How much is the home equity lending market worth, and how is it expected to expand?

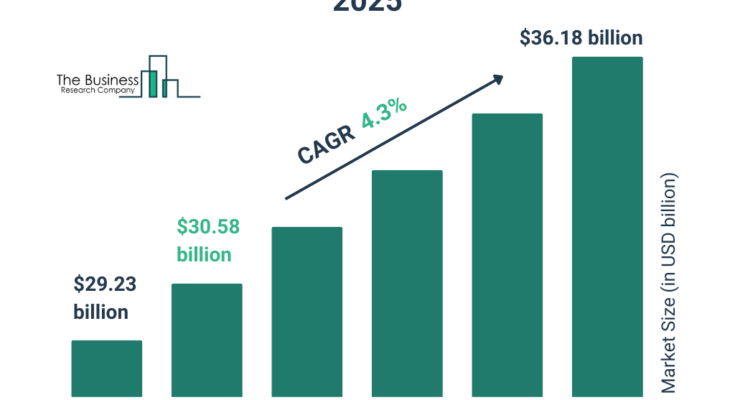

The home equity lending market size has grown steadily in recent years. It will grow from $29.23 $ billion in 2024 to $30.58 $ billion in 2025 at a compound annual growth rate (CAGR) of 4.6%. The growth in the historic period can be attributed to the surge in the prices of the properties, increasing demand for collateral as a risk mitigation strategy by the banks, increasing comparatively higher price rise of housing markets, increase in population, and rise in homeowner equity in real estate.

The home equity lending market size is expected to see steady growth in the next few years. It will grow to $36.18 $ billion in 2029 at a compound annual growth rate (CAGR) of 4.3%. The growth in the forecast period can be attributed to the shift towards remote work, rising real estate prices, rising home renovation, rising residential properties, and rising disposable income. Major trends in the forecast period include technological advancements and fintech innovations, the use of cloud banking software by the banks, advancements in the home equity borrowing process, and data-driven tools of artificial intelligence (AI) and machine learning (ML) are automating the decision-making process of banks.

Get Your Free Sample of The Global Home Equity Lending Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19509&type=smp

Which industry factors have accelerated the home equity lending market’s expansion?

The increase in residential properties is expected to propel the growth of the home equity lending market going forward. Residential properties are real estate assets for living accommodations, including single-family homes, apartments, and condominiums. The increase in residential properties can be attributed to infrastructure development, zoning law changes, proximity to workplaces, a shift towards homeownership, and general inflation. Home equity lending benefits residential properties by allowing homeowners to tap into their property’s increased value, providing them with funds for improvements, consolidations, or other needs, which can enhance property value and overall marketability. For instance, in March 2024, according to the Australian Bureau of Statistics, an Australia-based government agency, there are 30,992 dwellings of private new houses, rising 3.7% from December and an increase of 14.6% since March 2023. Further, private, and other residential completions increased to 14,844 dwellings, a 5.6% increase compared with December 2023. Therefore, the increase in residential properties has driven the growth of the home equity lending market.

What are the primary segments of the home equity lending market?

The home equity lendingmarket covered in this report is segmented –

1) By Type: Fixed Rate Loans, Home Equity Line Of Credit

2) By Deployment: Online, Offline

3) By Service Provider: Banks, Online, Credit Union, Other Service Providers

Subsegments:

1) By Fixed Rate Loans: Standard Fixed Rate Home Equity Loans, Home Equity Loans With No Closing Costs, Short-Term Fixed Rate Loans, Long-Term Fixed Rate Loans, Second Mortgages

2) By Home Equity Line Of Credit (HELOC): Traditional HELOCs, Interest-Only HELOCs, Variable Rate HELOCs, Fixed-Rate Conversion HELOCs, HELOCs With Draw Period Options.

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/home-equity-lending-global-market-report

Which firms are leading the home equity lending market?

Major companies operating in the home equity lending market are Bank Of America Corporation, HSBC Holdings PLC, Toronto-Dominion Bank, BMO Bank N.A., U.S. Bancorp, PNC Financial Services Inc., Discover Financial Services Inc., Citizens Financial Group Inc., M&T Bank Corporation, Regions Financial Corporation, Key Corp Limited, Rocket Mortgage LLC, Navy Federal Credit Union, HomeBridge Financial Services Inc., New American Funding Inc., Zillow Group, LoanDepot LLC, PenFed Credit Union, Simmons First National Corporation, Network Capital Funding Corporation, Spring EQ LLC

Which market trends are set to define the future of the home equity lending market?

Major companies operating in the home equity lending market offer focused on adopting advanced solutions such as real estate finance solutions utilizing eVault technology to streamline the loan application process, enhance customer experience, and provide flexible financing options tailored to meet diverse borrowers’ needs. eVault technology improves the efficiency, security, and compliance of managing electronic loan documents, benefiting both lenders and borrowers by simplifying and securing the lending process. For instance, in May 2022, Wolters Kluwer N.V., a Netherlands-based information services company, launched its OmniVault for Real Estate Finance solution. The solution ensures compliance with legal standards and provides a digitally sealed audit trail, enhancing the security and traceability of digital transactions. This innovative platform utilizes advanced eVault technology to facilitate digital home equity lending, specifically for Home Equity Lines of Credit (HELOCs) and home equity loans, alongside conventional, government-backed, and jumbo first mortgages.

Which geographic trends are shaping the home equity lending market, and which region has the highest market share?

North America was the largest region in the home equity lending market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the home equity lending market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Home Equity Lending Market Report 2025 Offer?

The home equity lending market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Home equity lending refers to a type of loan or line of credit that allows homeowners to borrow money using the equity in their home as collateral. Home equity lending can be used for various purposes, such as home improvements, debt consolidation, education expenses, or other major financial needs.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19509

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model