What is the current market size and future outlook for the defense support and auxiliary equipment market?

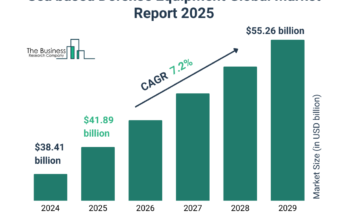

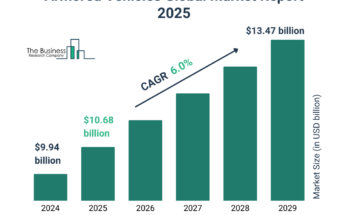

The defense support and auxiliary equipment market size has grown strongly in recent years. It will grow from $149.58 billion in 2024 to $158.91 billion in 2025 at a compound annual growth rate (CAGR) of 6.2%. The growth in the historic period can be attributed to defense budgets, geopolitical tensions, maintenance and upgrades, global terrorism, peacekeeping missions.

The defense support and auxiliary equipment market size is expected to see strong growth in the next few years. It will grow to $200.79 billion in 2029 at a compound annual growth rate (CAGR) of 6.0%. The growth in the forecast period can be attributed to emerging technologies, modernization programs, climate change and disaster response, global security challenges, international partnerships. Major trends in the forecast period include electrification and lightweighting, advanced materials, additive manufacturing, digitalization and connectivity, collaboration and partnerships,.

Get Your Free Sample of The Global Defense Support and Auxiliary Equipment Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2111&type=smp

How has the defense support and auxiliary equipment market evolved, and what factors have shaped its growth?

The increase in defense spending is expected to propel the growth of the defense support and auxiliary equipment market going forward. Defense spending refers to the financial resources allocated by governments to support their armed forces and military activities. It provides the necessary funding for government investments in R&D programs related to defense support and auxiliary equipment. Additionally, it covers the costs associated with the maintenance, repair, and upgrades of existing defense support and auxiliary equipment. For instance, in December 2024, according to the UK Parliament’s House of Commons Library, a UK-based government administration, UK defense spending is projected to reach £56.9 billion (approximately $70.5 billion) in the financial year 2024/25, with an increase to £59.8 billion (about $73.9 billion) in 2025/26. Therefore, the increase in defense spending is driving the growth of the defense support and auxiliary equipment market.

What are the major segments of the defense support and auxiliary equipment market?

The defense support and auxiliary equipment market covered in this report is segmented –

1) By Type: Military Radars, Military Satellites, Other Defense Support And Auxiliary Equipment

2) By Payload Type: Communication Payload, Navigation Payload, Imaging Payload, Others

3) By Application: Intelligence, Surveillance, And Reconnaissance (Isr), Communication, Navigation

Subsegments:

1) By Military Radars: Airborne Radars, Ground-Based Radars, Naval Radars, Space-Based Radars, Other Military Radars

2) By Military Satellites: Communication Satellites, Reconnaissance Satellites, Navigation Satellites, Earth Observation Satellites, Other Military Satellites

3) By Other Defense Support And Auxiliary Equipment: Military Communication Equipment, Military Sensors And Detectors, Defense Logistics Equipment, Military Transport Vehicles, Other Defense Support Equipment

Order your report now for swift delivery

Which companies dominate the defense support and auxiliary equipment market?

Major companies operating in the defense support and auxiliary equipment market include Raytheon Technologies Corporation, Thales Group, The Boeing Company, Leidos, Leonardo SpA, ManTech International Corp., L3 Technologies Inc., Rostec State Corporation, Bae Systems plc, RTX Corp, Lockheed Martin Corporation, General Dynamics Corporation, British Aerospace Engines Systems Plc, Northrop Grumman Corporation, Safran S.A, Honeywell International Inc., United Technologies Corporation, Elbit Systems Ltd., Rheinmetall AG, Harris Corporation, Cobham Ltd., Moog Inc., Meggitt Plc, Curtiss-Wright Corporation., Teledyne FLIR LLC, Ultra Electronics Holdings Plc, Esterline Technologies Corporation, Kongsberg Gruppen ASA, British Foreign & Colonial Automatic Light Controlling Company Ltd., QinetiQ Group Plc, Kratos Defense & Security Solutions Inc., AVAV – AeroVironment Inc., Textron Inc., Cubic Corp, Science Applications International Corporation.

How will evolving trends contribute to the growth of the defense support and auxiliary equipment market?

Major companies operating in the defense support and auxiliary equipment market are focused on introducing domestically built submarines to gain a competitive edge in the market. A domestically built submarine is a submarine that is designed, developed, and constructed within the country’s borders without relying on foreign technology or expertise. The submarine is a critical component of defense auxiliary equipment, and it is used to protect naval vessels and other assets from hostile attacks in the maritime domain. In September 2023, Taiwan, a country in East Asia, launched its first domestically built submarine, representing an important achievement in the replacement of an outdated naval capacity. The diesel-electric attack submarine, named Hai Kun after a legendary fish in Chinese folklore, was launched in the southern city of Kaohsiung at the CSBC (China Shipbuilding Corporation) Shipyard. The submarine is equipped with digital sonar systems, integrated combat systems, and auxiliary equipment systems, including periscopes.

What are the key regional dynamics of the defense support and auxiliary equipment market, and which region leads in market share?

North America was the largest region in defense support and auxiliary equipment market in 2023. Asia-Pacific is expected to be the fastest growing region in the forecast period. The regions covered in the defense support and auxiliary equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Defense Support and Auxiliary Equipment Market Report 2025 Offer?

The defense support and auxiliary equipment market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

The defense support and auxiliary equipment refer to support and auxiliary equipment used for defense operations, including equipment such as sonars. The defense support and auxiliary equipment include all mobile and fixed systems required to support the operation of the primary defense systems.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2111

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model