Overview and Scope

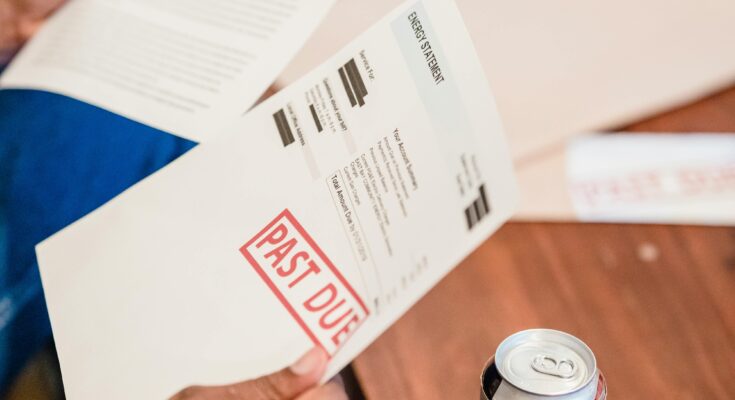

Lending is the act of allowing a person or organization to use a sum of money in exchange for an agreement to repay it later, typically with interest. Payment instruments are systems that enable funds held in accounts at credit, payment or similar institutions to be transferred to a payee on receipt of a payment order.

Sizing and Forecast

The lending and payments market size has grown strongly in recent years. It will grow from <b>$11495.08 billion in 2023 to $12410.68 billion in 2024 at a compound annual growth rate (CAGR) of 8.0%. </b> The growth in the historic period can be attributed to economic growth, expansion of banking and financial institutions, consumer demand, regulatory environment, .

The lending and payments market size is expected to see strong growth in the next few years. It will grow to <b>$16828.1 billion in 2028 at a compound annual growth rate (CAGR) of 7.9%. </b> The growth in the forecast period can be attributed to digital transformation, fintech disruption, financial inclusion, blockchain and cryptocurrency, data analytics and artificial intelligence. Major trends in the forecast period include peer-to-peer lending, contactless and mobile payments, open banking, embedded finance, sustainable and ethical finance.

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/lending-and-payments-global-market-report

Segmentation & Regional Insights

The lending and payments market covered in this report is segmented –

1) By Type: Lending, Cards And Payments

2) By Lending Channel: Offline, Online

3) By End User: B2B, B2C

Subsegments Covered: Corporate Lending, Household Lending, Government Lending, Cards, Payments

<b>Western Europe</b> was the largest region in the lending and payments market in 2023. <b>Asia-Pacific</b> was the second largest region in the lending and payments market. The regions covered in the lending and payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=1886&type=smp

Major Driver Impacting Market Growth

Artificial Intelligence is gaining prominence in the payments sector due to its various applications allowing businesses to synthesize data to improve customer experience. Artificial intelligence refers to the development of computer systems that can perform tasks using human intelligence. Payment companies can improve their operational efficiency through AI, such as reducing processing times, error-free insights, and increasing automation. Many banking and non-banking institutions are using AI applications to monitor payment transactions from the point of payment message to the payment gateway. For example, AI-enabled application chatbots are being adopted by payment firms as they can understand customer language and respond to customer queries on a real-time basis. AI machine learning is significantly used to improve fraud detection and reduce false transactions. For instance, according to the latest Economist Intelligence Unit adoption study, 54% of financial services organizations adopted AI for payments to strengthen customer relationships.

Key Industry Players

Major companies operating in the lending and payments market include <b> China Construction Bank, Agricultural Bank Of China, JPMorgan Chase & Co., Bank of China, Industrial and Commercial Bank of China, Bank of America Corporation, Banco Santander, Citi Group, Wells Fargo & Company, State Bank of India, Klarna Inc., Funding Circle, Advanced Financial Services Private Limited, Visa Payments Limited, Mastercard Inc., Tencent Holdings Limited, Ant Financial Service Group Co. Ltd., PayPal Payments Pvt Ltd., Square Capital LLC., Coinbase Global Inc., Social Finance Inc., Coinbase Global Inc., Robinhood Markets Inc., Venmo, Affirm Inc., Afterpay Australia Pty Ltd., LendingClub Bank., Camden Town Technologies Pvt Ltd., Kabbage Inc., On Deck Capital Inc., Avant LLC., Upstart Network Inc., Lendio.</b>

The lending and payments market report table of contents includes:

- Executive Summary

- Lending And Payments Market Characteristics

- Lending And Payments Product/Service Analysis -Product/Service Examples

- Lending And Payments Market Trends And Strategies

- Lending And Payments Market – Macro Economic Scenario

.

.

.

- Global Lending And Payments Market Competitive Benchmarking

- Global Lending And Payments Market Competitive Dashboard

- Key Mergers And Acquisitions In The Lending And Payments Market

- Lending And Payments Market Future Outlook and Potential Analysis

- Appendix

Top Major Players:

- China Construction Bank

- Agricultural Bank Of China

- JPMorgan Chase & Co

- Bank of China

- Industrial and Commercial Bank of China

Explore the trending research reports from TBRC:

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model