Overview and Scope

An exchange-traded fund (ETF) is a type of investment fund that is traded on stock exchanges, much like stocks. ETFs are designed to track the performance of a specific index, commodity, bond, or basket of assets. They offer investors exposure to a diversified portfolio of assets and are structured to replicate the performance of their underlying index or asset.

Sizing and Forecast

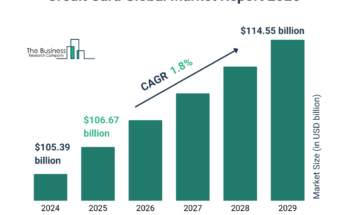

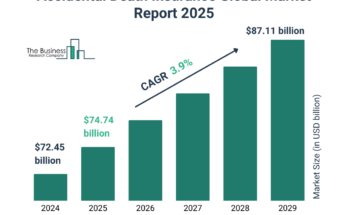

The exchange-traded fund market size has grown exponentially in recent years. It will grow from $15.97 billion in 2023 to $19.34 billion in 2024 at a compound annual growth rate (CAGR) of 21.1%. The growth in the historic period can be attributed to increasingly embracing passive investing, a rise in market liquidity, continuous trading activities, increasingly embracing passive investing, and trading associated with equity etfs.

The exchange-traded fund market size is expected to see exponential growth in the next few years. It will grow to $41.79 billion in 2028 at a compound annual growth rate (CAGR) of 21.2%. The growth in the forecast period can be attributed to the growth of bond etfs, regulatory complexity hampers, instant exposure to a diversified portfolio, and an accelerated shift towards e-commerce and digital transformation. Major trends in the forecast period include new ETF launches, technological advancements, online trading platform enhancements, robo-advisors to trade ETFs, and increased reliance on digital technologies.

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/exchange-traded-fund-global-market-report

Segmentation & Regional Insights

The exchange traded fund market covered in this report is segmented –

1) By Investment Style: Passive Exchange Traded Funds (ETFs), Active Exchange Traded Funds (ETFs), Smart Beta Exchange Traded Funds (ETFs)

2) By Asset Class: Equity Exchange Traded Funds (ETFs), Fixed-Income Exchange Traded Funds (ETFs), Commodity Exchange Traded Funds (ETFs), Currency Exchange Traded Funds (ETFs), Real Estate Exchange Traded Funds (ETFs), Hybrid Exchange Traded Funds (ETFs)

3) By Bond Type: Government Bond Exchange Traded Funds (ETFs), Corporate Bond Exchange Traded Funds (ETFs), Municipal Bond Exchange Traded Funds (ETFs), High-Yield Bond Exchange Traded Funds (ETFs)

4) By Investor Type: Individual Investor, Institutional Investor

5) By Distribution Channel: Retail, Institutional

North America was the largest region in the exchange traded fund market in 2023. The regions covered in the exchange traded fund market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16677&type=smp

Major Driver Impacting Market Growth

The rising total asset management is expected to propel the growth of the exchange-traded fund market going forward. Asset management is the professional handling of investments on behalf of others. The complexity of assets drives the rise in asset management, the necessity for superior risk control, and the quest for higher investment returns. ETFs aid asset management by providing diversification, ease of trading, reduced expenses, and improved portfolio and investment tactics. For instance, in February 2024, according to a report by the State Street Corporation, a US-based financial services company, the global ETF market experienced a record $11.6 trillion in assets under management, driven by investors reallocating funds from cash to equities and bonds, an increase of 15% from 2022. Therefore, rising total asset management is driving the growth of the exchange-traded fund market.

Key Industry Players

Major companies operating in the exchange traded fund market are JPMorgan Chase & Co., Bank of America, Wells Fargo & Company, BNP Paribas SA, Morgan Stanley, The Goldman Sachs Group Inc., UBS Group AG, Barclays PLC, FMR LLC, Hartford Funds, The Charles Schwab Corp., BlackRock Inc., State Street Corporation, The Vanguard Group Inc., Blackstone Inc., T. Rowe Price, Invesco Ltd., Morningstar Inc., Abrdn plc, BMO Global Asset Management, Virtus Investment Partners, VictoryShares (Victory Capital), WisdomTree Inc., Tata Mutual Fund, Van Eck Associates Corp

The exchange traded fund market report table of contents includes:

1. Executive Summary

2. Exchange Traded Fund Market Characteristics

3. Exchange Traded Fund Market Trends And Strategies

4. Exchange Traded Fund Market – Macro Economic Scenario

5. Global Exchange Traded Fund Market Size and Growth

.

.

.

32. Global Exchange Traded Fund Market Competitive Benchmarking

33. Global Exchange Traded Fund Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Exchange Traded Fund Market

35. Exchange Traded Fund Market Future Outlook and Potential Analysis

36. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model