Overview and Scope

Banking cyber security refers to the set of practices, measures, technologies, and strategies implemented by financial institutions to protect their digital systems, networks, data, and customer information from cyber threats, attacks, and unauthorized access. Banking cybersecurity provides an extra layer of security that protects consumer assets and data but also improves operational efficiency.

Sizing and Forecast

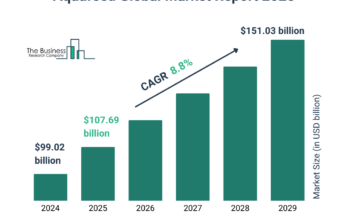

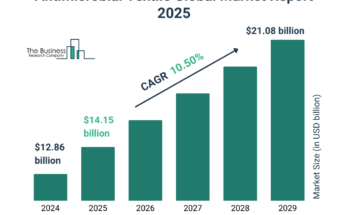

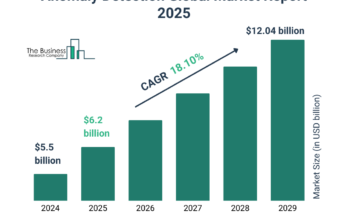

The banking cyber security market size has grown rapidly in recent years. It will grow from $280.68 billion in 2023 to $317.98 billion in 2024 at a compound annual growth rate (CAGR) of 13.3%. The growth in the historic period can be attributed to risk management, sophistication of cyber threats, digital transformation, mobile banking security, cloud security.

The banking cyber security market size is expected to see rapid growth in the next few years. It will grow to $517.8 billion in 2028 at a compound annual growth rate (CAGR) of 13%. The growth in the forecast period can be attributed to quantum computing threats, extended use of artificial intelligence (AI), enhanced biometric authentication, supply chain cybersecurity, rise of decentralized finance (DeFi). Major trends in the forecast period include deep learning for threat detection, 5G security challenges, zero-day threat protection, cybersecurity for digital currencies, intelligent security orchestration, collaborative threat intelligence sharing.

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/banking-cyber-security-global-market-report

Segmentation & Regional Insights

The banking cyber security market covered in this report is segmented –

1) By Type: Cloud Security, Network Security, Web Security, End Point Security, Application Security, Other Types

2) By Deployment Type: Cloud, On-premises

3) By Organization Size: Small And Medium Enterprise, Large Enterprise

4) By Application: Public Bank, Private Bank

North America was the largest region in the banking cyber security market in 2023. The regions covered in the banking cyber security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=14270&type=smp

Major Driver Impacting Market Growth

The rise of mobile banking is expected to propel the growth of the banking cybersecurity market going forward. Mobile banking refers to the use of a mobile device, such as a smartphone or tablet, to conduct various banking activities and financial transactions. Mobile banking provides convenience and accessibility, enabling users to manage their finances on the go. Banking cybersecurity in mobile banking protects sensitive financial data and transactions, safeguarding against cyber threats and unauthorized access. For instance, in October 2023, a national survey conducted on 2,211 participants by the American Bankers Association, a US-based trade association, found that in the past 12 months, 48% of bank customers have used mobile apps on phones or other mobile devices as their top option for managing their bank accounts, and 23% have used online banking via laptop or PC the most in the past 12 months. Therefore, the rise of mobile banking is driving the growth of the banking cybersecurity market.

Key Industry Players

Major companies operating in the banking cyber security market are Microsoft Corporation, Intel Corporation, International Business Machines Corporation, Cisco Systems Inc., Honeywell International Inc., Hewlett Packard Enterprise Systems, Palo Alto Network Solutions Inc., Fortinet Security Solutions LLC, Splunk Data Solutions LLC, Check Point Software Technologies, CrowdStrike Cybersecurity Inc., McAfee Cybersecurity LLC, Trend Micro Security Inc., Proofpoint Inc., FireEye Inc., Rapid7 Inc., CyberArk Software Ltd., Varonis Systems Inc., Symantec Technologies Inc., EMC RSA Cybersecurity LLC, Sophos Cybersecurity Solutions Inc., Netsparker Technologies Inc., KnowBe4 Security Training Inc., Carbon Black Inc., Computer Science Corporation LLC

The banking cyber security market report table of contents includes:

- Executive Summary

- Banking Cyber Security Market Characteristics

- Banking Cyber Security Market Trends And Strategies

- Banking Cyber Security Market – Macro Economic Scenario

- Global Banking Cyber Security Market Size and Growth

.

.

.

- Global Banking Cyber Security Market Competitive Benchmarking

- Global Banking Cyber Security Market Competitive Dashboard

- Key Mergers And Acquisitions In The Banking Cyber Security Market

- Banking Cyber Security Market Future Outlook and Potential Analysis

- Appendix

Explore the trending research reports from TBRC:

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model