The mobile money global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Mobile Money Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size –

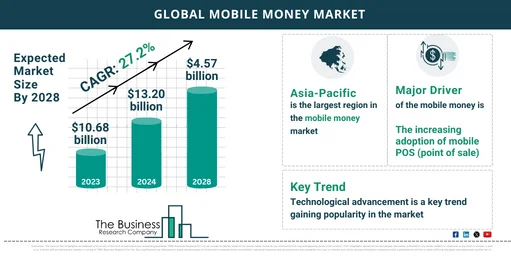

The mobile money market size has grown exponentially in recent years. It will grow from $10.68 billion in 2023 to $13.2 billion in 2024 at a compound annual growth rate (CAGR) of 23.5%. The growth in the historic period can be attributed to mobile penetration and connectivity, financial inclusion initiatives, government support and regulations, emergence of mobile banking and payments, user convenience and accessibility, security and trust building measures..

The mobile money market size is expected to see exponential growth in the next few years. It will grow to $34.57 billion in 2028 at a compound annual growth rate (CAGR) of 27.2%. The growth in the forecast period can be attributed to cross-border mobile money solutions, enhancesing user experience, customization for different demographics, expansion into new geographic markets, focus on user education and awareness, increasing integration with e-commerce.. Major trends in the forecast period include ai and machine learning applications, government initiatives for digital payments, financial wellness and education, blockchain and cryptocurrency integration, microfinance and lending services, integration with messaging apps..

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/mobile-money-global-market-report

Scope Of Mobile Money Market

The Business Research Company’s reports encompass a wide range of information, including:

- Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

- Drivers: Examination of the key factors propelling market growth.

- Trends: Identification of emerging trends and patterns shaping the market landscape.

- Key Segments: Breakdown of the market into its primary segments and their respective performance.

- Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

- Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers –

The increasing adoption of mobile POS (point of sale) is driving the growth of the mobile money market. The increased expectation for quick fulfillment and the growing popularity of the digital marketplace coupled with the need for improving customer experience, ease of use, and payment efficiency has led to the increased adoption of mobile POS. This increasing adoption of mobile POS will result in significant demand for mobile money as it is a convenient and efficient solution for point of sales. For instance, in July 2023, according to Pinnaca Retail Solutions, a UK-based company that offers software and hardware solutions that are specific to the retail industry, 44% of retailers cited mobile POS implementation and enhancement as their top POS priority, up from 33% the previous year. Additionally, 54% of businesses have used mobile POS for processing transactions. Therefore, the increasing adoption of mobile POS is expected to boost demand for mobile money during the forecast period.

Market Trends –

Product innovations have emerged as the key trend gaining popularity in the 5G chipset market. The major players in the market are developing innovative products for market growth. For instance, in June 2021, Samsung Electronics, a South Korea-based electronics company, developed 3GPP Rel.16 compliant chipsets, a range of next-generation 5G chipsets that deliver cutting-edge 5G technologies. The new chipsets consist of a second-generation 5G modem System-on-Chip (SoC), a third-generation mmWave Radio Frequency Integrated Circuit (RFIC) chip, and a Digital Front End (DFE)-RFIC integrated chip. These are designed to increase power efficiency, boost performance, and reduce the size of 5G solutions.

The mobile money market covered in this report is segmented –

1) By Transaction Type: Person to Person (P2P), Person to Business (P2B), Business to Person (B2P), Business to Business (B2B)

2) By Payment: Remote Payments, Proximity Payments

3) By Application: Bill Payments, Money transfers, Recharge & Top-up, Ticket Payment, Other Applications

Get an inside scoop of the mobile money market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=6971&type=smp

Regional Insights –

Asia-Pacific was the largest region in the mobile money market in 2023, and it is expected to be the fastest-growing region in the forecast period. The regions covered in the mobile money market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Key Companies –

Major companies operating in the mobile money market report are Vodafone Group plc, Google LLC, Orange S. A., Fidelity National Information Services Inc., PayPal Holdings Inc., Mastercard Incorporated, Fiserv Inc., Bharti Airtel Limited, Ant Group Co. Ltd., MTN Group Limited, Paytm Payments Bank Limited, Samsung Electronics Co. Ltd., Visa Inc., Tencent Holdings Limited, Global Payments Inc., Square Inc., Amazon. com Inc., Apple Inc., The Western Union Company, Comviva Technologies Limited, T-Mobile US Inc., Obopay Inc., FTS Group Inc., Peerbits Solution Pvt. Ltd., Panamax Inc., Alepo Technologies Inc., Econet Wireless, Millicom International Cellular S. A., Airtel Limited, Safaricom

Table of Contents

1. Executive Summary

2. Mobile Money Market Report Structure

3. Mobile Money Market Trends And Strategies

4. Mobile Money Market – Macro Economic Scenario

5. Mobile Money Market Size And Growth

…..

27. Mobile Money Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model