What is the present valuation and projected CAGR of the generative artificial intelligence in fintech market?

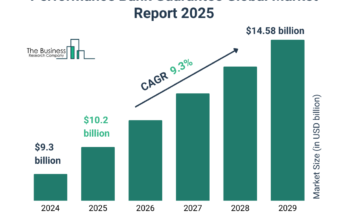

The generative artificial intelligence in fintech market size has grown exponentially in recent years. It will grow from $1.61 $ billion in 2024 to $2.17 $ billion in 2025 at a compound annual growth rate (CAGR) of 35.3%. The growth in the historic period can be attributed to the increasing availability of financial data, demand for automated financial services, growth in digital transactions, regulatory support for fintech innovation, need for improved risk management, and rising use of AI in customer service.

The generative artificial intelligence in fintech market size is expected to see exponential growth in the next few years. It will grow to $7.23 $ billion in 2029 at a compound annual growth rate (CAGR) of 35.1%. The growth in the forecast period can be attributed to the growing focus on personalized financial services, increasing adoption of AI for fraud detection, demand for efficient compliance solutions, expansion of AI-driven asset management tools, rise in AI-powered predictive analytics, emphasis on real-time decision-making, growth in digital and online banking services. Major trends in the forecast period include the integration of AI with blockchain technology, development of advanced AI-driven trading algorithms, growth of AI-powered personal finance management tools, innovations in AI for credit scoring and lending, advancements in generative AI for financial forecasting and planning.

Get Your Free Sample of The Global Generative Artificial Intelligence In Fintech Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19481&type=smp

What key drivers have fueled the generative artificial intelligence in fintech market’s development over the years?

The increasing shift towards digital banking is expected to propel the growth of generative artificial intelligence in the fintech market going forward. Digital banking refers to using digital technology to offer and manage banking services and transactions through online platforms and mobile applications. The demand for digital banking is due to convenience, the adoption of smartphones, advancements in financial technology, and the need for enhanced security and efficiency in managing financial transactions. Generative artificial intelligence enhances digital banking by automating complex tasks, personalizing customer interactions, and improving decision-making processes while enabling financial institutions to optimize operations, manage risks, and deliver more efficient and tailored banking experiences. For instance, in April 2024, UK Finance Limited, a UK-based trade association for the banking and financial services sector, reported that digital-only bank accounts were experiencing significant growth, increasing from 24% in 2023 to 36% in 2024. Therefore, the increasing shift towards digital banking drives the generative artificial intelligence in the fintech market.

What is the segmentation for the generative artificial intelligence in fintech market?

The generative artificial intelligence in fintechmarket covered in this report is segmented –

1) By Component: Service, Software

2) By Deployment: On-Premises, Cloud

3) By Application: Compliance And Fraud Detection, Personal Assistants, Asset Management, Predictive Analysis, Insurance, Business Analytics And Reporting, Customer Behavioral Analytics, Other Applications

4) By End-Use: Retail Banking, Investment Banking, Stock Trading Firms, Hedge Funds, Other End-Uses

Subsegments:

1) By Service: Consulting Services For AI Integration, Implementation And Deployment Services, Technical Support And Maintenance, Training And Education Services, Data Management And Analytics Services, Custom Development Services

2) By Software: Fraud Detection And Prevention Solutions, Risk Assessment And Management Tools, Algorithmic Trading Platforms, Personalized Financial Advisory Software, Automated Compliance And Reporting Tools, Customer Relationship Management (CRM) Systems.

Order your report now for swift delivery

Who are the most influential companies in the generative artificial intelligence in fintech market?

Major companies operating in the generative artificial intelligence in fintech market are Google LLC, Microsoft Corporation, Amazon Web Services Inc., Intel Corporation, International Business Machines Corporation, Morgan Stanley, Salesforce Inc., Capgemini Services SAS, Mastercard International Inc., Infosys Ltd., Adobe Inc., Temenos AG, Upstart Network Inc., Darktrace Holdings Limited, C3.AI inc., DataRobot Inc., Kore.AI inc., AlphaSense Inc., H2O.AI inc., Zest AI inc., Kasisto Inc., CLARA Analytics Inc., Zapata Computing Inc.

What are the top industry trends projected to impact the generative artificial intelligence in fintech market?

Major companies operating in the generative artificial intelligence in fintech market are focused on developing advanced AI solutions, such as generative AI bond assistants, to enhance bond trading efficiency and support real-time pricing and portfolio management decisions. Generative AI bond assistants support bond trading and investment by providing real-time analysis, enhancing liquidity discovery, and assisting in identifying and selecting bonds based on user criteria. For instance, in June 2023, LTX by Broadridge, a US-based company that provides a trading platform for the corporate bond industry, launched BondGPT. This new generative AI application by OpenAI’s GPT-4 is designed to enhance the efficiency and effectiveness of trading in the U.S. corporate bond market. BondGPT provides users with a conversational interface to ask bond-related questions and identify corporate bonds based on specific criteria. The application integrates real-time liquidity information from LTX’s Liquidity Cloud and uses advanced bond similarity technology to match bonds with similar characteristics to user-defined parameters. This innovation aims to simplify the bond selection and portfolio construction processes, offering asset managers, hedge funds, and dealers improved liquidity discovery and pricing decision support.

What are the major regional insights for the generative artificial intelligence in fintech market, and which region holds the top position?

North America was the largest region in the generative artificial intelligence (AI) in the fintech market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the generative artificial intelligence in fintech market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Generative Artificial Intelligence In Fintech Market Report 2025 Offer?

The generative artificial intelligence in fintech market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Generative artificial intelligence (AI) in fintech refers to the use of AI technologies to create and enhance financial products and services through advanced data analysis and predictive modeling. Fintech firms might employ generative AI to provide more accurate, efficient, and inventive solutions, enhancing financial decision-making processes and consumer experiences.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19481

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model