At what pace is the cash advance services market growing, and what is its estimated value?

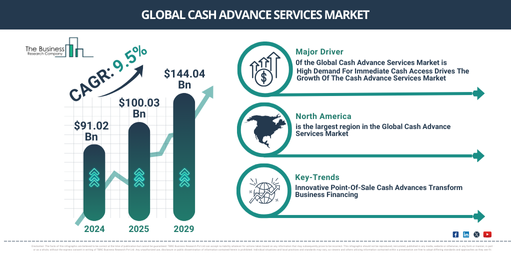

The cash advance services market size has grown strongly in recent years. It will grow from $91.02 billion in 2024 to $100.03 billion in 2025 at a compound annual growth rate (CAGR) of 9.9%. The growth in the historic period can be attributed to economic instability, high levels of consumer debt, limited access to traditional credit, raised demand for quick cash solutions, increasing use of credit cards, and high interest rates on personal loans.

The cash advance services market size is expected to see strong growth in the next few years. It will grow to $144.04 billion in 2029 at a compound annual growth rate (CAGR) of 9.5%. The growth in the forecast period can be attributed to increasing consumer demand for instant financial solutions, the expansion of fintech companies offering alternative credit products, rising awareness of flexible repayment options, economic uncertainty affecting consumer spending, and increased use of credit and debit cards. Major trends in the forecast period include increasing adoption of digital platforms for quick access to funds, greater integration of artificial intelligence for credit assessment, rising demand for flexible repayment options, expansion of cash advance services into emerging markets, enhanced regulatory frameworks for consumer protection, growth in partnerships between fintech companies and traditional financial institutions.

Get Your Free Sample of The Global Cash Advance Services Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18286&type=smp

What are the top drivers to the rising demand in the cash advance services market?

The demand for immediate cash access is expected to propel the growth of the cash advance services market going forward. Immediate cash access is quickly getting cash through ATMs, bank withdrawals, or cash advances, enabling people to address urgent financial needs. The demand for immediate cash access is due to the rising cost of living, unexpected expenses, and the shift towards cashless transactions. Cash advance services, such as those offered by credit cards, payday lenders, and ATMs, provide a quick and accessible means to obtain cash. The convenience of accessing cash without the need for extensive paperwork or lengthy approval processes attracts consumers who need immediate funds. For instance, in January 2023, according to Link Scheme Holdings Ltd., a UK-based cash access and automated teller machine network company, in 2022, the value of cash withdrawals at ATMs was $100.43 billion (£83 billion ), up from $95.59 billion (£79 billion) in 2021. Therefore, the high demand for immediate cash access is driving the growth of the cash advance services market.

How is the cash advance services market segmented?

The cash advance services market covered in this report is segmented –

1) By Type: Credit Card Cash Advance, Merchant Cash Advance, Payday Loans, Other Types

2) By Deployment: Online, Offline

3) By Service Provider: Bank, Credit Card Companies, Other Service Providers

4) By End User: Personal, Commercial

Subsegments:

1) By Credit Card Cash Advance: Standard Credit Card Cash Advance, Online Credit Card Cash Advance

2) By Merchant Cash Advance: Business Loan Advances, Point-Of-Sale (POS) Based Advances

3) By Payday Loans: Single Payment Payday Loans, Installment Payday Loans

4) By Other Types: Auto Title Loans, Pawnshop Loans

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/cash-advance-services-global-market-report

Who are the top competitors in the cash advance services market?

Major companies operating in the cash advance services market are Wells Fargo & Co., American Express Company, PayPal Holdings Inc., Square Inc., Stripe Inc., Worldpay Inc., Advance America Cash Advance Centers Inc., SoFi Technologies Inc., TMX Finance LLC, ACE Cash Express Inc., Speedy Cash LLC, Lendio Inc., Moneytree Inc., CAN Capital Inc., BlueVine Inc., National Business Capital and Services Inc., LendNation Inc., Fundbox Inc., MoneyMutual Inc., LendUp Inc., Blue Trust Loans LLC, CashNetUSA Inc., Finova Capital LLC, Payday Express Inc.

What significant trends should we anticipate in the cash advance services market over the forecast period?

Major companies operating in the cash advance services market are focusing on developing innovative technologies, such as point-of-sale (POS) cash advances, to offer superior user experiences. POS cash advances allow businesses to receive funds upfront, which are repaid through a portion of their daily sales via POS systems. For instance, in August 2023, SumUp, a UK-based fintech company, launched SumUp Cash Advance, a point-of-sale cash advance to provide short-term financing to merchants based on their payment history. SumUp Cash Advance is introduced, backed by a $100 million credit facility from the alternative investment firm Victory Park Capital (VPC). This credit facility will enable SumUp to provide advance payments to merchants, initially launching in the UK market before expanding to other European countries.

Which regional trends are influencing the cash advance services market, and which area dominates the industry?

North America was the largest region in the cash advance services market in 2024. The regions covered in the cash advance services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Cash Advance Services Market Report 2025 Offer?

The cash advance services market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Cash advance services refer to financial services that allow individuals to obtain cash or access funds from their credit card or bank account. These services provide immediate liquidity with specific conditions and fees.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18286

About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model