The electronic (e) brokerages global market report 2024from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Electronic (E) Brokerages Market, 2024The electronic (e) brokerages global market report 2024

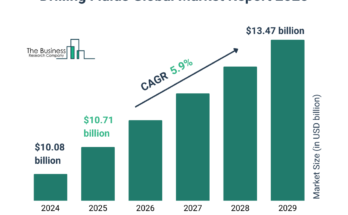

Market Size – The electronic (E) brokerages market size has grown rapidly in recent years. It will grow from $10.86 billion in 2023 to $12.01 billion in 2024 at a compound annual growth rate (CAGR) of 10.5%. The growth in the historic period can be attributed to lower transaction costs, increased internet penetration, financial crises and market volatility, regulatory changes, and rising financial literacy.

The electronic (E) brokerages market size is expected to see rapid growth in the next few years. It will grow to $18.02 billion in 2028 at a compound annual growth rate (CAGR) of 10.7%. The growth in the forecast period can be attributed to global economic trends, regulatory support, sustainability and ESG investing, demographic trends, and increasing demand for alternative investments. Major trends in the forecast period include increased security measures, enhanced user experience, robo-advisory services, innovation in fintech, and the and the integration of AI.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/electronic-e-brokerages-global-market-report

Scope Of Electronic (E) Brokerages MarketThe Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Electronic (E) Brokerages Market Overview

Market Drivers -The rise of Millennial and Gen Z investors is expected to drive the growth of the electronic (E) brokerage market as these tech-savvy generations actively participate in investment activities. Millennials, born between 1981 and 1996, and Gen Z, born between the late 1990s and early 2010s, are attracted to investing due to easy access to financial information, low-cost platforms, and an interest in socially responsible investments. Social media influence, financial independence goals, and engaging investment tools also contribute to their involvement. E-brokerages provide accessible, user-friendly platforms for trading and investing with lower fees and more transparency. For example, as of May 2024, Broadridge Financial Solutions reported that asset ownership in equities increased significantly among younger investors, with Gen Z participation growing from 0.2% to 0.4%, and Millennials’ ownership rising from 2% to 6%. Therefore, the increasing involvement of Millennial and Gen Z investors is expected to further propel the electronic brokerage market.

Market Trends – Major companies operating in the electronic (E) brokerage market are developing AI-backed trading solutions platforms to enhance trading efficiency, provide personalized investment strategies, and improve the overall user experience. An AI-backed trading solutions platform uses artificial intelligence and machine learning algorithms to analyze vast amounts of market data, predict trends, and execute trades with enhanced precision and efficiency. For instance, in January 2023, Octanom Tech Pvt. Ltd., an India-based financial technology company specializing in artificial intelligence-powered trading solutions, launched Hedged, an e-brokerage platform. This platform is tailored to deliver advanced investment and trading strategies for retail investors. Hedged specializes in providing hedged options trades through a sophisticated blend of proprietary algorithms. A notable feature of the platform is the Nifty Crash Meter, a predictive tool designed to anticipate market fluctuations, enabling investors to proactively adjust their portfolios.

The electronic (E) brokerages market covered in this report is segmented –

1) By Service Provider: Full Time Broker, Discounted Broker

2) By Ownership: Privately Held, Publicly Held

3) By End User: Retail Investor, Institutional Investor

Get an inside scoop of the electronic (e) brokerages market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=18591&type=smp

Regional Insights – North America was the largest region in the electronic (E) brokerages market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the electronic (E) brokerages market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies – Major companies in the market are Fidelity Investments Inc., The Charles Schwab Corporation, Ally Invest Securities LLC, TD Ameritrade Inc., Interactive Brokers LLC, E*TRADE Financial Holdings LLC, Robinhood Markets Inc., IG Group Holdings plc, Plus500 Ltd, Saxo Bank A/S, eToro Group Ltd, TradeStation Group Inc., Questrade Inc., Pepperstone Group Limited, Xtrade Europe Ltd, Webull Financial LLC, NinjaTrader LLC, DEGIRO B.V., Stocktrade, eOption, Arab National Bank, tastyworks Inc., Firstrade Securities Inc., Nippon Life India Asset Management Limited

Table of Contents 1. Executive Summary2. Electronic (E) Brokerages Market Report Structure3. Electronic (E) Brokerages Market Trends And Strategies4. Electronic (E) Brokerages Market – Macro Economic Scenario5. Electronic (E) Brokerages Market Size And Growth…..27. Electronic (E) Brokerages Market Competitor Landscape And Company Profiles28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model