The Digital Remittance Global Market Report 2024 by The Business Research Company provides market overview across 60+ geographies in the seven regions – Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa, encompassing 27 major global industries. The report presents a comprehensive analysis over a ten-year historic period (2010-2021) and extends its insights into a ten-year forecast period (2023-2033).

Learn More On The Digital Remittance Market:

https://www.thebusinessresearchcompany.com/report/digital-remittance-global-market-report

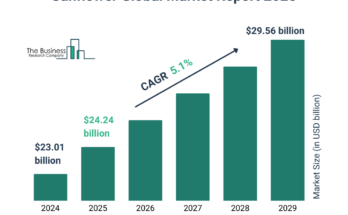

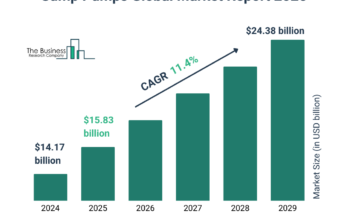

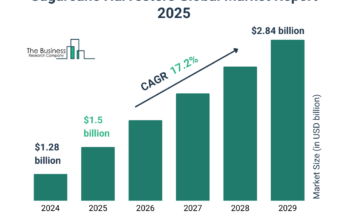

According to The Business Research Company’s Digital Remittance Global Market Report 2024, The digital remittance market size has grown rapidly in recent years. It will grow from $21.85 billion in 2023 to $25.02 billion in 2024 at a compound annual growth rate (CAGR) of 14.5%. The growth in the historic period can be attributed to globalization and increased migration patterns, expansion of the internet and digital connectivity, rise of mobile and smartphone usage, emergence of online banking and fintech platforms, demand for faster and more convenient money transfers

The digital remittance market size is expected to see rapid growth in the next few years. It will grow to $43.26 billion in 2028 at a compound annual growth rate (CAGR) of 14.7%. The growth in the forecast period can be attributed to regulatory changes facilitating digital transactions, development of secure online payment gateways, adoption of central bank digital currencies, development of low-cost and scalable digital payment solutions, surge in the use of cryptocurrency for remittances, development of instant and real-time cross-border payment systems, growth of remittance-as-a-service (raas) models. Major trends in the forecast period include technological advancements in payment systems, integration of blockchain for secure and transparent transactions, artificial intelligence in remittance services, integration of biometric authentication in remittance services, integration of machine learning.

A rising number of international transactions is expected to propel the growth of the digital remittance market going forward. International money transactions refer to the process by which money is paid directly to a person’s or company’s overseas bank account. One can make international money transfers with the aid of a bank, an international money transfer service, online platforms, or specific agents. Digital remittances can provide quicker and more effective transfers with other money transfer operator developments since they use new money movement networks and, in many cases, avoid correspondent banking movements. For instance, in May 2022, according to the World Bank, a US-based international financial institution, the amount of officially registered money transfers sent to low- and middle-income countries (LMICs) is anticipated to rise by 4.2% in 2022 to $630 billion. Therefore, the rising number of international transactions is driving the growth of the digital remittance market.

Get A Free Sample Of The Report (Includes Graphs And Tables):

https://www.thebusinessresearchcompany.com/sample.aspx?id=12517&type=smp

The digital remittance market covered in this report is segmented –

1) By Type: Inward Digital Remittance, Outward Digital Remittance

2) By Channel: Banks, Money Transfer Operators, Online Platforms, Other Channels

3) By End Use: Migrant Labor Workforce, Individual, Small Businesses, Other End Uses

Product innovation is a key trend gaining popularity in the digital remittance market. Major players operating in the digital remittance market are focused on innovating new products and solutions to sustain their position in the market. For instance, in June 2023, Velmie, a US-based financial technology provider, launched its white-label international remittance software, an international money transfer platform. It will make international transactions faster and more affordable than conventional cross-border payment methods and international money transfers. Its cost-effective, flexible, and scalable cloud-native software enables clients to launch their products in an average of three months. With an innovative currency translation engine powered by real-time market data and revenue optimization algorithms, the system now supports more than 38 currencies around the globe.

The digital remittance market report table of contents includes:

1. Executive Summary

2. Digital Remittance Market Characteristics

3. Digital Remittance Market Trends And Strategies

4. Digital Remittance Market – Macro Economic Scenario

5. Global Digital Remittance Market Size and Growth

.

.

.

26. South America Digital Remittance Market

27. Brazil Digital Remittance Market

28. Middle East Digital Remittance Market

29. Africa Digital Remittance Market

30. Digital Remittance Market Competitive Landscape And Company Profiles

Top Major Players:

- Remitly Inc

- Citigroup Inc

- American Express Company

- PayPal Holdings Inc

- Mastercard Inc

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model