annuity insurance market research, global annuity insurance market, annuity insurance market share, annuity insurance market uk, annuity insurance market trends, annuity insurance market size

What are the latest figures on the annuity insurance market’s size and projected CAGR?

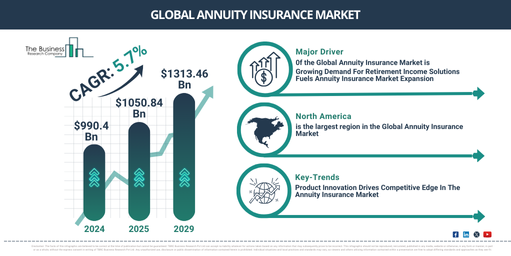

The annuity insurance market size has grown strongly in recent years. It will grow from $990.4 billion in 2024 to $1050.84 billion in 2025 at a compound annual growth rate (CAGR) of 6.1%. The growth in the historic period can be attributed to a rise in digitalization, reduced operational and administrative costs, heavy discounting on insurance premiums, a high level of internet penetration, and switch from traditional to annuity insurance services.

The annuity insurance market size is expected to see strong growth in the next few years. It will grow to $1313.46 billion in 2029 at a compound annual growth rate (CAGR) of 5.7%. The growth in the forecast period can be attributed to increasing mobile usage, internet usage continuing to rise, increasing popularity for purchasing insurance, people purchasing insurance online, rise in convenience and accessibility of purchasing insurance, and growing awareness of the benefits of having health coverage. Major trends in the forecast period include rising uptake of the Internet of Things technology, demand for customized insurance products, the advent of mobile apps and AI technologies, the transition of insurance companies from product-based towards consumer-centric strategies, and the adoption of InsurTech.

Get Your Free Sample of The Global Annuity Insurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18223&type=smp

Which Market drivers have played a significant role in driving the annuity insurance market?

The growing pool of individuals seeking retirement income solutions is expected to propel the growth of the annuity insurance market in the future. Retirement income solutions refer to financial products, strategies, and plans designed to provide individuals with a stable and sustainable income stream during their retirement. Retirement income solutions are attributed to financial products and strategies designed to provide individuals with a steady and reliable income stream during their retirement years, ensuring economic stability and peace of mind. Annuity insurance offers a guaranteed, steady income stream for retirees by converting a lump-sum payment into regular payments for a specified period, ensuring financial stability and mitigating the risk of a money crunch. For instance, according to the Asset Management 2024 Defined Contribution (DC) plan participant survey of 1,503 participants conducted by J.P. Morgan, a US-based investment banking company, found that guaranteed income alternatives are appealing. Moreover, Seven out of ten (72%) believed their workplace retirement plan was vital to how they perceived their households’ financial well-being, and 85% said retirement benefits were an important consideration in selecting whether to stay with an employer or pursue a new job opportunity. Therefore, the growing pool of individuals requiring retirement income solutions is driving the growth of the annuity insurance market.

What are the key segments within the annuity insurance market?

The annuity insurance market covered in this report is segmented –

1) By Type: Fixed Annuity Insurance, Variable Annuity Insurance, Indexed Annuity Insurance, Other Types

2) By Application: Financial, Manufacturing, Industrial, Travel And Hospitality, Other Applications

3) By Distribution Channel: Insurance Agencies And Brokers, Banks, Other Distribution Channels

Subsegments:

1) By Fixed Annuity Insurance: Immediate Fixed Annuity, Deferred Fixed Annuity

2) By Variable Annuity Insurance: Equity-Linked Variable Annuity, Bond-Linked Variable Annuity, Balanced Variable Annuity

3) By Indexed Annuity Insurance: Fixed Indexed Annuity, Equity Indexed Annuity

4) By Other Types: Longevity Annuity, Multi-Year Guarantee Annuity (MYGA), Structured Settlement Annuity

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/annuity-insurance-global-market-report

Which key players are shaping the annuity insurance market?

Major companies operating in the annuity insurance market are China Ping An Insurance (Group) Co. Ltd., Allianz SE, China Life Insurance Company, Axa S.A., The Dai-ichi Life Insurance Company Limited, MetLife Services and Solutions LLC, China Pacific Insurance Co. Ltd., Nationwide Mutual Insurance Company, American International Group Inc., Allstate Insurance Company, Zurich Insurance Group Ltd., Sumitomo Life Insurance Company, Aviva PLC, Aegon Life Insurance Company, SBI Life Insurance Co. Ltd., Pacific Life Insurance Company, Bright House Financial Inc., Transamerica Corporation, Voya Financial Inc., Globe Life Inc., Symetra Life Insurance Company, Reliance Nippon Life Insurance Company Limited, Protective Insurance Corporation, Assurity Life Insurance, Colonial Penn Life Insurance Company, Gerber Life Insurance Company, HDFC Standard Life Insurance Company Limited, Assicurazioni Generali SpA

Which transformative trends will shape the annuity insurance market landscape?

Major companies operating in the annuity insurance market increasingly focus on product advancements to cater to diverse customer needs, whether for individual or group general annuity savings. The annuity saving plan offers flexible premium payment options, including single premium, limited premium payment terms, and regular premium payments. For instance, in January 2024, Max Life Insurance Company Limited, an India-based insurance company, launched the ‘Smart Wealth Annuity Guaranteed Pension Plan’ (SWAG Pension Plan). This non-linked, non-participating individual or group general annuity savings plan allows customers to tailor their policies by selecting various annuity options and ‘Return of Premium’ options. The plan aims to help individuals prepare for retirement by offering customizable features and variants. The plan’s key features include selecting from various annuity and ‘Return of Premium’ options, subject to policy terms and conditions.

How do regional factors impact the annuity insurance market, and which region is the largest contributor?

North America was the largest region in the annuity insurance market in 2024. The regions covered in the annuity insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Annuity Insurance Market Report 2025 Offer?

The annuity insurance market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Annuity insurance is a financial product offered by insurance companies that provides a series of payments made at equal intervals. These payments can be made either immediately or at some future date, depending on the terms of the annuity contract. he primary purpose of an annuity is to provide a steady income stream, typically for retirees.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18223

About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model