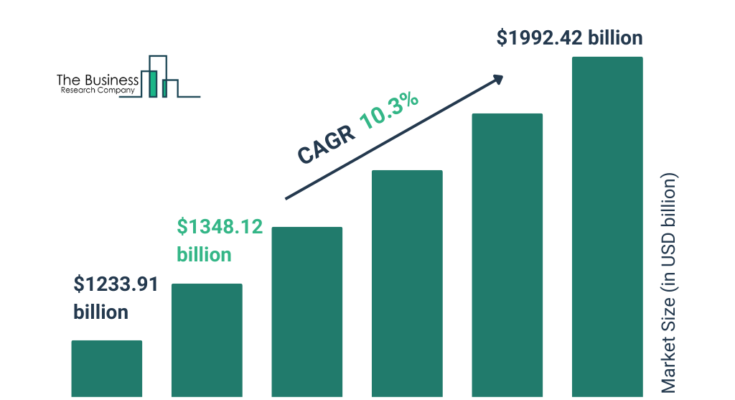

The B2B payments market size has grown strongly in recent years. It will grow from $1233.91 billion in 2024 to $1348.12 billion in 2025 at a compound annual growth rate (CAGR) of 9.3%. The growth in the historic period can be attributed to globalization and cross-border transactions, demand for faster and secure transactions, regulatory changes and compliance, automation of financial processes, emergence of fintech solutions.

The B2B payments market size is expected to see rapid growth in the next few years. It will grow to $1992.42 billion in 2029 at a compound annual growth rate (CAGR) of 10.3%. The growth in the forecast period can be attributed to continued global trade growth, focus on working capital optimization, rise of subscription-based services, integration with ERP systems, enhanced data security measures. Major trends in the forecast period include customization of payment solutions for industries, shift towards contactless and mobile payments, enhanced supplier and buyer collaboration platforms, focus on working capital optimization, integration of payment analytics for decision-making.

Get Your Free Sample of The Global B2B Payments Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9045&type=smp

Which major factors have contributed to the expansion of the b2b payments market?

Growing global trade is expected to propel the B2B payments market going forward. Trade refers to the selling and buying of items, goods, and services between two firms, countries, or groups of people with the sole purpose of making a profit, when it is done internationally it is referred to as global trade. B2B payments are used in trade business for the rapid exchange of currency or money for goods and services, which plays an important role in export and import deals. For instance, in February 2022, according to the United Nations Conference on Trade and Development, a Switzerland-based intergovernmental organization that promotes world trade, the global trade value increased by 25% to reach $28.5 trillion in 2021 compared to 2020. Furthermore, according to the World Trade Organization, a Switzerland -based regulator and facilitator of international trade, global merchandise trade volumes is increase by 3.5% in 2022. Therefore, the growth of global trade is driving the demand for the B2B payments market.

How is the b2b payments market segmented?

The B2B payments market covered in this report is segmented –

1) By Payment Type: Domestic Payments, Cross-Border Payments

2) By Payment Mode: Bank Transfer, Cards, Other Payment Modes

3) By Enterprise Size: Large Enterprises, Medium-Sized Enterprises, Small-Sized Enterprises

4) By Industry Vertical: Manufacturing, IT And Telecom, Metals And Mining, Energy And Utilities, Banking, Financial Services And Insurance, Government Sector, Other Industry Vertical

Subsegments:

1) By Domestic Payments: ACH Transfers, Wire Transfers, Credit And Debit Card Payments, E-checks And Electronic Invoicing

2) By Cross-Border Payments: International Wire Transfers, Foreign Exchange Services, Payment Processing Platforms For Global Transactions, Remittance Services

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/b2b-payments-global-market-report

Who are the top competitors in the b2b payments market?

Major companies operating in the B2B payments market include JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., American Express Company, Capital One Financial Corporation, Visa Inc., PayPal Holdings Inc., Mastercard Inc., Fiserv Inc., Block Inc., Square Inc., Fidelity National Information Services Inc., Stripe Inc., Global Payments Inc., Ant Group Co., Worldpay Inc., Fleetcor Technologies Inc., Comdata Inc., WEX Inc., ACI Worldwide Inc., Adyen N.V., Bill.com Inc., TransferWise Ltd., Coupa Software Inc., Wise Payments Limited, Payoneer Global Inc., Bottomline Technologies Inc., Flywire Corporation, Paystand Inc., AvidXchange Inc., Divvy Inc., Tipalti Inc., Airwallex, WePay Inc., Billtrust Holdings Inc.

Which key trends are expected to influence the b2b payments market in the coming years?

Product innovations are a key trend gaining popularity in the B2B payments market. Major companies operating in the B2B payments market are focused on developing new technological solutions to strengthen their position. For instance, in December 2022, American Express, a US-based provider of financial services corporations that specialize in payment cards, launched Amex Business Link, a digital B2B payment ecosystem for network issuing and acquiring participants. It is uniquely designed to connect to all customer relationship management (CRM) and enterprise resource planning (ERP) systems that accept APIs and has a special architecture with reporting and reconciliation features. It supports domestic and international transactions by accepting card and non-card payments and enabling convenient payments for customers and providers of all sizes. Additionally, buyers and suppliers can get dynamic data that enables automatic reconciliation as well as monitor insights into sales and purchases.

Which regional trends are influencing the b2b payments market, and which area dominates the industry?

The countries covered in the B2B payments market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

What Does The B2B Payments Market Report 2025 Offer?

The b2b payments market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

B2B payments refer to a payment that occurs between two organizations or businesses, from a buyer to a supplier, for the supply of goods and services. The payment is a one-time or recurring transaction that depends on the contractual agreement of the buyer and supplier. It is used for transacting payments between two businesses.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9045

About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model