life Insurance Company Limited, MetLife Inc., Ping An Insurance Company of China Ltd., AXA SA, Sumitomo Life Insurance Company, Aegon Life Insurance Company Limited, Dai-ichi Life Insurance Company Limited, Clinical Pharmacogenetics Implementation, Aviva plc, Munich Re Group, Zurich Insurance Group Ltd., Reliance Nippon Life Insurance Company, Gerber Life Insurance Company, American International Group Inc., Prudential Financial Inc., Mutual of Omaha Insurance Company, Aflac Inc., Transamerica Corporation, Fidelity Life Association, Hartford Financial Services Group Inc., Sun Life Financial Inc., Taiwan Life Insurance Co. Ltd., Massachusetts Mutual Life Insurance Company, Farglory Life Insurance Col Ltd., TruStage Financial Group Inc., Securian Financial Group Inc., American National Insurance Company, American Family Insurance, Amica Mutual Insurance Company, Erie Insurance Group

Which market trends are set to define the future of the accidental death insurance market?

Major companies operating in the accidental death insurance market are introducing innovative products to gain a competitive edge in the market. For instance, in March 2022, Asteya, a US-based technology company specializing in income insurance, unveiled a new product, namely accidental death coverage. Asteya’s digital insurance platform is designed to cater to the needs of modern entrepreneurs, offering cost-effective, rapid, and easily accessible insurance to safeguard their earnings. The company’s mission is to ensure that income insurance is within reach for everyone, with the ultimate objective of bolstering individuals’ financial, physical, and mental well-being.

How do regional factors impact the accidental death insurance market, and which region is the largest contributor?

North America was the largest region in the accidental death insurance market in 2024. Asia-Pacific was the second-largest region in the accidental death insurance market. The regions covered in the accidental death insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

What Does The Accidental Death Insurance Market Report 2025 Offer?

The accidental death insurance market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

An accidental death insurance policy protects you and your family in the event of serious injuries or death in an accident. The financial institutions pay a lump sum amount to the beneficiary in case of an accidental death, in addition to the standard benefit payable if the insured dies of natural causes. This type of insurance is often an addition or a clause connected to a life insurance policy.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2451

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model