At what pace is the generative artificial intelligence (ai) in banking market growing, and what is its estimated value?

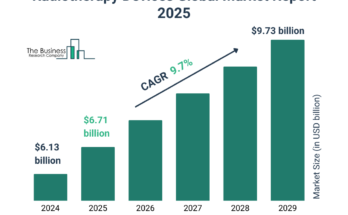

The generative artificial intelligence (AI) in banking market size has grown exponentially in recent years. It will grow from $1.16 billion in 2024 to $1.44 billion in 2025 at a compound annual growth rate (CAGR) of 24.1%. The growth in the historic period can be attributed to increasing data availability, cloud computing adoption, customer personalization demand, regulatory pressure for compliance, and the rise of fintech disruptors.

The generative artificial intelligence (AI) in banking market size is expected to see exponential growth in the next few years. It will grow to $3.39 billion in 2029 at a compound annual growth rate (CAGR) of 23.9%. The growth in the forecast period can be attributed to automation of banking processes, demand for fraud detection, expansion of digital banking, rising operational efficiency needs, and enhanced customer experience focus. Major trends in the forecast period include AI-driven chatbots, AI-based risk management, personalized financial services, AI-powered investment tools, and the integration of AI in mobile banking apps.

Get Your Free Sample of The Global Generative Artificial Intelligence (AI) In Banking Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=20800&type=smp

What are the top drivers to the rising demand in the generative artificial intelligence (ai) in banking market?

The rising demand for fraud detection and prevention is expected to propel the growth of generative artificial intelligence (AI) in banking market. Fraud detection and prevention refers to the strategies and technologies employed to identify, prevent, and manage fraudulent activities. Demand for fraud detection and prevention is rising due to the increasing sophistication of fraud tactics and growing financial transaction volumes. Generative AI in banking helps mitigate fraud and enhance detection by analyzing vast data patterns to identify unusual transactions and prevent fraudulent activities in real time. For instance, in March 2024, according to the Australian Bureau of Statistics, an Australia-based government agency, about 8.7% of individuals (1.8 million) experienced card fraud in 2022–23, up from the 8.1% rate recorded in 2021–22. Therefore, the rising demand for fraud detection and prevention is driving the growth of the generative artificial intelligence (AI) in banking market.

How is the generative artificial intelligence (ai) in banking market segmented?

The generative artificial intelligence (AI) in banking market covered in this report is segmented –

1) By Technology: Natural Language Processing; Deep Learning; Reinforcement Learning; Generative Adversarial Networks; Computer Vision; Predictive Analytics

2) By Deployment Model: Cloud Deployment; On-Premises Deployment; Hybrid Deployment

3) By End-User: Retail Banking Customers; Small And Medium Enterprises; Investment Professionals; Compliance And Risk Management Teams; Operations And Process Optimization; Executives And Decision Makers

Subsegments:

1) By Natural Language Processing (NLP): Chatbots And Virtual Assistants; Sentiment Analysis For Financial Markets; Document And Contract Analysis; Speech Recognition For Customer Service

2) By Deep Learning: Fraud Detection And Prevention; Credit Scoring And Risk Assessment; Predictive Analytics For Investment; Customer Behavior Analysis

3) By Reinforcement Learning: Algorithmic Trading; Portfolio Management And Optimization; Dynamic Pricing Models; Personalized Financial Services

4) By Generative Adversarial Networks (GANs): Synthetic Data Generation For Training Models; Fraud Detection And Risk Management; Customer Data Augmentation For Personalization; Market Simulation And Analysis

5) By Computer Vision: Document Verification And Processing; ATM Surveillance And Security; Image-Based Fraud Detection; Visual Data Extraction For Financial Analysis

6) By Predictive Analytics: Risk Assessment And Management; Credit Scoring And Loan Default Prediction; Customer Churn Prediction; Market Trend Forecasting

Order your report now for swift delivery

Who are the top competitors in the generative artificial intelligence (ai) in banking market?

Major companies operating in the generative artificial intelligence (AI) in banking market areGoogle LLC, Microsoft Corporation, Amazon Web Services (AWS) Inc., Accenture plc, International Business Machines Corporation (IBM), Oracle Corporation, SAP SE, Tata Consultancy Services (TCS) Ltd., Nvidia Corporation, Salesforce Inc., Capgemini SE, Cognizant Technology Solutions Corporation, Infosys Limited, Finastra Group Holdings Limited, Pegasystems Inc., Temenos AG, C3.ai Inc., Clari Inc, DataRobot Inc., Aisera, Kasisto Inc.

What significant trends should we anticipate in the generative artificial intelligence (ai) in banking market over the forecast period?

Major companies in the generative artificial intelligence (AI) banking market are developing innovative solutions, such as responsible generative AI, to ensure ethical, transparent, and secure financial processes while enhancing fraud detection and customer service. Responsible generative AI refers to the development and use of generative artificial intelligence (AI) systems in a way that prioritizes ethical standards, fairness, transparency, and accountability. For instance, in May 2024, Temenos AG, a Switzerland-based software company, launched Responsible Generative AI solutions for core banking, a significant advancement in AI integration within the financial services sector. These solutions are part of Temenos’ AI-infused banking platform, designed to improve how banks handle their data, ultimately increasing productivity and profitability while ensuring compliance and security. Users can interact with the system using natural language queries to quickly generate unique insights and reports, reducing the time needed for business stakeholders to access critical data, such as identifying the most profitable customer segments based on demographics.

Which regional trends are influencing the generative artificial intelligence (ai) in banking market, and which area dominates the industry?

North America was the largest region in the generative artificial intelligence (AI) in banking market in 2024. The regions covered in the generative artificial intelligence (AI) in banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Generative Artificial Intelligence (AI) In Banking Market Report 2025 Offer?

The generative artificial intelligence (ai) in banking market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Generative artificial intelligence (AI) in banking refers to the use of advanced AI algorithms to create personalized content, automate processes, and enhance customer interactions. It can be applied to areas such as fraud detection, customer service, and financial forecasting by generating insights from vast data sets. The technology improves efficiency, reduces operational costs, and enhances decision-making in banking operations.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=20800

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model