Overview and Scope

Carbon credits, or carbon allowances, are permits that represent 1 ton of CO2e (carbon dioxide equivalent) that an organization is permitted to emit. Carbon credits can be used by individuals or companies to offset their greenhouse gas emissions. They were devised to reduce greenhouse gas emissions, creating a monetary incentive for companies to reduce their carbon emissions.

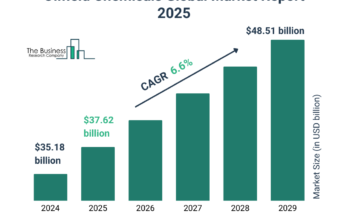

Sizing and Forecast

The carbon credits market size has grown exponentially in recent years. It will grow from $26.78 billion in 2023 to $33.8 billion in 2024 at a compound annual growth rate (CAGR) of 26.2%. The growth in the historic period can be attributed to kyoto protocol implementation, clean development mechanism (cdm), voluntary carbon offset programs, renewable energy projects, corporate social responsibility (csr).

The carbon credits market size is expected to see exponential growth in the next few years. It will grow to $79.28 billion in 2028 at a compound annual growth rate (CAGR) of 23.8%. The growth in the forecast period can be attributed to paris agreement commitments, carbon pricing mechanisms, global sustainability initiatives, natural climate solutions, voluntary market growth. Major trends in the forecast period include blockchain technology integration, technology innovations, carbon credit standardization, increased corporate participation, technological innovations in monitoring, .

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/carbon-credits-global-market-report

Segmentation & Regional Insights

The carbon credits market covered in this report is segmented –

1) By Type: Regulatory, Voluntary

2) By System: Cap-And-Trade, Baseline-And-Credit

3) By End-User: Power, Energy, Aviation, Transportation, Industrial, Buildings, Other End Users

Europewas the largest region in the carbon credits market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the carbon credits market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=13398&type=smp

Major Driver Impacting Market Growth

The increase in global warming is expected to propel the growth of the carbon credit market going forward. Global warming refers to the long-term heating of the Earth’s surface due to human activities, primarily the release of carbon dioxide (CO2) and other greenhouse gases into the atmosphere. The increase in global warming is addressed through the use of carbon credits, which incentivize and promote activities that reduce carbon dioxide and other greenhouse gas emissions. For instance, in August 2023, according to Copernicus EU, a Europe-based provider of Earth observation data, 2023 is currently the third warmest year to date, at 0.43 ºC above the recent average, with the average global temperature in July at 1.5 ºC above preindustrial levels. Furthermore, in January 2022, according to the US National Oceanic and Atmospheric Administration (NOAA), a US-based government agency, the annual temperature of Africa in 2021 was 1.33°C (2.39°F) higher than the continent’s average, with West and North Africa experiencing an extremely warm year. Therefore, the increase in global warming is driving the growth of the carbon credit market.

Key Industry Players

Major companies operating in the carbon credits market report are NRG Energy Inc. , Atos SE, WGL Holdings Inc., AltaGas Ltd., Aker Carbon Capture AS, South Pole Group AG, ClimatePartner Gmbh, Bluesource LLC, 3 Degrees Inc., EKI Energy Services Limited, Sustainable Travel International Inc., Cool Effect Inc., NativeEnergy Inc., ClimeCo Corporation, Tasman Environmental Markets Pty Ltd., Carbon Care Asia Limited, Carbon Credit Capital LLC, Carbonbetter Inc., Carbonfund.org Foundation Inc., Clearsky Climate Solutions LLC, Climate Impact Partners LLC, ClimateTrade Inc., Climetrek Ltd., Base Carbon Inc., Finite Carbon Corporation, Forest Carbon Ltd., Moss Earth LLC, NatureOffice Gmbh, Sterling Planet Inc., Terrapass Inc.</b

The carbon credits market report table of contents includes:

1. Executive Summary

2. Carbon Credits Market Characteristics

3. Carbon Credits Market Trends And Strategies

4. Carbon Credits Market – Macro Economic Scenario

5. Global Carbon Credits Market Size and Growth

.

.

.

32. Global Carbon Credits Market Competitive Benchmarking

33. Global Carbon Credits Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Carbon Credits Market

35. Carbon Credits Market Future Outlook and Potential Analysis

36. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model