How much is the credit card market worth, and how is it expected to expand?

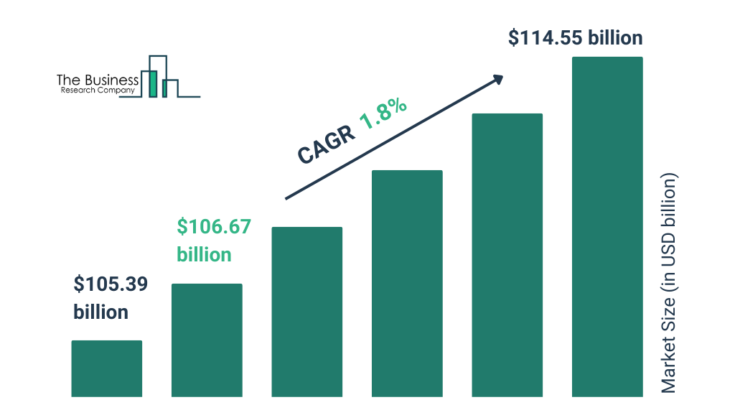

The credit card market size has grown marginally in recent years. It will grow from $105.39 billion in 2024 to $106.67 billion in 2025 at a compound annual growth rate (CAGR) of 1.2%. The growth in the historic period can be attributed to consumer spending patterns, rewards programs and incentives, ease of transactions and accessibility, online shopping and e-commerce growth, travel and international transactions.

The credit card market size is expected to see marginal growth in the next few years. It will grow to $114.55 billion in 2029 at a compound annual growth rate (CAGR) of 1.8%. The growth in the forecast period can be attributed to contactless payment adoption, security and fraud protection features, integration with mobile wallets, innovative card designs and personalization, emergence of buy now, pay later (BNPL). Major trends in the forecast period include personalized rewards programs, focus on sustainability, and integration of artificial intelligence, flexible payment options, regulatory compliance and data security.

Get Your Free Sample of The Global Credit Card Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3999&type=smp

Which industry factors have accelerated the credit card market’s expansion?

The rising demand for credit cards is expected to fuel the growth of the credit card market in the forecast period. The rise in demand for consumer credit and the benefits offered by credit cards encourage individuals to use credit cards. According to the Equifax Quarterly Consumer Credit Demand Index June 2022, the demand for credit cards in Australia increased by 6% in 2022 as compared to June 2021. Overall consumer credit demand grew by 10.2% in 2022 as compared to June 2021. Therefore, the rising demand for credit cards drives the growth of the credit card market.

What are the primary segments of the credit card market?

The credit card market covered in this report is segmented –

1) By Type: Reward Card, Credit Builder Card, Travel Credit Card, Balance Transfer Card, Other Types

2) By Card Type: Base, Signature, Platinum

3) By Service Provider: Visa, Mastercard, Rupay, Other Service Providers

Subsegments:

1) By Reward Card: Cashback Cards, Points-based Cards, Miles-based Cards, Category-specific Reward Cards

2) By Credit Builder Card: Secured Credit Cards, Student Credit Cards, Low-limit Credit Cards

3) By Travel Credit Card: Airline-branded Cards, Hotel-branded Cards, General Travel Rewards Cards, Premium Travel Cards

4) By Balance Transfer Card: Low Or 0% APR For Balance Transfers, Long-term Balance Transfer Cards, Introductory Offer Balance Transfer Cards

5) By Other Types: Business Credit Cards, Prepaid Credit Cards, Store Credit Cards, Co-branded Credit Cards, Corporate Cards

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/credit-card-global-market-report

Which firms are leading the credit card market?

Major companies operating in the credit card market include SBI Card and Payment Services Limited, JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Wells Fargo & Company, American Express Company, Capital One Financial Corporation, TD Bank N.A., Barclays plc, U.S. Bancorp, Truist Financial Corporation, The PNC Financial Services Group Inc., HDFC Bank Ltd., ICICI Bank Limited, Synchrony Financial, Discover Financial Services, SunTrust Banks Inc., Axis Bank Limited, Navy Federal Credit Union, BBVA Compass Bancshares Inc., Bank of Baroda, Pentagon Federal Credit Union, First National Bank of Omaha, Credit One Bank, Merrick Bank Corporation, Comenity Capital Bank, First Premier Bank, Applied Bank

How will evolving trends contribute to the growth of the credit card market?

Major companies operating in the credit card market are adopting a strategic partnership approach to enhance technology integration and expand market reach. A strategic partnership typically refers to a collaborative relationship between two or more organizations where they combine their resources, expertise, and efforts to achieve common goals or objectives. For instance, in June 2023, Federal Bank Limited, an India-based private sector bank, partnered with Scapia Technology Private Limited, an India-based Fintech company, to launch the Federal Scapia Co-branded Credit Card, This credit card stands out due to its lifetime free membership, eliminating any initial or annual fees. It provides customers with the convenience of contactless payments and the ‘Tap and Pay’ feature for seamless transactions. The card is designed for use in over 150 countries and at a vast network of over one million merchants that accept Visa cards. Additionally, cardholders can earn Scapia Coins at a reward rate of 4% on travel bookings made through the Scapia app.

How do regional factors impact the credit card market, and which region is the largest contributor?

Asia-Pacific was the largest region in the global credit card market share in 2024. Western Europe was the second largest region in the credit card market. The regions covered in the credit card market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Credit Card Market Report 2025 Offer?

The credit card market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

A credit card is a class of payment cards issued by a bank or financial services company that allows cardholders to make purchases while having the option of repaying the amount later.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3999

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model