A credit card is a class of payment cards issued by a bank or financial services company that allows cardholders to make purchases while having the option of repaying the amount later.

Sizing and Forecast

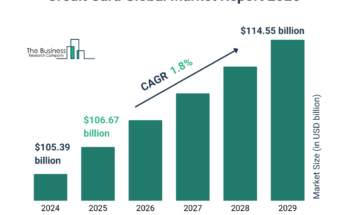

The credit card market size has grown marginally in recent years. It will grow from $103.72 billion in 2023 to $105.39 billion in 2024 at a compound annual growth rate (CAGR) of 1.6%. The growth in the historic period can be attributed to consumer spending patterns, rewards programs and incentives, ease of transactions and accessibility, online shopping and e-commerce growth, travel and international transactions.

The credit card market size is expected to see marginal growth in the next few years. It will grow to $111.65 billion in 2028 at a compound annual growth rate (CAGR) of 1.5%. The growth in the forecast period can be attributed to contactless payment adoption, security and fraud protection features, integration with mobile wallets, innovative card designs and personalization, emergence of buy now, pay later (bnpl). Major trends in the forecast period include personalized rewards programs, focus on sustainability, integration of artificial intelligence, flexible payment options, regulatory compliance and data security.

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/credit-card-global-market-report

Segmentation & Regional Insights

The credit card market covered in this report is segmented –

1) By Type: Reward Card, Credit Builder Card, Travel Credit Card, Balance Transfer Card, Other Types

2) By Card Type: Base, Signature, Platinum

3) By Service Provider: Visa, Matercard, Rupay, Other Service Providers

Asia-Pacific was the largest region in the global credit card market share in 2023. Western Europe was the second largest region in the credit card market. The regions covered in the credit card market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3999&type=smp

Major Driver Impacting Market Growth

The rising demand for credit cards is expected to fuel the growth of the credit card market in the forecast period. The rise in demand for consumer credit and the benefits offered by credit cards encourage individuals to use credit cards. According to the Equifax Quarterly Consumer Credit Demand Index June 2022, the demand for credit cards in Australia increased by 6% as compared to June 2021. Overall consumer credit demand grew by 10.2% as compared to June 2021. Therefore, the rising demand for credit cards drives the growth of the credit card market.

Key Industry Players

Major companies operating in the credit card market report are SBI Card and Payment Services Limited, JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Wells Fargo & Company, American Express Company, Capital One Financial Corporation, TD Bank N.A., Barclays plc, Visa Inc., U.S. Bancorp, Truist Financial Corporation, The PNC Financial Services Group Inc., Mastercard Incorporated, HDFC Bank Ltd., ICICI Bank Limited, Synchrony Financial, Discover Financial Services, SunTrust Banks Inc., Axis Bank Limited, Navy Federal Credit Union, BBVA Compass Bancshares Inc., Bank of Baroda, Pentagon Federal Credit Union, Total System Services Inc., Mango Financial Inc., First National Bank of Omaha, Credit One Bank, Merrick Bank Corporation, Comenity Capital Bank, First Premier Bank, Applied Bank, Fiserv Inc., Global Payments Inc., Square Inc., PayPal Holdings Inc.

The credit card market report table of contents includes:

1. Executive Summary

2. Market Characteristics

3. Market Trends And Strategies

4. Impact Of COVID-19

5. Market Size And Growth

6. Segmentation

7. Regional And Country Analysis

.

.

.

27. Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

Explore the trending research reports from TBRC:

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model