Overview and Scope

A charge card is a sort of electronic payment card that does not charge interest but requires to pay the statement balance in full on a monthly basis.

Sizing and Forecast

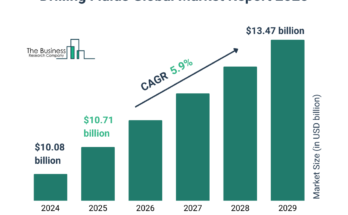

The charge card market size has grown marginally in recent years. It will grow from $1.99 billion in 2023 to $2.02 billion in 2024 at a compound annual growth rate (CAGR) of 1.4%. The growth in the historic period can be attributed to emergence of electronic payments, convenience and security, travel and entertainment, rewards programs.

The charge card market size is expected to see marginally grown in the next few years. It will grow to $2.27 billion in 2028 at a compound annual growth rate (CAGR) of 3.0%. The growth in the forecast period can be attributed to digital payments, contactless payments, online shopping, security and fraud prevention. Major trends in the forecast period include digital transformation, contactless payments, sustainability and esg, business charge cards, travel charge cards.

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/charge-card-global-market-report

Segmentation & Regional Insights

The charge card market covered in this report is segmented –

1) By Type: Gold Card, Platinum Card, Plum Card, Business Gold Card, Business Platinum Card, Other Types

2) By Institution Type: Banking Institutions, Non-Banking Institutions

3) By End User: Retail, Corporate, Government/Public Sector

Asia-Pacific was the largest region in the charge card market in 2023. Western Europe was the second largest region in the charge card market. The regions covered in the charge card market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=4001&type=smp

Major Driver Impacting Market Growth

The lack of a pre-set spending limit and greater flexibility in spending contributed to the growth of the charge card market. Charge cards offer financial flexibility with no pre-set spending limit on the purchase, which means more buying power. Additionally, charge cards offer premium rewards, maximize reward points based on spending patterns, and also offer a variety of travel and purchase protections. For instance, American Express offers complimentary airport lounge access, hotel room upgrades, travel insurance, and much more. Customers will be able to improve their credit score by using charge cards responsibly and paying on time every month. A charge card allows a customer to organize personal events, dining reservations, golf bookings, movie, and theatre ticket bookings, and enjoy exclusive rates and discounts with leading airlines. These factors boosted demand for charge card services, and this, in turn, drove the charge card market. However, having no pre-set spending limit does not mean unlimited spending. The purchasing power is adjusted based on the use of the card, payment history, credit record, financial resources, and other factors. This, in turn, will assist the customer in developing financial discipline the charge card market.

Key Industry Players

Major companies operating in the charge card market include American Express, Diners Club International, Coutts and Co., Chase Bank, Citibank NA, Capital One Financial Corporation, Bank of America Corporation, Discover Financial Services, U.S. Bancorp, Wells Fargo, Barclays plc, Navy Federal Credit Union, Pentagon Federal Credit Union, United Services Automobile Association, Visa Inc., Mastercard Inc., JCB Co. Ltd., Equifax Inc., TransUnion LLC, Experian plc, Credit Karma, Credit Sesame, NerdWallet, Evolution Finance Inc., CreditCards.com, Bankrate LLC, PayPal Holdings Inc., Stripe Inc., Braintree, Authorize.net, Worldpay Group plc, First Data Corporation, Total System Services Inc., Global Payments Inc., Elavon Inc., Heartland Payment Systems Inc.

The charge card market report table of contents includes:

1. Executive Summary

2. Charge Card Market Characteristics

3. Charge Card Market Trends And Strategies

4. Charge Card Market – Macro Economic Scenario

5. Global Charge Card Market Size and Growth

…

31. Global Charge Card Market Competitive Benchmarking

32. Global Charge Card Market Competitive Dashboard

33. Key Mergers And Acquisitions In The Charge Card Market

34.Charge Card Market Future Outlook and Potential Analysis

35. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model