Overview and Scope

Crop insurance is a comprehensive, yield-based policy designed to cover losses incurred by farmers as a result of production issues. It covers losses caused by climatic conditions, accidents, or any other unfavorable conditions that result in a decrease in a farmer’s revenue.

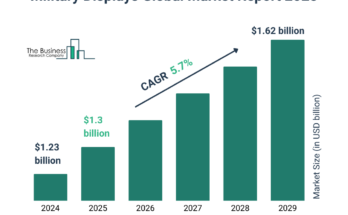

Sizing and Forecast

The crop insurance market size has grown strongly in recent years. It will grow from $40.05 billion in 2023 to $43.49 billion in 2024 at a compound annual growth rate (CAGR) of 8.6%. The growth in the historic period can be attributed to volatility in weather patterns, government support programs, globalization of agriculture, market liberalization, financial sector participation, natural disasters and catastrophes..

The crop insurance market size is expected to see strong growth in the next few years. It will grow to $60.66 billion in 2028 at a compound annual growth rate (CAGR) of 8.7%. The growth in the forecast period can be attributed to climate-resilient crop varieties, education and awareness programs, market-driven insurance solutions, data analytics and remote sensing, index-based insurance.. Major trends in the forecast period include technological integration, blockchain for transparency, integration with agtech solutions, customization and flexibility, data analytics for predictive modeling, innovative premium payment models..

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/crop-insurance-global-market-report

Segmentation & Regional Insights

The crop insurance market covered in this report is segmented –

1) By Type: Crop Yield Insurance, Crop Revenue Insurance

2) By Coverage: Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance

3) By Distribution Channel: Banks, Insurance Companies, Brokers Or Agents, Other Distribution Channels

North America was the largest region in the crop insurance market in 2023. The regions covered in the crop insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample_request?id=9141&type=smp

Major Driver Impacting Market Growth

Major companies operating in the crop insurance market report are Agriculture Insurance Company of India Limited, American Financial Group Inc., Chubb Corporation, ICICI Lombard General Insurance Company Limited, QBE Insurance Group Limited, Sompo International Holdings Ltd., Tokio Marine Holdings Inc., Zurich Insurance Company Ltd., Philippine Crop Insurance Corporation, AXA S.A., People’s Insurance Company of China (Group) Co. Ltd., Fairfax Financial Holdings Limited, American International Group Inc., AmTrust Financial Services Inc., Santam Limited, China United Property Insurance Company Limited, XL Group Ltd., Everest Reinsurance Holdings Inc., Endurance Specialty Holdings Ltd., CUNA Mutual Group, CGB Diversified Services Inc., Farmers Mutual Hail Insurance Company, Archer Daniels Midland Company, Swiss Reinsurance Company Ltd., Munich Reinsurance Company, Bajaj Allianz General Insurance Company Limited, Marsh & McLennan Companies Inc., Willis Towers Watson Holdings PLC, Lockton Companies, Brown & Brown Insurance and Risk Management, HUB International Limited, Arthur J. Gallagher & Co..

Key Industry Players

Major companies operating in the crop insurance market are innovating new technological products, such as a do it yourself (DIY) insurance platform, to sustain their position in the market. A DIY insurance platform is a self-service digital tool that empowers individuals to customize, purchase, and manage their insurance policies independently, often leveraging online resources and user-friendly interfaces. For instance, in November 2022, Absolute, an Indian-based bioscience company launched Digifasal. Digifasal is a do it yourself (DIY) insurance platform for farmers to provide financial support to farmers leading to sustainable agricultural practices. Digifasal allows farmers to select parametric insurance products from several insurers with pin codes, providing them with the freedom to choose the insurance products for their needs. Digifasal contains AgCloud ecosystem which provides a one-stop solution to farmers at every stage of crop production.

The crop insurance market report table of contents includes:

1. Executive Summary

2. Crop Insurance Market Characteristics

3. Crop Insurance Market Trends And Strategies

4. Crop Insurance Market – Macro Economic Scenario

5. Global Crop Insurance Market Size and Growth

.

.

.

31. Global Crop Insurance Market Competitive Benchmarking

32. Global Crop Insurance Market Competitive Dashboard

33. Key Mergers And Acquisitions In The Crop Insurance Market

34. Crop Insurance Market Future Outlook and Potential Analysis

35. Appendix

Explore the trending research reports from TBRC:

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model