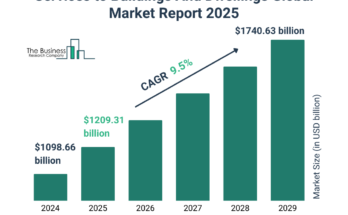

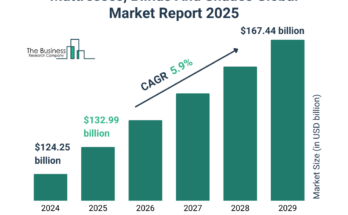

What is the current market size and future outlook for the insurance eligibility verification market?

The insurance eligibility verification market size has grown strongly in recent years. It will grow from $2.22 billion in 2024 to $2.40 billion in 2025 at a compound annual growth rate (CAGR) of 7.5%. The growth in the historic period can be attributed to the rise in healthcare digitalization, the rise in telehealth services, increasing healthcare costs, the rise in demand for real-time eligibility checks, and the growth in insurance coverage.

The insurance eligibility verification market size is expected to see strong growth in the next few years. It will grow to $3.21 billion in 2029 at a compound annual growth rate (CAGR) of 9.6%. The growth in the forecast period can be attributed to rising demand for streamlined healthcare administration, increasing complexity of insurance policies, rising number of insurance claims, and growing investments in healthcare IT infrastructure. Major trends in the forecast period include the use of artificial intelligence (AI), mobile-friendly verification solutions, the use of blockchain technology, integration with billing systems, and personalized verification systems.

Get Your Free Sample of The Global Insurance Eligibility Verification Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=21494&type=smp

How has the insurance eligibility verification market evolved, and what factors have shaped its growth?

The rising number of insured individuals is expected to propel the growth of the insurance eligibility verification market going forward. Insured individuals refer to people who have coverage through an insurance policy, providing financial protection against specific risks or losses. The growing number of insured individuals is driven by factors such as expanding government healthcare programs, rising employer-sponsored insurance plans, and increasing awareness of the importance of health coverage. Insurance eligibility verification helps insured individuals by ensuring accurate coverage details and preventing claim denials, unexpected costs, and treatment delays. This process enhances transparency, reduces financial stress, and improves the patient experience. For instance, in September 2023, according to the United States Census Bureau (USCB), a US-based government agency, in 2022, 92.1% of the US population had health insurance at some point, an increase from 91.7% or 300.9 million in 2021. Therefore, the rising number of insured individuals drives the growth of the insurance eligibility verification market.

What are the major segments of the insurance eligibility verification market?

The insurance eligibility verification market covered in this report is segmented –

1) By Type: Cloud-Based, On-Premises

2) By Application: Payers, Healthcare Providers, Third-Party Administrators

3) By End-User: Clinics, Hospitals, Insurance Companies

Subsegments:

1) By Cloud-Based: Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS

2) By On-Premises: Licensed Software, Integrated Systems

Order your report now for swift delivery

Which companies dominate the insurance eligibility verification market?

Major companies operating in the insurance eligibility verification market are Access Healthcare, Flatworld Solutions, Waystar, Firstsource, Medusind Solutions, SunTec India, Plutus Health Inc., AdvancedMD, Vee Healthtek, OmniMD, ClinicSpectrum, DataMatrix Technologies, Business Integrity Services, e-care India, Medical Billing Wholesalers, SSR Techvison Pvt, Clearwave Corporation, AccuReg Software, eClaimStatus, iTech Data Services, pVerify Inc., Cortex EDI Inc., AGS Health, Outsource Strategies International, Med Xpert Services

How will evolving trends contribute to the growth of the insurance eligibility verification market?

Major companies operating in the insurance eligibility verification market are focusing on developing advanced solutions such as an advanced AI-powered dental insurance verification to streamline the verification process. An AI-powered dental insurance verification is a software solution designed to optimize the verification of dental insurance coverage. Integrating with dental practice management systems, this tool automates eligibility checks, reduces administrative workload, and minimizes errors, ensuring a more efficient and accurate verification process. For instance, in June 2024, Pearl Inc., a US-based dental AI company, launched Precheck, an AI-powered insurance eligibility verification tool. This tool utilizes natural language processing to streamline the insurance verification process, enabling dental practices to provide patients with accurate and comprehensive coverage information. Precheck can identify coverage for 30% more patients than traditional verification methods, enhancing operational efficiency and patient trust in dental care.

What are the key regional dynamics of the insurance eligibility verification market, and which region leads in market share?

Asia-Pacific was the largest region in the insurance eligibility verification market in 2024. The regions covered in the insurance eligibility verification market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Insurance Eligibility Verification Market Report 2025 Offer?

The insurance eligibility verification market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Insurance eligibility verification is the process of verifying a patient’s active health insurance coverage before administering medical services. This verification ensures that healthcare providers receive proper reimbursement from insurers while informing patients of their financial obligations. The primary goal of this process is to minimize claim denials, reduce billing errors, and enhance revenue cycle management for healthcare providers.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=21494

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model