At what pace is the bicycle insurance market growing, and what is its estimated value?

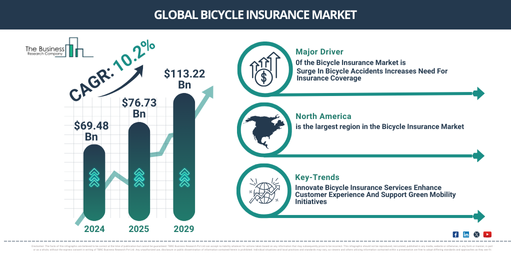

The bicycle insurance market size has grown rapidly in recent years. It will grow from $69.48 billion in 2024 to $76.73 billion in 2025 at a compound annual growth rate (CAGR) of 10.4%. The growth in the historic period can be attributed to an increase in bicycle usage, an increase the danger of accidents, a surge in the number of cycle riders, the rising popularity of adventure sports, and growing awareness of the benefits of bicycles.

The bicycle insurance market size is expected to see rapid growth in the next few years. It will grow to $113.22 billion in 2029 at a compound annual growth rate (CAGR) of 10.2%. The growth in the forecast period can be attributed to the growing popularity of multi-modal transportation, rising adoption of e-bikes, rising traffic congestion, growing health-conscious and environmentally friendly population, and rising crude oil prices. Major trends in the forecast period include technology development, digital integration and claims process, government initiatives, customizable coverage plans, and environmental and sustainability discounts.

Get Your Free Sample of The Global Bicycle Insurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18970&type=smp

What are the top drivers to the rising demand in the bicycle insurance market?

The increasing number of bicycle-related accidents is expected to propel the growth of the bicycle insurance market going forward. Bicycle-related accidents refer to incidents where cyclists are involved in collisions or crashes. Bicycle-related accidents occur due to several factors, such as infrastructure challenges, insufficient safety education, driver awareness, and distractions. Bicycle insurance helps users by covering repair costs, medical expenses, and liability for damages in case of accidents, providing financial support and peace of mind. For instance, in September 2023, according to the National Coalition for Safety Roadways, a US-based organization, approximately 850 cyclists were killed in collisions with cars and trucks in 2022, representing a 12% increase compared to the previous year. Therefore, the increasing number of bicycle-related accidents is driving the growth of the bicycle insurance market.

How is the bicycle insurance market segmented?

The bicycle insurancemarket covered in this report is segmented –

1) By Type: Third-Party Insurance Policy, Standalone Own-Damage Insurance Policy, Comprehensive Insurance Policy

2) By Platform: Online, Offline

3) By Coverage: Injury, Sickness, Death, Other Coverages

4) By Distribution Channel: Insurance Agents Or Brokers, Direct Response, Banks, Other Distribution Channels

5) By Application: Pedal Cycle, Exercise Cycle, Other Applications

Subsegments:

1) By Third-Party Insurance Policy: Liability Coverage, Bodily Injury Coverage, Property Damage Coverage

2) By Standalone Own-Damage Insurance Policy: Theft Protection, Accidental Damage Coverage, Natural Calamity Protection

3) By Comprehensive Insurance Policy: Third-Party Liability Coverage, Own-Damage Coverage, Personal Accident Coverage

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/bicycle-insurance-global-market-report

Who are the top competitors in the bicycle insurance market?

Major companies operating in the bicycle insurance market are Allianz SE, Progressive Corporation, Zurich Insurance Group Ltd., Chubb, Liberty Mutual Insurance, GEICO, Aviva Plc, Farmers Insurance Group, QBE Insurance Group Limited, Markel Group Inc., Suncorp Bank, Hiscox Ltd., Direct Line Insurance Group plc, HDFC Ergo General Insurance Company Limited, Admiral Group plc, Axa SA, Laka Ltd., Bikmo UK, Qover SA, BTA Baltic Insurance Company, AAS, Yellow Jersey LLP, Pedal Cover, Velosurance, Symbo Southasia Enterprises Pvt. Ltd

What significant trends should we anticipate in the bicycle insurance market over the forecast period?

Major companies operating in the bicycle insurance market focus on developing innovative insurance services to enhance customer experience and address specific coverage needs for cyclists. Innovative insurance services refer to customized, tech-driven policies that offer flexible coverage, real-time claims processing, and tailored protection for unique customer needs. For instance, in July 2024, Laka Ltd., a UK-based insurance company, launched bicycle insurance in France, offering comprehensive coverage options tailored to cyclists’ needs. The new plan includes theft protection, accidental damage coverage, roadside assistance, and race and travel insurance. This launch marks a significant move in Laka’s strategy to expand its presence in the European cycling market while supporting green mobility initiatives.

Which regional trends are influencing the bicycle insurance market, and which area dominates the industry?

North America was the largest region in the bicycle insurance market in 2024. The regions covered in the bicycle insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Bicycle Insurance Market Report 2025 Offer?

The bicycle insurance market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Bicycle insurance provides coverage for damages or theft of your bike, as well as liability for injuries or damages you may cause to others while riding. It can include protection for accessories and gear, along with coverage for bike repairs. Policies vary widely, offering options for both recreational and high-value bicycles.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18970

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model