What is the present valuation and projected CAGR of the banking, financial services, and insurance (bfsi) crisis management market?

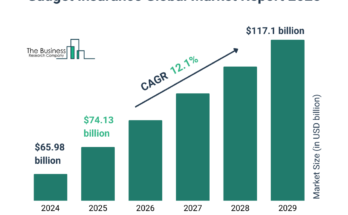

The banking, financial services, and insurance (BFSI) crisis management market size has grown rapidly in recent years. It will grow from $13.26 $ billion in 2024 to $15.45 $ billion in 2025 at a compound annual growth rate (CAGR) of 16.5%. The growth in the historic period can be attributed to rising remote work culture, growth in the digitization of banks and financial services, increasing frequency and severity of financial crises, growing regulatory requirements, and increasing complexity of the financial system.

The banking, financial services, and insurance (BFSI) crisis management market size is expected to see rapid growth in the next few years. It will grow to $28.15 $ billion in 2029 at a compound annual growth rate (CAGR) of 16.2%. The growth in the forecast period can be attributed to increasing cybersecurity threats, rising awareness among banking, financial services, and insurance (BFSI) organizations, rising need for operational resilience, demand for enhanced customer experience, and accelerating the shift towards online financial services. Major trends in the forecast period include cloud-based technology, technology advancements, integrating artificial intelligence(AI), incorporating machine learning, and adopting big data analytics.

Get Your Free Sample of The Global Banking, Financial Services, And Insurance (BFSI) Crisis Management Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19329&type=smp

What key drivers have fueled the banking, financial services, and insurance (bfsi) crisis management market’s development over the years?

The increasing cybersecurity threats are expected to propel the growth of the banking, financial services, and insurance (BFSI) crisis management market going forward. Cybersecurity threats refer to malicious activities or events that target computer systems, networks, or data intending to steal, alter, destroy, or otherwise cause harm. The increasing cybersecurity threats are due to digital transformation, the sophistication of attackers, and regulatory compliance. Crisis management in the BFSI is integral to handling cybersecurity threats, ensuring organizations can respond effectively, comply with regulations, and maintain trust with their stakeholders. For instance, in March 2023, according to the Federal Bureau of Investigation, a US-based law enforcement agency, complaints about investment fraud jumped 127%, from $1.45 billion in 2021 to $3.31 billion in 2022. Further, cryptocurrency investment fraud rose from $907 million in 2021 to $2.57 billion in 2022. Therefore, the rise in cyberattacks is driving the growth of the banking, financial services, and insurance (BFSI) crisis management market

What is the segmentation for the banking, financial services, and insurance (bfsi) crisis management market?

The banking, financial services, and insurance (BFSI) crisis management market covered in this report is segmented –

1) By Component: Software, Services

2) By Deployment: On-Premise, Cloud

3) By Enterprise Size: Large Enterprises, Small And Medium Enterprises

4) By Application: Risk And Compliance Management, Disaster Recovery And Business Continuity, Incident Management And Response, Other Applications

Subsegments:

1) By Software: Crisis Management Software, Risk Assessment and Management Software, Incident Management Software, Business Continuity Planning Software, Communication and Collaboration Tools

2) By Services: Consulting Services, Training and Awareness Programs, Incident Response Services, Recovery and Continuity Services, Compliance and Regulatory Advisory Services

Order your report now for swift delivery

Who are the most influential companies in the banking, financial services, and insurance (bfsi) crisis management market?

Major companies operating in the banking, financial services, and insurance (BFSI) crisis management market are Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers International Limited, KPMG International Limited, Capgemini SE, SAS Institute Inc., Software AG, LogicGate Inc., Everbridge Inc., NCC Group, MetricStream Inc., CURA Software Solutions, Resolver Inc., Fusion Risk Management Inc., Beekeeper AG, 4C Group AB, Noggin Pty Ltd., RQA Europe Ltd., Veoci Inc., Konexus, Rockdove Solutions Inc.

What are the top industry trends projected to impact the banking, financial services, and insurance (bfsi) crisis management market?

Major companies operating in the banking, financial services, and insurance (BFSI) crisis management market are focusing on developing climate technology to mitigate financial risks associated with climate-related disruptions. Climate technology refers to innovative solutions and tools designed to address and mitigate the impacts of climate change, including renewable energy, emissions reduction, and climate risk management systems. For instance, in October 2024, Adaptive Insurance, a UK-based tech-focused parametric insurance platform, launched the GridProtect, to protect insureds from the impact of power outages due to climate risks. This technology-driven solution promises to offer financial relief following grid disruptions, filling a gap left by traditional insurance policies. Adaptive Insurance noted that power outages in the US pose a significant challenge, affecting an estimated 15 million businesses each month and leading to considerable economic losses.

What are the major regional insights for the banking, financial services, and insurance (bfsi) crisis management market, and which region holds the top position?

North America was the largest region in the banking, financial services, and insurance (BFSI) crisis management market in 2024. The regions covered in the banking, financial services, and insurance (BFSI) crisis management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Banking, Financial Services, And Insurance (BFSI) Crisis Management Market Report 2025 Offer?

The banking, financial services, and insurance (bfsi) crisis management market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Banking, financial services, and insurance (BFSI) crisis management refers to financial institutions and insurance companies’ strategies, processes, and practices to prepare for, respond to, and recover from crises that could significantly disrupt their operations. This management is essential for maintaining trust with customers, investors, and regulators, as well as for protecting the institution’s financial stability. Effective crisis management helps minimize losses, maintain operational continuity, and safeguard the institution’s reputation during uncertainty or disruption.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19329

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model