Overview and Scope

Digital payments are a payment mode that uses digital mediums such as the internet, cell phones, and automated devices to send and receive money. It needs both the payer and the payee to use digital means to send and receive money; it is not mandatory in some situations for the payee to use a digital medium to receive money.

Sizing and Forecast

The digital payments market size has grown strongly in recent years. It will grow from $115.93 billion in 2023 to $126.47 billion in 2024 at a compound annual growth rate (CAGR) of 9.1%. The growth in the historic period can be attributed to strong economic growth in emerging markets, increased internet penetration, government initiatives in developing economies, rising penetration of e-commerce and increased availability of mobile devices.

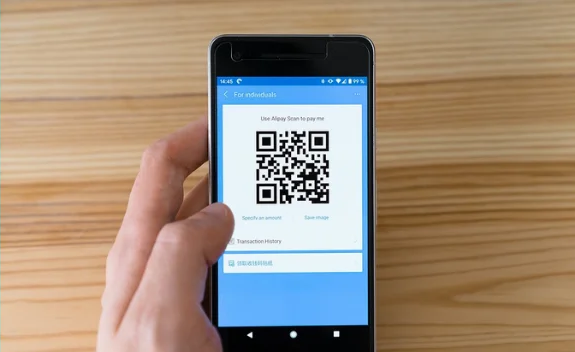

The digital payments market size is expected to see strong growth in the next few years. It will grow to $180.26 billion in 2028 at a compound annual growth rate (CAGR) of 9.3%. The growth in the forecast period can be attributed to the increasing smart cities, government initiatives for digital payments, internet of things (iot), increasing adoption of 5g networks, increase in internet penetration and covid-19. Major trends in the forecast period include offering digital wallet services to increase convenience for customers, offering wearable payment devices for quicker payments, investing in qr based payments technologies to cater to a wider audience, making robust contactless payment options for consumers, investing in ai solutions in order to improve the efficiency, investing in blockchain technologies to offer easily interoperable, efficient, affordable and accessible financial systems and payment solutions in fuel stations to reduce operational costs.

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/digital-payments-global-market-report

Segmentation & Regional Insights

The digital payments market covered in this report is segmented –

1) By Mode Of Payment: Point Of Sale, Online Sale

2) By End-User Industry: Retail, Banking And Financial Service, Telecommunication, Government, Transportation, Others

3) By Deployment: Cloud, On-Premise

4) By Enterprise: Large Enterprises, Small And Medium Enterprises

Asia-Pacific was the largest region in the digital payments market in 2023. Western Europe was the second largest region in the digital payments market report. The regions covered in the digital payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample_request?id=3041&type=smp

Major Driver Impacting Market Growth

Quick onboarding and ease of use are expected to drive the digital payment market. Individuals require flexibility, transparency, and friction-free onboarding. They are more attracted to methods that are frictionless, and as a result, software innovators such as Square and PayPal are using automation to decrease the onboarding time to a few minutes. Digital payments are very easy to use compared to conventional methods, as they only require a bank account or phone number and a smartphone with an internet facility. For instance, according to new data compiled by Taiwan’s government, out of a population of about 23 million, nearly 10 million are mobile payment users. The ease of adoption increases the number of users, thereby contributing to the growth of the digital payments market.

Key Industry Players

Major companies operating in the digital payments market report are Paypal Holdings Inc., Ant Group, Amazon.com, Inc., Visa Inc., Apple Inc., Google Pay, Mastercard Incorporated, JP Morgan Chase & Co., Fiserv Inc., ACI Worldwide Inc., PayUmoney, Paytm, CCAvenue, Razorpay, Instamojo, Cashfree, Line Pay, Rakuten Pay, Origami Pay, D-barai, AliPay, WeChatPay, UnionPay, 99Bill, PayEase, Worldpay, Stripe, Shopify Payments, Opayo, Adyen, SystemPay International, Novalnet, Wirecard, Sberbank Online, Yandex Money, QIWI, WebMoney, Tinkoff Bank, Cielo, Rede, Getnet S, toneCo, GlobalCollect, Lyra Network, Paybox Services, CASHU, Trriple, Monami Tech, DPO Group, MTN Group Limited, Flutterwave, M-Pesa, Coruscate’s Alexpay, Digipay, Software Group, Kineto

The digital payments market report table of contents includes:

1. Executive Summary

2. Digital Payments Market Characteristics

3. Digital Payments Market Trends And Strategies

4. Digital Payments Market – Macro Economic Scenario

5. Global Digital Payments Market Size and Growth

.

.

.

31. Digital Payments Market Other Major And Innovative Companies

32. Global Digital Payments Market Competitive Benchmarking

33. Global Digital Payments Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Digital Payments Market

35. Digital Payments Market Future Outlook and Potential Analysis

36.Appendix

Explore the trending research reports from TBRC:

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model