The performance bank guarantee global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Performance Bank Guarantee Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size –

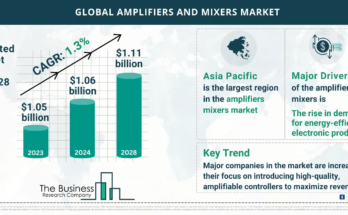

The performance bank guarantee market size has grown strongly in recent years. It will grow from $8.51 billion in 2023 to $9.30 billion in 2024 at a compound annual growth rate (CAGR) of 9.2%. The growth in the historic period can be attributed to increasing demand for online performance bank guarantees (PBGs), increasing the scale and complexity, rise in import and export activities between the countries, rising number of construction projects, and increasing cross border transactions.

The performance bank guarantee market size is expected to see strong growth in the next few years.

It will grow to $13.34 billion in 2028 at a compound annual growth rate (CAGR) of 9.5%. The growth in the forecast period can be attributed to increasingly adopting digital solutions to streamline processes, increasing integration with trade finance platforms, growing demand for work and financial securities, increasing number of small businesses in the developing countries, and increasing trend in global commerce. Major trends in the forecast period include technology innovations, adoption of blockchain technology, integration of artificial intelligence (AI) and machine learning for risk assessment and fraud detection, adoption of e-signature, and integrating cloud technology.

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/performance-bank-guarantee-global-market-report

Scope Of Performance Bank Guarantee Market

The Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Performance Bank Guarantee Market Overview

Market Drivers –

The increasing demand for construction is expected to propel the growth of the performance bank guarantee market going forward. Construction activities involve the physical development of buildings, infrastructure, and other structures. The increasing construction is due to rapid urbanization, infrastructure development, and a focus on efficiency and accuracy in building projects. Performance bank guarantees provide financial protection and confidence to construction project owners and contractors, facilitating smoother project execution and enhancing construction projects’ overall stability and reliability. For instance, in February 2023, according to the Office for National Statistics, a UK-based statistics authority, a 5.6% annual growth in construction output in 2022, following a significant 12.8% increase in 2021. Therefore, the increasing demand for construction drives the performance bank guarantee market.

Market Trends –

Major companies operating in the performance bank guarantee market are focusing on developing innovative solutions, such as blockchain-based guarantee solutions, to enhance security, transparency, and efficiency in the issuance and management of guarantees. Blockchain technology in performance bank guarantees enhances the guaranteed process’s reliability, efficiency, and security, benefiting both the issuing banks and the beneficiaries. For instance, in November 2023, Hong Kong and Shanghai Banking Corporation (HSBC), a UK-based banking and financial services company, launched its blockchain-based performance guarantee solution, which allows for real-time tracking of guarantees and automated verification processes. This solution features enhanced security through decentralized ledger technology, significantly reduced processing time, and an improved customer experience by minimizing paperwork. It will foster trust among stakeholders and position companies to meet the growing demand for efficient and secure financial services.

The performance bank guarantee market covered in this report is segmented –

1) By Type: Tender Guarantee, Financial Guarantee, Advance Payment Guarantee, Foreign Bank Guarantee, Other Types

2) By Bank: Government, Private Sector

3) By Service Deployment: Online, Offline

4) By Application: Small And Medium Enterprises (SMEs), Large Enterprise, Other Applications

Get an inside scoop of the performance bank guarantee market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=19642&type=smp

Regional Insights –

Asia-Pacific was the largest region in the performance bank guarantee market in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the performance bank guarantee market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies –

Major companies operating in the performance bank guarantee market are JPMorgan Chase & Co., Citigroup Inc., Wells Fargo & Company, Royal Bank of Canada, BNP Paribas SA, Deutsche Bank AG, Barclays Bank plc, Société Generale S.A., Standard Chartered PLC, Scotiabank (BNS), HDFC Bank Limited, ICICI Bank Limited, Mizuho Financial Group Inc., DBS Bank Limited, KBC Group, Rabobank Group, Nordea Bank AB, Lloyds Banking Group, United Overseas Bank Limited, Federal Bank Limited, Soleil Chartered Bank (SCB)< /b>

Table of Contents

1. Executive Summary

2. Performance Bank Guarantee Market Report Structure

3. Performance Bank Guarantee Market Trends And Strategies

4. Performance Bank Guarantee Market – Macro Economic Scenario

5. Performance Bank Guarantee Market Size And Growth

…..

27. Performance Bank Guarantee Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model