What is the current size and annual growth rate of the liability insurance carriers market?

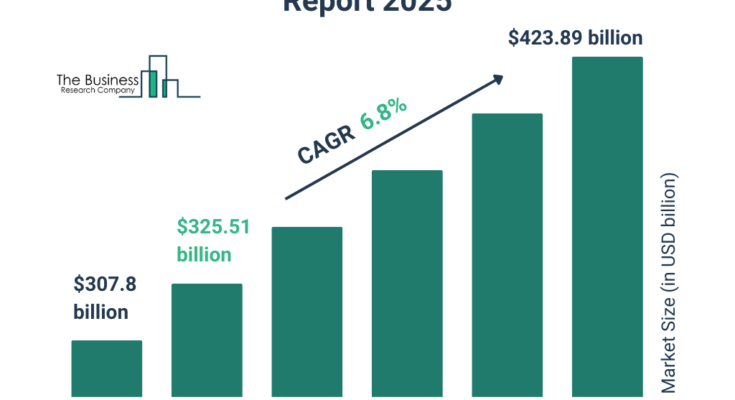

The liability insurance carriers market size has grown strongly in recent years. It will grow from $307.8 billion in 2024 to $325.51 billion in 2025 at a compound annual growth rate (CAGR) of 5.8%. The growth in the historic period can be attributed to lifetime coverage, tax advantages, financial stability in economic downturns, conservative investment options, legacy and estate planning.

The liability insurance carriers market size is expected to see strong growth in the next few years. It will grow to $423.89 billion in 2029 at a compound annual growth rate (CAGR) of 6.8%. The growth in the forecast period can be attributed to rise in financial literacy, shift in consumer preferences, health and wellness incentives, wealth transfer and estate planning, innovative product offerings. Major trends in the forecast period include customization and tailored policies, innovative product features, evolving customer expectations, wealth transfer and estate planning, and technology integration in underwriting.

Get Your Free Sample of The Global Liability Insurance Carriers Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9254&type=smp

Which major factors have contributed to the expansion of the liability insurance carriers market?

Increasing medical inflation is driving the liability insurance carriers market. Medical inflation refers to an increase in medical costs due to changing medical trends. Increasing medical costs make medical care unaffordable for individuals and small enterprises in case of third-party accidents or damage. Liability insurance comes off as useful in these cases as medical costs are basic coverage provided in liability insurance. For instance, in 2022, according to the Kaiser Family Foundation, a US-based non-profit organization, the costs of medical products and services increased by 7.7% as compared to 2021. The medical care cost increased by 5%. Additionally, in 2022, a survey of 257 leading health insurers conducted by Willis Towers Watson, a UK-based insurance advisor, global medical cost growth increased from 8.2% in 2021 to 8.8% in 2022 and the rate is expected to increase to 10% in 2023. As a result, the increasing medical inflation is driving the liability insurance carrier’s market.

How is the liability insurance carriers market segmented?

The liability insurance carriers market covered in this report is segmented –

1) By Coverage Type: General Liability Insurance, Professional Liability Insurance, Insurance For Directors And Officers

2) By Enterprise Size: Medium-Sized Enterprises, Large Enterprises, Small Enterprises

3) By Application: Commercial, Personal

Subsegments:

1) By General Liability Insurance: Commercial General Liability, Product Liability, Completed Operations Liability

2) By Professional Liability Insurance: Errors And Omissions Insurance, Malpractice Insurance, Directors And Officers Liability Insurance

3) By Insurance For Directors And Officers: D And O Liability Insurance, Employment Practices Liability Insurance (EPLI), Fiduciary Liability Insurance

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/liability-insurance-carriers-global-market-report

Who are the top competitors in the liability insurance carriers market?

Major companies operating in the liability insurance carriers market include American International Group Inc., Allianz SE, AXIS Capital Holdings Limited, CNA Financial Corporation, Chubb Corp., IFFCO-Tokio General Insurance Company Limited, Liberty General Insurance Limited, The Hartford Financial Services Group Inc., The Travelers Indemnity Company, Zurich American Insurance Company, Hiscox Ltd., Berkshire Hathaway GUARD Insurance Companies, Great American Insurance Group, Progressive Commercial, Thimble Insurance, Nationwide Mutual Insurance Company, Markel Corporation, Munich Re Group, Westfield Insurance Company, QBE Insurance Group Limited, COUNTRY Financial, Acuity A Mutual Insurance Co., Erie Insurance Group, The Hanover Insurance Group, The Cincinnati Insurance Company, The Main Street America Group, The United States Liability Insurance Group, The Zenith Insurance Company, Tokio Marine America Insurance Company, Tower Group Companies

How will emerging trends drive the liability insurance carriers market throughout the forecast period?

Major companies in the liability insurance carriers’ market are incorporating advanced solutions, such as liability insurance policies, to streamline claims processing, enhance risk assessment, and improve customer experience. Liability insurance policies are contracts that provide financial protection to individuals or businesses against claims resulting from injuries or damage to other people or property. For instance, in May 2024, Tata AIG, an India-based general insurance company, launched satellite in-orbit third-party liability insurance policy. This policy specifically addresses the risks associated with satellite operations, particularly as India’s space industry continues to expand significantly. With the increased frequency of satellite launches, comprehensive risk management strategies have become crucial. This insurance coverage aims to protect against third-party injuries and property damage arising from satellite operations, enabling satellite companies to operate with greater confidence and supporting India’s ambitions in the global space market.

What are the major regional insights for the liability insurance carriers market, and which region holds the top position?

North America was the largest region in the liability insurance carriers’ market in 2024. The regions covered in the liability insurance carriers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

What Does The Liability Insurance Carriers Market Report 2025 Offer?

The liability insurance carriers market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Liability insurance carriers refer to companies that provide liability insurance services. These companies are used to compare and buy insurance. Liability insurance is a type of insurance that offers defense against lawsuits brought by victims of injuries and property damage to others.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9254

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model