What is the current size and annual growth rate of the hematology analyzers and reagents market?

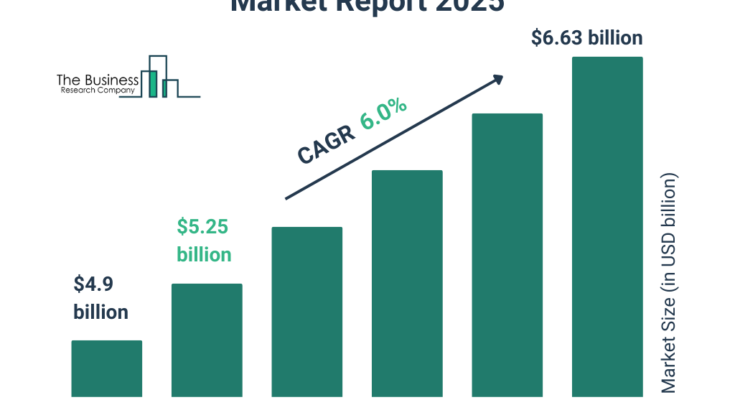

The hematology analyzers and reagents market size has grown strongly in recent years. It will grow from $4.9 billion in 2024 to $5.25 billion in 2025 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to the increasing prevalence of chronic diseases, aging population, increased disease burden, and rising prevalence of infectious diseases.

The hematology analyzers and reagents market size is expected to see strong growth in the next few years. It will grow to $6.63 billion in 2029 at a compound annual growth rate (CAGR) of 6.0%. The growth in the forecast period can be attributed to global health concerns, growing investment in hematology analyzer and reagent infrastructure, personalized medicine, expansion of remote monitoring. Major trends in the forecast period include advancements in technology, high-sensitivity testing, molecular hematology testing, automation and integration, point-of-care testing (POCT), data analytics and artificial intelligence, and digital hematology.

Get Your Free Sample of The Global Hematology Analyzers and Reagents Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2572&type=smp

Which major factors have contributed to the expansion of the hematology analyzers and reagents market?

The rising incidence of infectious diseases is expected to drive the growth of the hematology analyzers and reagents market going forward. Infectious diseases are illnesses that result from pathogenic microorganisms, including bacteria, viruses, fungi, or parasites, which can spread from person to person or from environmental sources. The rising incidence of infectious diseases can be attributed to several interrelated factors, including globalization, which facilitates the rapid spread of pathogens, antimicrobial resistance due to the overuse of antibiotics, and socioeconomic conditions. The data from hematology analyzers aid epidemiological studies by enabling public health officials to track outbreaks and comprehend the dynamics of infectious disease transmission. For instance, in March 2024, according to the Centers for Disease Control and Prevention, a US-based government agency, the number of tuberculosis cases rose from 8,320 in 2022 to 9,615 in 2023, reflecting an increase of 1,295 cases. Therefore, the rising incidence of infectious diseases is propelling the hematology analyzer and reagent market forward

How is the hematology analyzers and reagents market segmented?

The hematology analyzers and reagents market covered in this report is segmented –

1) By Product: Hematology Analyzers, Hemostasis Analyzers, Plasma Protein Analyzers, Hemoglobin Analyzers, Erythrocyte Sedimentation Rate Analyzer, Coagulation Analyzer, Flow Cytometers, Slide Stainers, Differential Counters, Hematology Stains

2) By Applications: Anemias, Blood Cancers, Hemorrhagic Conditions, Infection Related Conditions, Immune System Related Conditions, Other Applications

3) By End User: Specialized Research Institutes, Hospitals, Specialized Diagnostic Centers, Other End Users

Subsegments:

1) By Hematology Analyzers: Automated Hematology Analyzers, Semi-Automated Hematology Analyzers

2) By Hemostasis Analyzers: Platelet Function Analyzers, Coagulation Testing Analyzers

3) By Plasma Protein Analyzers: Electrophoresis Analyzers, Immunofixation Analyzers

4) By Hemoglobin Analyzers: Point-Of-Care Hemoglobin Analyzers, Laboratory Hemoglobin Analyzers

5) By Erythrocyte Sedimentation Rate Analyzer: Manual ESR Analyzers, Automated ESR Analyzers

6) By Coagulation Analyzer: Clotting Time Analyzers, Thromboelastography (TEG) Analyzers

Order your report now for swift delivery

Who are the top competitors in the hematology analyzers and reagents market?

Major companies operating in the hematology analyzers and reagents market include Abbott Laboratories, Bio-Rad Laboratories, Horiba Ltd., Siemens AG, Sysmex Corporation, BioSystems Diagnostics Pvt. Ltd, Boule Diagnostics, Danaher Corporation, Diatron MI PLC, Drew Scientific, EKF Diagnostics, Mindray, Nihon Kohden, Ortho Clinical Diagnostics, Roche, Beckman Coulter, Bayer AG, Heska, Drucker, Instrumentation Laboratory, Abaxis Inc., Accriva Diagnostics, ACON, Diamond Diagnostics, ERBA Diagnostics, Hycel, Maccura Biotechnology Co. Ltd., Genrui Biotech Inc., A&T Corporation, Beijing Succeeder Technology Inc., Diagnostica Stago SAS

What are the most influential trends expected to drive the hematology analyzers and reagents market forward?

Recalls of defective hematology analyzers are acting as a restraint on the hematology analyzers and reagents market. A product recall is done by the manufacturer or developer of the product as a precautionary measure when safety issues or defects are discovered that can endanger the consumer. A faulty hematology analyzer may provide wrong results and may lead to misdiagnosis, affecting consumer confidence in the analyzers. Regulatory authorities caution healthcare professionals to be aware of the potential for inaccurate diagnostic results with these analyzers and to take appropriate actions including the use of alternative diagnostic testing or confirming analyzer results with manual scanning or estimate of cell counts. For instance, Beckman Coulter Life Sciences recalled its DxH800, DxH600, and DxH900 hematology analyzers due to the risk of inaccurate results. Such kind product recalls not only pose a serious safety risk to the public but can also cause significant financial and reputational damage to the companies concerned.

Which geographic trends are shaping the hematology analyzers and reagents market, and which region has the highest market share?

North America was the largest region in the hematology analyzers and reagents market in 2024. Western Europe was the second-largest region in the hematology analyzers and reagents market report. The regions covered in the hematology analyzers and reagents market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

What Does The Hematology Analyzers and Reagents Market Report 2025 Offer?

The hematology analyzers and reagents market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Hematology analyzers provide complete blood count (CBC) with a three-part differential white blood cell (WBC) count and can detect small cell populations to diagnose rare blood conditions, and measure cell morphology.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2572

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model