The Cash Advance Services Global Market Report 2024 by The Business Research Company provides market overview across 60+ geographies in the seven regions – Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa, encompassing 27 major global industries. The report presents a comprehensive analysis over a ten-year historic period (2010-2021) and extends its insights into a ten-year forecast period (2023-2033).

Learn More On The Cash Advance Services Market:

https://www.thebusinessresearchcompany.com/report/cash-advance-services-global-market-report

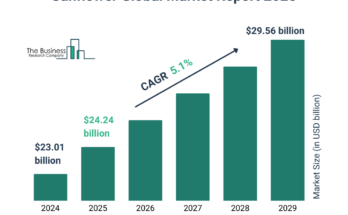

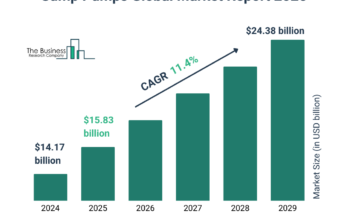

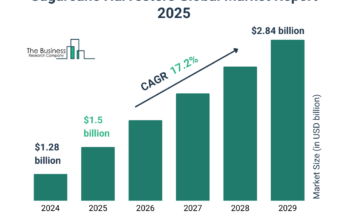

According to The Business Research Company’s Cash Advance Services Global Market Report 2024, The cash advance services market size has grown strongly in recent years. It will grow from $83.26 billion in 2023 to $91.02 billion in 2024 at a compound annual growth rate (CAGR) of 9.3%. The growth in the historic period can be attributed to economic instability, high levels of consumer debt, limited access to traditional credit, raised demand for quick cash solutions, increasing use of credit cards, and high interest rates on personal loans.

The cash advance services market size is expected to see strong growth in the next few years. It will grow to $131.50 billion in 2028 at a compound annual growth rate (CAGR) of 9.6%. The growth in the forecast period can be attributed to increasing consumer demand for instant financial solutions, the expansion of fintech companies offering alternative credit products, rising awareness of flexible repayment options, economic uncertainty affecting consumer spending, and increased use of credit and debit cards. Major trends in the forecast period include increasing adoption of digital platforms for quick access to funds, greater integration of artificial intelligence for credit assessment, rising demand for flexible repayment options, expansion of cash advance services into emerging markets, enhanced regulatory frameworks for consumer protection, growth in partnerships between fintech companies and traditional financial institutions.

The demand for immediate cash access is expected to propel the growth of the cash advance services market going forward. Immediate cash access is quickly getting cash through ATMs, bank withdrawals, or cash advances, enabling people to address urgent financial needs. The demand for immediate cash access is due to the rising cost of living, unexpected expenses, and the shift towards cashless transactions. Cash advance services, such as those offered by credit cards, payday lenders, and ATMs, provide a quick and accessible means to obtain cash. The convenience of accessing cash without the need for extensive paperwork or lengthy approval processes attracts consumers who need immediate funds. For instance, in January 2023, according to Link Scheme Holdings Ltd., a UK-based cash access and automated teller machine network company, in 2022, the value of cash withdrawals at ATMs was £83 billion ($106.54 billion), up from £79 billion in 2021. Therefore, the high demand for immediate cash access is driving the growth of the cash advance services market.

Get A Free Sample Of The Report (Includes Graphs And Tables):

https://www.thebusinessresearchcompany.com/sample.aspx?id=18286&type=smp

The cash advance services market covered in this report is segmented –

1) By Type: Credit Card Cash Advance, Merchant Cash Advance, Payday Loans, Other Types

2) By Deployment: Online, Offline

3) By Service Provider: Bank, Credit Card Companies, Other Service Providers

4) By End User: Personal, Commercial

Major companies operating in the cash advance services market are focusing on developing innovative technologies, such as point-of-sale (POS) cash advances, to offer superior user experiences. POS cash advances allow businesses to receive funds upfront, which are repaid through a portion of their daily sales via POS systems. For instance, in August 2023, SumUp, a UK-based fintech company, launched SumUp Cash Advance, a point-of-sale cash advance to provide short-term financing to merchants based on their payment history. SumUp Cash Advance is introduced, backed by a $100 million credit facility from the alternative investment firm Victory Park Capital (VPC). This credit facility will enable SumUp to provide advance payments to merchants, initially launching in the UK market before expanding to other European countries.

The cash advance services market report table of contents includes:

1. Executive Summary

2. Cash Advance Services Market Characteristics

3. Cash Advance Services Market Trends And Strategies

4. Cash Advance Services Market – Macro Economic Scenario

5. Global Cash Advance Services Market Size and Growth

.

.

.

32. Global Cash Advance Services Market Competitive Benchmarking

33. Global Cash Advance Se36. Appendixrvices Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Cash Advance Services Market

35. Cash Advance Services Market Future Outlook and Potential Analysis

36. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model