Amphibious vehicle market overview, amphibious vehicle market growth, amphibious vehicle market analysis, amphibious vehicle market, amphibious vehicle market outlook, amphibious vehicle market share, amphibious vehicle market size, amphibious vehicle industry, amphibious vehicle market report, amphibious vehicle market research, amphibious vehicle trends

The amphibious vehicle global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Amphibious Vehicle Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size –

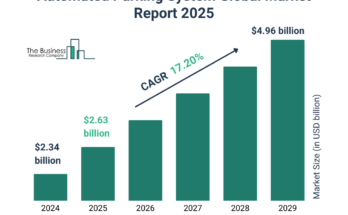

The amphibious vehicle market size has grown strongly in recent years. It will grow from $3.82 billion in 2023 to $4.17 billion in 2024 at a compound annual growth rate (CAGR) of 9.0%. The growth in the historic period can be attributed to increased military applications, tourism and recreational activities, search and rescue operations, transportation in remote areas, amphibious excavation and construction, coastal patrol and surveillance, environmental conservation and research.

The amphibious vehicle market size is expected to see rapid growth in the next few years. It will grow to $6.11 billion in 2028 at a compound annual growth rate (CAGR) of 10.1%. The growth in the forecast period can be attributed to growing interest in amphibious sports, urban development near water bodies, advancements in materials, commercial fishing modernization, smart city initiatives, increasing awareness of environmental conservation, public awareness and education. Major trends in the forecast period include environmentally friendly designs, commercial shipping and logistics, autonomous amphibious vehicles, customization for specific applications, technological advancements, collaborations and partnerships.

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/amphibious-vehicle-global-market-report

Scope Of Amphibious Vehicle Market

The Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Amphibious Vehicle Market Overview

Market Drivers –

The rise in concern for border security and terrorism is driving the amphibious vehicle market. The border security system offers administration of border-patrol missions, real-time surveillance, early warning, and targeting, further enhancing land and maritime security, regional control, and border protection. Amphibious vehicles are utilized for military purposes because they make it simple to transfer supplies and troops through hazardous or inaccessible terrain, including flooded areas, and various engineering and mining applications. For instance, according to the US Customs and Border Protection Enforcement Statistics 2022, the total enforcement action increased from 646,822 in 2020 to 2,493,721 in 2022. Thus, rising concern for border security and terrorism will propel the amphibious vehicle market.

Market Trends –

Product innovations are the key trends gaining popularity in the amphibious vehicle market. Major companies operating in various industries such as defense, excavators, and others are developing innovative solutions, such as multipurpose amphibious vehicles, to sustain their position in the amphibious vehicle market. For instance, in May 2021, DCD Protected Mobility, a South Africa-based company that offers the transportation and defense industries sustainable products and solutions introduced an amphibious vehicle that can be used for various purposes, including mining, military, search and rescue, and private use.

The amphibious vehicle market covered in this report is segmented –

1) By Propulsion: Waterjet, Track-Based, Screw Propellers, Other Propulsions

2) By Application: Surveillance And Rescue, Water Sports, Water Transportation, Excavation, Other Applications

3) By End Use: Defense, Commercial

Get an inside scoop of the amphibious vehicle market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=8516&type=smp

Regional Insights –

Asia-Pacific was the largest region in the amphibious vehicle market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the amphibious vehicle market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies –

Major companies operating in the amphibious vehicle market report are Bae Systems plc, General Dynamics Corporation, Lockheed Martin Corporation, Rheinmetall Aktiengesellschaft, Science Applications International Corporation Inc., Textron Inc., The Volvo Group, JSC Kurganmashzavod, Hitachi Construction Machinery, Wilco Manufacturing Limited, Wetland Equipment Company, EIK Engineering Sdn. Bhd., Marsh Buggies Inc., Ultratrex Machinery Sdn. Bhd. – Ultratrex Machinery Sendirian Berhad, Lemac Pty. Ltd., Aquamec Ltd., AmphiCraft Industries, Gibbs Sports Amphibians Inc., Cool Amphibious Manufacturers International LLC, Iguana Yachts, Sealegs International Limited, Explorer Industries Ltd., Kaman Aerospace Corporation, Lomac Nautica S.r.l., Marine Advanced Research Inc., Marine Technology Inc., Nauti-Craft Pty Ltd., Panthera Corporation, Phoenix International Holdings Inc., Polaris Industries Inc., INNESPACE PRODUCTIONS Inc.

1. Executive Summary

2. Amphibious Vehicle Market Report Structure

3. Amphibious Vehicle Market Trends And Strategies

4. Amphibious Vehicle Market – Macro Economic Scenario

5. Amphibious Vehicle Market Size And Growth

…..

27. Amphibious Vehicle Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model