Overview and Scope

Impact investing refers to a general investment strategy that helps investors make investments with the intention of generating positive, measurable social and environmental impact. This investment is also shown as a company’s commitment to corporate social responsibility. The impact investing is used to generate some beneficial financial returns.

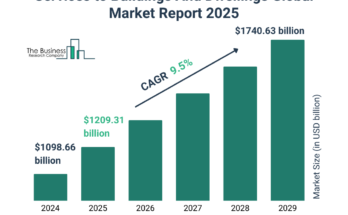

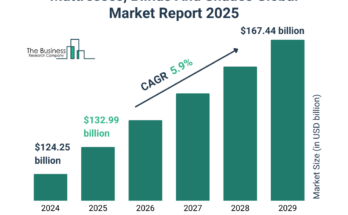

Sizing and Forecast

The impact investing market size has grown rapidly in recent years. It will grow from $478.15 billion in 2023 to $550.52 billion in 2024 at a compound annual growth rate (CAGR) of 15.1%. The growth in the historic period can be attributed to social and environmental awareness, shift in investor values, emergence of impact metrics, rise of social enterprises, millennial and gen z preferences, institutional commitment.

The impact investing market size is expected to see rapid growth in the next few years. It will grow to $1061.14 billion in 2028 at a compound annual growth rate (CAGR) of 17.8%. The growth in the forecast period can be attributed to renewable energy transition, racial and gender equity, global resilience planning, circular economy initiatives, education and skill development. Major trends in the forecast period include technology and innovation, outcome measurement and reporting, social bonds and green bonds, collaboration and partnerships, nature-based solutions.

Order your report now for swift delivery, visit the link:

https://thebusinessresearchcompany.com/report/impact-investing-global-market-report

Segmentation & Regional Insights

The impact investing market covered in this report is segmented –

1) By Illustrative Sector: Education, HealthCare, Housing, Agriculture, Environment, Clean Energy Access, Climate Change, Other Illustrative Sectors

2) By Enterprise Size: Large Enterprises, Medium and Small Enterprises

North America was the largest region in the impact investing market in 2023. The regions covered in the impact investing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample_request?id=7688&type=smp

Major Driver Impacting Market Growth

The increase in millennial investors is expected to propel the growth of the impact investing market going forward. Millennial investors refer to a type of investor who is less likely to invest in stocks. These millennial investors are adopting sustainable investing to aim for positive change in addressing social and environmental issues and to generate wealth constantly. Millennial investors believe impact investing is the best way to increase their share of social change and good as compared to the traditional forms of philanthropy to create long-term positive change in society. For instance, in April 2022, according to a survey conducted by Fidelity Charitable, a US-based independent public charity with a donor-advised fund program, that included more than 1,200 investors to understand their approach to investing in social change, stated that approximately 61% of millennial investors participated in impact investing and 40% of non-participating investors are expected to make their impact investment in the future in the US. Therefore, increasing the number of millennial investors is driving the growth of the impact investing market.

Key Industry Players

Major companies operating in the impact investing market report are LeapFrog Investments Ltd., Sustainalytics, The Rise Fund, Revolution Foods Inc., Root Capital Inc., Triodos Bank N.V., MicroVest Capital Management LLC, New Ventures LLC, Acumen Fund Inc., Omidyar Network Fund Inc., responsAbility Investments AG, Calvert Impact Capital Inc., Capricorn Investment Group LLC, Toniic Network Inc., Bridges Fund Management Ltd., Veris Wealth Partners LLC, RSF Social Finance Inc., Sarona Asset Management Inc., ClearlySo Ltd., Elevar Equity LLC, Open Road Alliance, Shared Interest, SJF Ventures Management LLC, Big Path Capital LLC, Blue Haven Initiative LLC, Core Innovation Capital Management LLC, BlueOrchard Finance S.A., Lok Capital LLC, RENEW Strategies LLC, Capria Ventures LLC

The impact investing market report table of contents includes:

1. Executive Summary

2. Impact Investing Market Characteristics

3. Impact Investing Market Trends And Strategies

4. Impact Investing Market – Macro Economic Scenario

5. Global Impact Investing Market Size and Growth

.

.

.

31. Impact Investing Market Other Major And Innovative Companies

32. Global Impact Investing Market Competitive Benchmarking

33. Global Impact Investing Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Impact Investing Market

35. Impact Investing Market Future Outlook and Potential Analysis

36.Appendix

Explore the trending research reports from TBRC:

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model