Overview and Scope

Artificial intelligence (AI) in fraud management refers to the use of advanced technologies, algorithms, and machine learning techniques to detect, prevent, and mitigate fraudulent activities in various domains. The purpose of AI in fraud management is to enhance the detection and prevention of fraudulent activities in real-time, with automating the fraud detection process, increasing efficiency and reducing the time required to identify and respond to fraudulent activities.

Sizing and Forecast

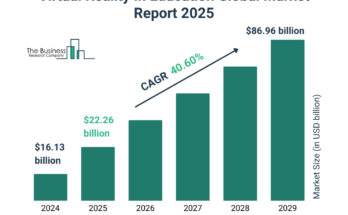

The AI in fraud management market size has grown rapidly in recent years. It will grow from $10.88 billion in 2023 to $13.05 billion in 2024 at a compound annual growth rate (CAGR) of 20%. The growth in the historic period can be attributed to increasing cyber threats, data breaches, increasing transaction volumes, cost of fraud, awareness and education.

The AI in fraud management market size is expected to see rapid growth in the next few years. It will grow to $26.51 billion in 2028 at a compound annual growth rate (CAGR) of 19.4%. The growth in the forecast period can be attributed to AI integration in business processes, advancements in explainable AI, globalization of fraud, continued regulatory emphasis, integration of real-time data streams. Major trends in the forecast period include rapid technological advancements, regulatory compliance, collaborative fraud detection networks, behavioral biometrics adoption, convergence of AI and blockchain.

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/ai-in-fraud-management-global-market-report

Segmentation & Regional Insights

The AI in fraud management market covered in this report is segmented –

1) By Solution: AI-Powered Fraud Prevention Software, Services

2) By Enterprise Size: Small and Medium Enterprises (SMEs), Large Enterprises

3) By Application: Identity Theft Protection, Payment Fraud Prevention, Anti-Money Laundering, Other Applications

4) By Industry: Banking, Financial Services and Insurance, IT And Telecom, Healthcare, Government, Education, Retail And Consumer packaged goods (CPG), Media And Entertainment, Other Industries

North America was the largest region in the AI in fraud management market in 2023. The regions covered in the AI in fraud management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=14241&type=smp

Major Driver Impacting Market Growth

The rising popularity of digital payments and cross-border transactions is expected to propel the growth of AI in the fraud management market going forward. The increasing popularity of digital payments and cross-border transactions is driven by convenience, allowing users to transact anytime, anywhere, using mobile devices or computers. The integration of AI in fraud management is essential for maintaining the security and trustworthiness of digital payment systems and protecting users and businesses from fraudulent activities. For instance, according to the National Payments Corporation of India (NPCI), an India-based organization that operates retail payments, the overall transaction value of UPI at the end of the calendar year 2022 was INR 125.95 trillion (USD 1.52 trillion), rising 1.75 times year on year (YoY). Additionally, the entire value of UPI transactions accounted for over 86% of India’s GDP in FY 22. Therefore, the rising popularity of digital payments and cross-border transactions is driving the growth of AI in the fraud management market.

Key Industry Players

Major companies operating in the AI in fraud management market are Trusteer, Hewlett Packard Enterprise, BAE Systems plc, Capgemini SE, Cognizant Technology Solutions India Private Limited., SAS Institute Inc., Splunk Inc., Temenos AG, Shift Technology SAS, Pelican Products Inc., Riskified Ltd., NICE Actimize Inc., Jumio Corp., Onfido Ltd., Subex Limited, BehavioSec Inc., Arxan Technologies Inc., Socure Inc., ACTICO GmbH, BioConnect Inc., Matellio Inc., MaxMind Inc., Zest AI Inc., Chargeback.com Inc., Brighterion Inc.

The ai in fraud management market report table of contents includes:

1. Executive Summary

2. AI In Fraud Management Market Characteristics

3. AI In Fraud Management Market Trends And Strategies

4. AI In Fraud Management Market – Macro Economic Scenario

5. Global AI In Fraud Management Market Size and Growth

…..

32. Global AI In Fraud Management Market Competitive Benchmarking

33. Global AI In Fraud Management Market Competitive Dashboard

34. Key Mergers And Acquisitions In The AI In Fraud Management Market

35. AI In Fraud Management Market Future Outlook and Potential Analysis

36. Appendix

Explore the trending research reports from TBRC:

https://www.thebusinessresearchcompany.com/report/ai-in-genomics-global-market-report

https://www.thebusinessresearchcompany.com/report/ai-infrastructure-global-market-report

https://www.thebusinessresearchcompany.com/report/ai-in-oil-and-gas-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model