How has the islamic finance market evolved, and where is it heading next?

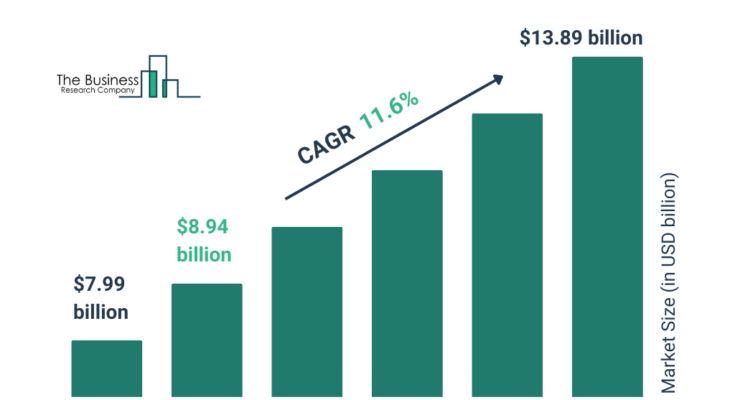

The islamic finance market size has grown rapidly in recent years. It will grow from $7.99 $ billion in 2024 to $8.94 $ billion in 2025 at a compound annual growth rate (CAGR) of 11.9%. The growth in the historic period can be attributed to demand for sharia-compliant products and practices, vast oil wealth stimulated fresh interest, the importance of risk-sharing in raising finance, strong investments in halal sectors, and expanding Islamic banking services.

The islamic finance market size is expected to see rapid growth in the next few years. It will grow to $13.89 $ billion in 2029 at a compound annual growth rate (CAGR) of 11.6%. The growth in the forecast period can be attributed to the expansion of the Islamic finance industry, increase in the muslim population, ethical and socially responsible investing, government support and regulation, and globalization of Islamic finance. Major trends in the forecast period include the introduction of electronic modes in all products and services, innovation in financial products, new launches of Islamic exchange-traded funds (ETFs), popularity of ESG-related financial assets, and integration of financial technology.

Get Your Free Sample of The Global Islamic Finance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19539&type=smp

What are the key drivers behind the rapid expansion of the islamic finance market?

An increase in the muslim population is expected to propel the growth of the Islamic finance market going forward. The Muslim population is growing due to high fertility rates and a relatively young demographic. Muslim populations use Islamic finance to manage their financial needs in accordance with shariah law, which prohibits interest and encourages ethical, risk-sharing financial practices, ensuring that their financial activities align with their religious beliefs and values. For instance, in June 2024, according to the Alliance for a New Middle East Peace (ALLMEP), a US-based non-profit organization, Israel’s muslim population was estimated at 1.782 million at the end of 2023, representing 18.1% of the total residents and marking an increase of 35,000 from 2022. Therefore, the increase in the muslim population is driving the growth of the Islamic finance market.

What is the segmentation for the islamic finance market?

The islamic financemarket covered in this report is segmented –

1) By Financial Sector: Islamic Banking, Islamic Insurance – Takaful, Islamic Bonds ‘Sukuk’, Other Islamic Financial Institutions (OIFI’s), Islamic Funds

2) By Size Of Business: Small And Medium Business, Large Business

3) By Banking: Retail Banking, Commercial Banking, Investment Banking

Subsegments:

1) By Islamic Banking: Retail Banking, Corporate Banking, Investment Banking, Islamic Microfinance, Islamic Cooperative Banks

2) By Islamic Insurance – Takaful: Family Takaful (Life Insurance), General Takaful (Non-Life Insurance), Health Takaful, Takaful Investment Accounts, Corporate Takaful Solutions

3) By Islamic Bonds ‘Sukuk’: Sovereign Sukuk, Corporate Sukuk, Sukuk Ijarah, Sukuk Murabaha, Sukuk Musharakah

4) By Other Islamic Financial Institutions (OIFIs): Islamic Investment Banks, Islamic Asset Management Firms, Islamic Leasing Companies, Islamic Microfinance Institutions, Islamic Credit Unions

5) By Islamic Funds: Equity Funds, Real Estate Investment Funds, Commodity Funds, Islamic Index Funds, Shariah-Compliant Mutual Funds.

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/islamic-finance-global-market-report

Who are the most influential companies in the islamic finance market?

Major companies operating in the islamic finance market are Maybank Islamic, Abu Dhabi Commercial Bank, Etiqa Islamic Berhad, Al Rajhi Bank, Mellat Bank, Riyad Bank, Abu Dhabi Islamic Bank Egypt, Kuwait Finance House, Saudi British Bank, Al Baraka Bank, Bank ABC Islamic, HSBC Amanah, First Security Islami Bank, Bank of Khartoum, Al-Arafah Islami Bank, Social Islami Bank, Al Salam Bank, Ajman Bank, Al Hilal Bank, Bank Islam Brunei Darussalam, Bank Nizwa, EXIM Bank, Iraqi Islamic Bank of Inv & Dev, Affin Islamic Bank, OCBC Al-Amin Bank, Bank Keshavarzi, Barwa Bank, Khaleeji Commercial Bank

What are the most influential trends expected to drive the islamic finance market forward?

Major companies operating in the islamic finance market are focusing on innovating in financial products, such as digital banking platforms, to gain a competitive edge in the market. Digital banking platforms are online services provided by financial institutions that allow customers to conduct banking activities electronically, such as managing accounts, making transactions, and accessing financial products, via the internet or mobile applications. For instance, in March 2023, Salaam Bank Limited, a Uganda-based commercial financial institution, launched its first-ever interest-free commercial banking system and digital banking platforms, allowing it to operate following Islamic principles. The bank’s national operations assert that Islamic banking has the potential to significantly contribute to Uganda’s financial sector development and attract more Muslims to invest in the country’s economy.

What are the major regional insights for the islamic finance market, and which region holds the top position?

Middle East And Africa was the largest region in the islamic finance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the market. The regions covered in the islamic finance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Islamic Finance Market Report 2025 Offer?

The islamic finance market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Islamic finance refers to a financial system that operates under Islamic law (Sharia), which prohibits interest (riba) and emphasizes ethical investing, profit-and-loss sharing, and asset-backed financing. It includes banking, investments, insurance, and other financial services that comply with these principles, aiming to promote social justice, economic welfare, and the equitable distribution of wealth.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19539

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model