The discount brokerage global market report 2024from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Market Size –

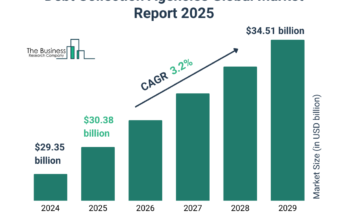

The discount brokerage market size has grown strongly in recent years. It will grow from $23.6 billion in 2023 to $25.63 billion in 2024 at a compound annual growth rate (CAGR) of 8.6%. The growth in the historic period can be attributed to zero-commission trades, expansion of fractional shares, increasingly offer cryptocurrency trading options, expand their educational offerings, and increasing disposable income.

The discount brokerage market size is expected to see strong growth in the next few years. It will grow to $35.76 billion in 2028 at a compound annual growth rate (CAGR) of 8.7%. The growth in the forecast period can be attributed to use of gamification techniques, focus on retirement planning and savings, focus on sustainable and impact investing, expansion of high-speed internet access, and lower operational costs. Major trends in the forecast period include blockchain technology, artificial intelligence, personalization of services, integration of fintech solutions, and advanced analytics tools.

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/discount-brokerage-global-market-report

Scope Of Discount Brokerage Market

The Business Research Company’s reports encompass a wide range of information, including:

- Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

- Drivers: Examination of the key factors propelling market growth.

- Trends: Identification of emerging trends and patterns shaping the market landscape.

- Key Segments: Breakdown of the market into its primary segments and their respective performance.

- Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

- Macro Economic Factors: Assessment of broader economic elements impacting the market.

Discount Brokerage Market Overview

Market Drivers –

The increasing number of retail investors is projected to boost the growth of discount brokerage services. Retail investors are non-professional individuals who invest in securities like stocks, bonds, and mutual funds for personal accounts. The rise of technology-based platforms has made investing more accessible to a broader audience. Discount brokerages enable retail investors to trade at reduced costs through lower fees, empowering them to manage investments independently. According to the World Economic Forum, in October 2022, retail investors accounted for 52% of global assets under management in 2021, with this figure expected to exceed 61% by 2030. Therefore, the growth of retail investors will drive the discount brokerage market.

Market Trends –

Major companies operating in the discount brokerage market are focusing on developing advanced web-based trading platforms to enhance trading efficiency. A web-based trading platform is an online software application that allows users to buy and sell financial instruments, such as stocks, bonds, options, futures, and cryptocurrencies, over the internet. For instance, in September 2023, HDFC Securities, an India-based financial services company, launched HDFC SKY. HDFC SKY is a discount broking all-in-one mobile app with a flat pricing model for intraday and delivery trades. It offers access to various investment options and includes advanced technology for a seamless trading experience.

The discount brokerage market covered in this report is segmented –

1) By Mode: Online Discount Brokerage Service, Offline Discount Brokerage Service

2) By Service: Order Execution And Advisory, Discretionary, Online Trading Platforms, Education And Investor Resources

3) By Commission: Commission-Free Brokers, Fixed Commission Brokers

4) By Application: Individual, Enterprise, Government Agencies

Get an inside scoop of the discount brokerage market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=18570&type=smp

Regional Insights –

South America was the largest region in the discount brokerage market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the discount brokerage market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies –

Major companies in the market are Fidelity Investments Inc., Charles Schwab Corporation, Ally Financial Inc., TD Ameritrade Holding Corporation, Interactive Brokers Group Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated, SoFi Technologies Inc., Robinhood Markets Inc., IG Group Holdings plc, Citadel Securities LLC, NerdWallet Inc., Acorns Grow Inc., TradeStation Group Inc., Apex Fintech Solutions LLC, Stash Financial Inc., Saxo Bank A/S, Public Holdings Inc., Wealthfront Inc., Alice Blue Financial Services Private Limited, Folio Investments Inc., OANDA Corporation, eOption, Tastytrade Inc., Zacks Investment Research Inc.

Table of Contents

- Executive Summary

- Discount Brokerage Market Characteristics

- Discount Brokerage Market Trends And Strategies

- Discount Brokerage Market – Macro Economic Scenario

- Global Discount Brokerage Market Size and Growth

…………..

- Key Mergers And Acquisitions In The Discount Brokerage Market

- Discount Brokerage Market Future Outlook and Potential Analysis

- Appendix

List Of Tables:

Table 1: Global Historic Market Growth, 2018-2023, $ Billion

Table 2: Global Forecast Market Growth, 2023-2028F, 2033F, $ Billion

Table 3: Global Discount Brokerage Market, Segmentation By Mode, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

Table 4: Global Discount Brokerage Market, Segmentation By Service, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

Table 5: Global Discount Brokerage Market, Segmentation By Commission, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

………….

Table 75: Fidelity Investments Inc. Financial Performance

Table 76: Charles Schwab Corporation Financial Performance

Table 77: Ally Financial Inc. Financial Performance

Table 78: TD Ameritrade Holding Corporation Financial Performance

Table 79: Interactive Brokers Group Inc. Financial Performance

Read Related Reports:

https://goodprnews.com/diabetic-foot-ulcer-treatment-market-size-2/

https://topprnews.com/display-calibration-management-tools-market-size-2/

Learn About Us:

The Business Research Company is a market intelligence firm that pioneers in market, company, and consumer research. TBRC’s specialist consultants are located globally and are experts in a wide range of industries that include healthcare, manufacturing, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model