What are the recent trends in market size and growth for the flood insurance market?

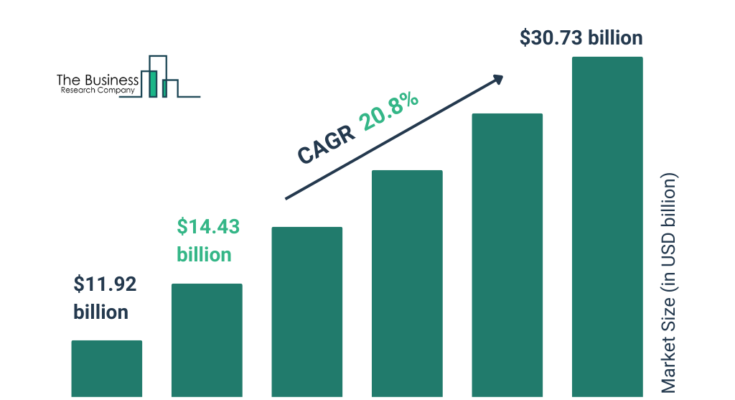

The flood insurance market size has grown exponentially in recent years. It will grow from $11.92 $ billion in 2024 to $14.43 $ billion in 2025 at a compound annual growth rate (CAGR) of 21.0%. The growth in the historic period can be attributed to increase in frequency of flood events, rise in awareness of flood risks, rise in property prices, increase in public funding for flood protection, and increase in insurance coverage requirements.

The flood insurance market size is expected to see exponential growth in the next few years. It will grow to $30.73 $ billion in 2029 at a compound annual growth rate (CAGR) of 20.8%. The growth in the forecast period can be attributed to rising frequency of extreme weather events, increasing government regulations, increasing investment in flood defense infrastructure, growing insurance coverage options, and increasing number of flood insurance providers. Major trends in the forecast period include adoption of advanced flood risk assessment tools, adoption of satellite imagery and remote sensing technologies, integration of climate change models, development of customizable flood insurance policies, and implementation of automated claims processing systems.

Get Your Free Sample of The Global Flood Insurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19441&type=smp

How have varous drivers impacted the growth of the flood insurance market?

The rise in climate change and increasing flood risks is expected to propel the growth of the flood insurance market going forward. The climate change and flood risks are increasing due to rise in urbanization, deforestation, and poor drainage infrastructure. Insurance helps communities to recover more quickly after flooding events by providing the necessary funds for rebuilding and repairs, reinforcing the importance of flood insurance. For instance, in December 2023, according to the UK Health Security Agency, an UK-based government agency, flood risk is anticipated to increase by 61% by 2050 under a modest warming scenario (+2°C) and 118% in a high warming scenario (+4°C) compared with current risk. Therefore, climate change and increasing flood risks is driving the flood insurance market.

What are the primary segments of the flood insurance market?

The flood insurancemarket covered in this report is segmented –

1) By Type: Life Insurance, Non Life Insurance

2) By Coverage: Building Property Coverage, Personal Contents Coverage

3) By Application: Commercial, Residential

Subsegments:

1) By Life Insurance: Flood-Related Life Coverage, Term Life Insurance With Flood Riders, Whole Life Insurance With Flood Risk Coverage, Accidental Death And Disability Due To Floods, Critical Illness Policies Covering Flood-Related Diseases

2) By Non-Life Insurance: Homeowners Flood Insurance, Commercial Flood Insurance, Flood Insurance For Businesses And Properties, Auto Flood Insurance, Agricultural Flood Insurance, Renters Flood Insurance, Flood Insurance For Public Infrastructure, Business Interruption Insurance Due To Flooding

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/flood-insurance-global-market-report

Which firms are leading the flood insurance market?

Major companies operating in the flood insurance market are Berkshire Hathaway Inc., Ping An Insurance Company of China Ltd., Allianz SE, Axa S.A., Munich Re Group, American International Group Inc., Liberty Mutual Insurance Company, Tokio Marine Holdings Inc., The Allstate Corporation, The Progressive Corporation, Swiss Reinsurance Company Ltd, Zurich Insurance Group Ltd, Chubb Limited, The Travelers Companies Inc., Sompo Holdings Inc., Hannover Rück SE, Mapfre SA, The Hartford Financial Services Group Inc., QBE Insurance Group Limited, Everest Re Group Ltd., CNA Financial Corporation, Markel Corporation, Assurant Inc., Arch Capital Group Ltd., Suncorp Group Limited

How will industry trends affect the trajectory of the flood insurance market?

Major companies operating in the flood insurance market are developing automated flood insurance services to streamline claim processing and enhance the customer experience. Automated flood insurance service uses technology to simplify and speed up flood insurance processes, offering quick quotes, efficient policy management, and streamlined claims handling through data analytics and digital tools. For instance, in March 2024, Chubb, a Switzerland-based insurance company, launched a self-service flood insurance system that provides flood insurance quotes for low hazard properties in under two minutes. Integrated with the Chubb Agent Portal and Masterpiece EZ Quote platform, it leverages advanced digital technology for efficiency. It is significant in the flood insurance market as it provides fast and complete coverage options, showing their proactive response to increasing flood risks.

Which geographic trends are shaping the flood insurance market, and which region has the highest market share?

North America was the largest region in the flood insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the flood insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Flood Insurance Market Report 2025 Offer?

The flood insurance market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Flood insurance refers to a specialized type of property coverage designed to protect against financial losses caused by flooding. It helps cover repair and replacement costs for flood damaged property and personal belongings, providing financial protection, peace of mind, and fulfilling lender requirements for flood prone areas.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19441

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model