Overview and Scope

A digital lending platform refers to a technology-based platform that allows financial institutions to improve business productivity by providing loans through web platforms or mobile apps to generate revenue per loan application. These are used to optimize loan processes, enable fast decision-making, improve regulatory compliance to improve business efficiency, and simplify financial services. The digital lending platform allow borrowers and lenders to lend money in a digital way.

Sizing and Forecast

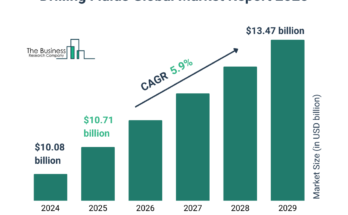

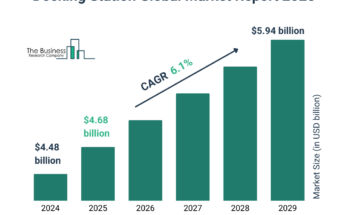

The digital lending platform market size has grown exponentially in recent years. It will grow from $13 billion in 2023 to $15.65 billion in 2024 at a compound annual growth rate (CAGR) of 20.4%. The growth in the historic period can be attributed to rise of fintech companies, mobile and internet penetration, data analytics and credit scoring, need for speed and convenience, economic inclusion initiatives, peer-to-peer lending growth.

The digital lending platform market size is expected to see exponential growth in the next few years. It will grow to $34.6 billion in 2028 at a compound annual growth rate (CAGR) of 21.9%. The growth in the forecast period can be attributed to open banking initiatives, rise of decentralized finance, focus on customer experience, continued regulatory support, global economic recovery. Major trends in the forecast period include cross-border lending, digitization in financial services, mobile-first approaches, blockchain technology for security, customer-centric approaches, partnerships with fintech startups.

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/digital-lending-platform-global-market-report

Segmentation & Regional Insights

The digital lending platform market covered in this report is segmented –

1) By Type: Loan Origination, Decision Automation, Collections And Recovery, Risk And Compliance Management, Other Types

2) By Component: Software, Service

3) By Deployment Model: On-Premise, Cloud

4) By Industry Vertical: Banks, Insurance Companies, Credit Unions, Savings And Loan Associations, Peer-To-Peer Lending, Other Industry Verticals

Top 5 Major Players:

- Nucleus Software Exports Limited

- Accenture PLC

- Fiserv Inc

- Fidelity National Information Services Inc. (FIS)

- One97 Communications Ltd

North America was the largest growing region in the digital lending platform market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the digital lending platform market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7633&type=smp

Major Driver Impacting Market Growth

The surge in the use of smartphones is expected to propel the growth of the digital lending platform market going forward. The smartphone is a mobile device that has a touchscreen interface, an operating system capable of running downloaded apps, and internet access. Due to the surge in the use of smartphones, users and borrowers are applying for instant loans using digital lending. For instance, according to DataReportal, a Singapore-based online reference library, in 2022, the number of smartphones in use is rising at a 5.1 percent annual rate, with an average of 1 million smartphones coming into use every day. Therefore, the surge in the use of smartphones is driving the growth of the digital lending platform market.

Key Industry Players

Major companies operating in the digital lending platform market report are Nucleus Software Exports Limited, Accenture plc, Fiserv Inc., Fidelity National Information Services Inc. (FIS), One97 Communications Ltd., HES FinTech POS, Wipro Limited, DocuSign Inc., Finastra Limited, Pegasystems Inc., Black Knight Inc., LendingTree LLC, Temenos AG, Ellie Mae Inc., ICE Mortgage Technology Inc., Tavant Technologies Inc., EdgeVerve Systems Limited, BlendLabs Inc., Teylor AG, Intellect Design Arena Ltd., Mambu GmbH, Newgen Software Technologies Ltd., Sigma Infosolutions Ltd., Auxmoney GmbH, Roostify Inc., DocuTech Corporation, Built Technologies lnc., Decimal Technologies Pvt Ltd., CU Direct Corporation, Swiss Fintech AG, Upstart Network Inc., ZestFinance Inc.

The digital lending platform market report table of contents includes:

1. Executive Summary

2. Digital Lending Platform Market Characteristics

3. Digital Lending Platform Market Trends And Strategies

4. Digital Lending Platform Market – Macro Economic Scenario

5. Global Digital Lending Platform Market Size and Growth

….

32. Global Digital Lending Platform Market Competitive Benchmarking

33. Global Digital Lending Platform Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Digital Lending Platform Market

35. Digital Lending Platform Market Future Outlook and Potential Analysis

36. Appendix

List Of Tables:

Table 1: Global Historic Market Growth, 2018-2023, $ Billion

Table 2: Global Forecast Market Growth, 2023-2028F, 2033F, $ Billion

Table 3: Global Digital Lending Platform Market, Segmentation By Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

Table 4: Global Digital Lending Platform Market, Segmentation By Component, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

Table 5: Global Digital Lending Platform Market, Segmentation By Deployment Model, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

…

Table 75: Nucleus Software Exports Limited Financial Performance

Table 76: Accenture plc Financial Performance

Table 77: Fiserv Inc. Financial Performance

Table 78: Fidelity National Information Services Inc. (FIS) Financial Performance

Table 79: One97 Communications Ltd. Financial Performance

Explore the trending research reports from TBRC:

https://goodprnews.com/bridges-and-tunnels-market-share/

https://goodprnews.com/global-cards-payments-market-share/

https://goodprnews.com/chartered-air-transport-market-share/

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model