At what pace is the invoice factoring market growing, and what is its estimated value?

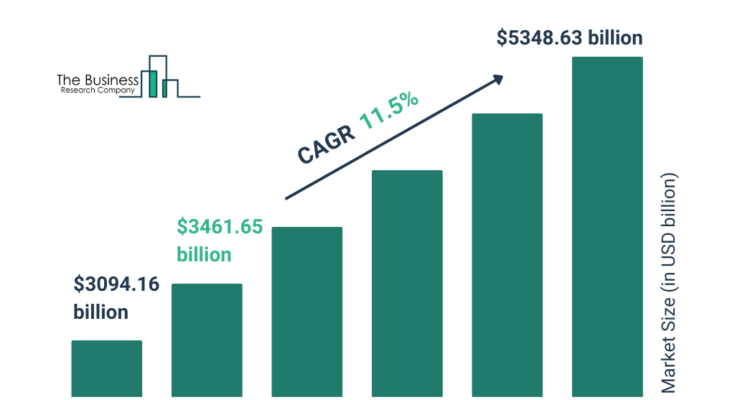

The invoice factoring market size has grown rapidly in recent years. It will grow from $3094.16 $ billion in 2024 to $3461.65 $ billion in 2025 at a compound annual growth rate (CAGR) of 11.9%. The growth in the historic period can be attributed to the rising fintech solution adoption rate among small and medium-sized enterprises (SMEs), increasing network security, increasing trade with quickly expanding markets, and increasing open account trading.

The invoice factoring market size is expected to see rapid growth in the next few years. It will grow to $5348.63 $ billion in 2029 at a compound annual growth rate (CAGR) of 11.5%. The growth in the forecast period can be attributed to the increase in entrepreneurial endeavors, growth of e-commerce and online marketplaces, increasing demand for factory services, increasing network security, and increasing demand for alternative sources of financing for micro, small, and medium enterprises (MSMEs). Major trends in the forecast period include technological advancements, blockchain integration, product innovations, innovative contract capabilities, and integration of artificial intelligence (AI) and machine learning (ML).

Get Your Free Sample of The Global Invoice Factoring Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19537&type=smp

What are the top drivers to the rising demand in the invoice factoring market?

The increasing demand for fintech solutions is expected to propel the growth of invoice factoring forward. Fintech solutions refer to the application of innovative technologies to enhance and streamline traditional financial services and processes. The increasing fintech solution is due to factors such as changing customer expectations, digital connectivity, dissatisfaction with traditional financial services, and unbundling of financial services. Invoice factoring supports the expansion and innovation of fintech solutions by enhancing cash flow management, integrating advanced technology, diversifying financial services, improving accessibility, streamlining processes, and promoting market growth. For instance, in November 2023, according to the International Financial Trade Administration, a US-based government agency, the FinTech sector in the UK is comprised of over 1,600 firms, a number that is projected to double by 2030. Therefore, the increase in popularity of fintech solutions is driving the growth of the invoice factoring market.

How is the invoice factoring market segmented?

The invoice factoringmarket covered in this report is segmented –

1) By Type: Recourse Factoring, Non-Recourse Factoring

2) By Provider: Banks, Non-Banking Financial Companies (NBFCs)

3) By Enterprise Size: Large Enterprises, Small And Medium-Sized Enterprises

4) By Application: Domestic, International

5) By Industry: Construction, Manufacturing, Healthcare, Transportation And Logistics, Energy And Utilities, Information Technology (IT) And Telecom, Staffing, Other Industries

Subsegments:

1) By Recourse Factoring: Standard Recourse Factoring, Selective Recourse Factoring, Spot Factoring, Recourse Factoring With Reserve, Invoice Financing With Recourse

2) By Non-Recourse Factoring: Standard Non-Recourse Factoring, Non-Recourse Factoring With Full Advance, Non-Recourse Factoring With Credit Protection, Non-Recourse Spot Factoring, Non-Recourse Factoring For Startups

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/invoice-factoring-global-market-report

Who are the top competitors in the invoice factoring market?

Major companies operating in the invoice factoring market are Industrial and Commercial Bank of China Limited (ICBC), Adobe Inc., Intuit Inc., Lloyds Bank Corporate Markets PLC, American Express Company, Accord Financial Corporation, eCapital Corporation, Fundbox Inc., Riviera Finance LLC, Sonovate Limited, TBS Factoring Service LLC, Porter Capital Corporation, Barclays Bank UK PLC, Triumph Financial Inc., Nav Technologies Inc., Eagle Business Credit LLC, Breakout Capital Finance Holdings Inc., Invoiced Inc., Paragon Financial Group Inc., Velotrade Management Limited

What significant trends should we anticipate in the invoice factoring market over the forecast period?

Major companies operating in the invoice factoring market are focused on developing advanced solutions, such as web-based invoice financing, to offer more flexible, user-friendly platforms for businesses to manage their receivables, improve cash flow, and reduce administrative overhead. A web-based invoice financing solution is a digital platform that allows businesses to obtain financing by leveraging their outstanding invoices, thereby improving cash flow by providing immediate access to funds based on the amounts due from their customers. For instance, in July 2024, the State Bank of India (SBI), an India-based company, launched a Web-Based Invoice Financing Solution. A web-based invoice financing solution streamlines the borrowing process, making it accessible and efficient for businesses looking to leverage their accounts receivable for immediate cash flow needs. SBI aims to address small businesses’ liquidity challenges, which often need help accessing formal credit. This initiative is particularly relevant given that many of India’s microbusinesses and small and midsize enterprises (SMEs) need more access to financial resources.

Which regional trends are influencing the invoice factoring market, and which area dominates the industry?

Europe was the largest region in the invoice factoring market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the invoice factoring market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Invoice Factoring Market Report 2025 Offer?

The invoice factoring market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Invoice factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (invoices) to a third party (called a factor) at a discount. This provides the company with immediate cash flow, while the factor is responsible for collecting the outstanding invoice amounts from the business’s customers. Invoice factoring is commonly used by businesses to manage cash flow, especially those with long payment cycles or seasonal sales fluctuations.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19537

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model