How large is the merchant acquiring market, and what is its growth trajectory?

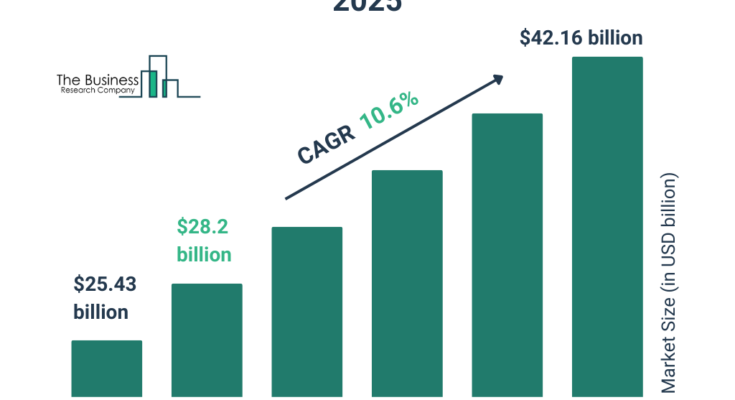

The merchant acquiring market size has grown rapidly in recent years. It will grow from $25.43 $ billion in 2024 to $28.2 $ billion in 2025 at a compound annual growth rate (CAGR) of 10.9%. The growth in the historic period can be attributed to increasing demand for cross-border e-commerce, growth of peer-to-peer (p2p) payment systems, growth of digital banking and fintech innovations, growth of e-commerce, and rise in demand for cash alternatives.

The merchant acquiring market size is expected to see rapid growth in the next few years. It will grow to $42.16 $ billion in 2029 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to the increasing use of smartphones and mobile payments, rising adoption of contactless payments, increasing demand for digital payments, rising need for secure and fraud-resistant payment solutions, and growing investment in payment technology. Major trends in the forecast period include technological advancements, integration of AI, subscription-based models, digital currencies, and contactless wearables.

Get Your Free Sample of The Global Merchant Acquiring Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19582&type=smp

What are the key forces behind the merchant acquiring market’s growth in recent years?

The increasing demand for digital payments is expected to propel the growth of merchant acquiring going forward. Digital payments refer to the electronic transfer of funds from one party to another using digital technologies, bypassing the need for physical cash or checks. The increasing demand for digital payments is driven by several factors, including the growth of e-commerce, the rise of contactless payment methods, and the widespread penetration of internet access. The use of digital payments in merchant acquiring streamlines transactions, reduces cash handling, and enhances payment security, leading to increased efficiency for businesses. For instance, in September 2023, according to the Consumer Financial Protection Bureau, a US-based government agency, American consumers used Google Pay (a mobile payment service developed by Google, designed to facilitate in-app, online, and in-person contactless purchases using mobile devices) to spend $65.2 billion at retail establishments in 2022, up from $24.8 billion in 2021. Therefore, the increasing demand for digital payments is driving the growth of the merchant acquiring market.

What are the major segments of the merchant acquiring market?

The merchant acquiringmarket covered in this report is segmented –

1) By Type: Digital Commerce, Traditional Commerce

2) By Payment Method: Visa, Mastercard, American Express, Discover, Japan Credit Bureau, Local Card Networks, Alternative Payment Models

3) By Sales Channel: Direct Channel, Distribution Channel

4) By Application: Small And Medium Enterprises, Large Enterprises, Other Applications

Subsegments:

1) By Digital Commerce: E-commerce Payment Gateways, Mobile Payment Solutions, Online Point-of-Sale (POS) Systems, Digital Wallet and NFC Payments, Subscription-Based Payment Solutions, Peer-to-Peer (P2P) Payment Platforms

2) By Traditional Commerce: In-Store POS Systems, Card-Not-Present (CNP) Transactions, Retail Payment Solutions, Contactless Payment Solutions, Terminal-Based Payment Systems, Multi-Channel Payment Processing

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/merchant-acquiring-global-market-report

Which companies dominate the merchant acquiring market?

Major companies operating in the merchant acquiring market are Commercial and Industrial Bank of China, JPMorgan Chase & Co., Bank of America Merchant Services, Citi Merchant Services, American Express Company, ING Group N.V., Banco Bilbao Vizcaya Argentaria S.A., Fiserv Inc., Fidelity National Information Services Inc., Global Payments Inc., Sberbank, The Royal Bank of Scotland plc, Shift4 Payments Inc., Worldpay Group plc, Heartland Payment Systems Inc., Adyen N.V., Paysafe Group, Elavon Inc., Crédit Agricole S.A., Zettle by PayPal, Chase Paymentech Solutions LLC, PayCommerce Inc.

What major trends will shape the merchant acquiring market during the forecast period?

Major companies operating in the merchant acquiring market are focused on forming strategic partnerships to gain a competitive edge in the market. Strategic partnerships in merchant acquiring involve collaborations between financial institutions, payment processors, and technology providers to enhance payment solutions and expand market reach. For instance, in July 2024, Shift4 Payments, Inc., a US-based payment processing company, partnered with Phos, a Bulgaria-based software company, to enhance Phos’ acquiring capabilities and boost the adoption of its SoftPOS solution among merchant customers across Europe. This partnership enables Phos customers to utilize Shift4’s global acquiring and payment processing services, allowing them to accept payments through global card networks and digital wallets.

What are the key regional dynamics of the merchant acquiring market, and which region leads in market share?

North America was the largest region in the merchant acquiring market in 2024. The regions covered in the merchant acquiring market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Merchant Acquiring Market Report 2025 Offer?

The merchant acquiring market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Merchant acquiring refers to the process through which financial institutions, known as acquiring banks or acquirers, provide services to merchants for accepting card payments. This involves setting up the necessary infrastructure for processing credit and debit card transactions, including point-of-sale (POS) systems and payment gateways. Acquirers also handle transaction processing, settlement, and risk management, ensuring that merchants receive funds from card transactions efficiently and securely.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19582

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model