The mortgage servicing software global market report 2024from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Mortgage Servicing Software Market, 2024The mortgage servicing software global market report 2024

Market Size –

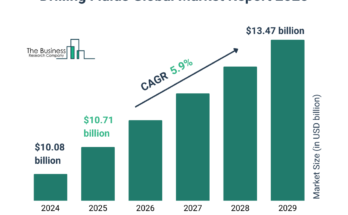

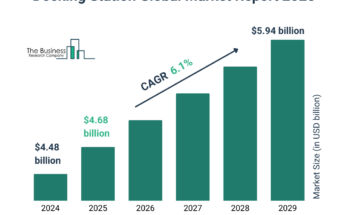

The mortgage servicing software market size has grown strongly in recent years. It will grow from $4.77 billion in 2023 to $5.16 billion in 2024 at a compound annual growth rate (CAGR) of 8.1%. The growth in the historic period can be attributed to regulatory compliance, technological advancements, market competition, economic conditions, and customer expectations.

The mortgage servicing software market size is expected to see strong growth in the next few years. It will grow to $7.08 billion in 2028 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to digital transformation, rising mortgage volumes, cost efficiency, customer expectations, and data security. Major trends in the forecast period include increasing adoption of AI and machine learning, cloud-based solutions, enhanced customer experience, regulatory compliance, and integration with other financial services.

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/mortgage-servicing-software-global-market-report

Scope Of Mortgage Servicing Software MarketThe Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Mortgage Servicing Software Market Overview

Market Drivers –

The rising adoption of cloud services is anticipated to enhance the growth of the mortgage servicing software market in the coming years. Cloud services encompass a wide range of computing resources and applications delivered over the internet on a subscription basis. Their growth is fueled by the ability to facilitate remote work, enable digital transformation, and meet the scalability and agility requirements of modern businesses. In mortgage servicing software, cloud services enhance scalability, security, and accessibility for streamlined loan management and customer service. According to Eurostat, a Luxembourg-based intergovernmental organization, in December 2023, 45.2% of enterprises within the European Union procured cloud computing services primarily for hosting email systems, storing electronic files, and performing various tasks. This marked a 4% increase in cloud computing service purchases among EU enterprises in 2023 compared to 2021, with large enterprises showing a notable adoption rate of 77.6% in 2023, reflecting a 6% rise from 2021. Thus, the growing adoption of cloud services is driving the growth of the mortgage servicing software market.

Market Trends –

Major companies in the mortgage servicing software market are focusing on developing innovative software platforms, such as AI-based software, to gain a competitive edge in the market. AI-based software refers to applications or systems that use artificial intelligence techniques, such as machine learning, natural language processing, and computer vision, to perform tasks that typically require human intelligence, including data analysis, decision-making, language translation, and predictive analytics. For instance, in February 2024, Sagent M&C, LLC, a US-based intech software company, launched Dara, a groundbreaking mortgage servicing platform that unifies all data and user experiences for servicers and homeowners across the entire servicing lifecycle. Dara is the first and only platform that powers the entire servicing ecosystem, including core, consumer, default, loan movement, data, and AI, in a single root system. This innovative platform can lower servicer operational costs by up to 40% and will start going live for customers in 2024.

The mortgage servicing software market covered in this report is segmented –

1) By Product: Cloud-based, On Premise

2) By Application: Banking And Financial Institutions, Real Estate Companies, Other Applications

3) By End-user: Large Enterprises, Small And Medium Enterprises

Get an inside scoop of the mortgage servicing software market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=18678&type=smp

Regional Insights –

North America was the largest region in the mortgage servicing software market in 2023. The regions covered in the mortgage servicing software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies –

Major companies in the market are Fiserv Inc., Wolters Kluwer Financial Services, SS&C Technologies Holdings Inc, Finastra, CoreLogic Inc., Dovenmuehle Mortgage Inc., Ocwen Financial Solutions Pvt. Ltd., Altisource Portfolio Solutions S.A, Sagent M&C LLC, Mortgage Cadence, McCracken Financial Solutions Corp., MortgageFlex Systems, Aspire Financial Technologies, Nortridge Software, Shaw Systems Associates LLC, Applied Business Software, Bryt Software, Financial Industry Computer Systems Inc., Fidelity National Financial, RealINSIGHT, ICE Mortgage Technology, Mortgage Builder Software Inc.

Table of Contents

1. Executive Summary

2. Mortgage Servicing Software Market Characteristics

3. Mortgage Servicing Software Market Trends And Strategies

4. Mortgage Servicing Software Market – Macro Economic Scenario

5. Global Mortgage Servicing Software Market Size and Growth

…

32. Global Mortgage Servicing Software Market Competitive Benchmarking

33. Global Mortgage Servicing Software Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Mortgage Servicing Software Market

35. Mortgage Servicing Software Market Future Outlook and Potential Analysis

36. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model