What is the current size and annual growth rate of the mutual fund assets market?

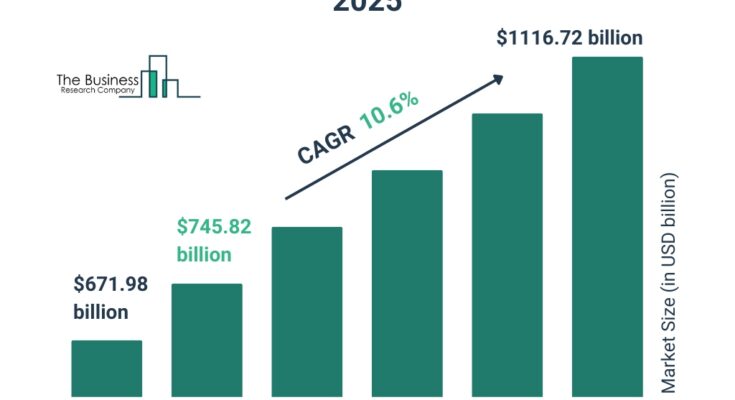

The mutual fund assets market size has grown rapidly in recent years. It will grow from $671.98 billion in 2024 to $745.82 billion in 2025 at a compound annual growth rate (CAGR) of 11.0%. The growth in the historic period can be attributed to stock market performance, growth increase in disposable income and savings, governments offering tax benefits on investments in mutual funds, the rise in importance of retirement planning, and financial awareness and education.

The mutual fund assets market size is expected to see rapid growth in the next few years. It will grow to $1116.72 billion in 2029 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to the evolving regulatory landscape, increased cross-border investment opportunities, rising awareness and education, a low-interest rate environment, and greater involvement of institutional investors. Major trends in the forecast period include artificial intelligence and machine learning, blockchain technology, cloud-based solutions improving the scalability, flexibility, and security of mutual fund operations, and the development of mobile apps for mutual fund management and regtech.

Get Your Free Sample of The Global Mutual Fund Assets Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18684&type=smp

How has the mutual fund assets market evolved, and what factors have shaped its growth?

The rising aging population is expected to propel the growth of the mutual fund assets market going forward. Aging population refers to individuals aged 65 and older, who are considered to be in the senior age bracket. The aging population is rising due to increased life expectancy and declining birth rates. The rising aging population will boost the mutual fund assets market as older individuals seek secure investment options for retirement savings. As individuals approach retirement age, they tend to transition from high-risk, growth-oriented investments to more conservative, income-generating mutual funds that offer stability and regular income, driving the growth of mutual fund assets market. For instance, in July 2024, according to the UK Parliament’s House of Commons Library, a UK-based government administration, In 2022, the UK had 12.7 million people aged 65 and older, representing 19% of the total population. This figure is projected to rise to 22.1 million by 2072, accounting for 27% of the population. Therefore, the rising aging population is driving the growth of the mutual fund assets market.

What are the major segments of the mutual fund assets market?

The mutual fund assets market covered in this report is segmented –

1) By Type: Open-Ended, Close-Ended

2) By Investor Type: Retail, Institutional

3) By Investment Strategy: Equity Strategy, Fixed Income Strategy, Multi-Asset Or Balanced Strategy, Sustainable Strategy, Money Market Strategy, Other Investment Strategy

4) By Investment Style: Active, Passive

5) By Distribution Channel: Direct Sales, Financial Advisor, Broker-Dealer, Banks, Other Distribution Channels

Subsegments:

1) By Type: Open-Ended: Equity Mutual Funds, Bond Mutual Funds, Hybrid Mutual Funds, Money Market Funds, Index Funds, Exchange-Traded Funds (ETFS), Close-Ended: Equity Close-Ended Funds, Debt Close-Ended Funds, Interval Funds

2) By Investor Type: Retail: Individual Investors, High Net-Worth Individuals (HNWIS), Affluent Investors, Institutional: Pension Funds, Endowments And Foundations, Insurance Companies, Sovereign Wealth Funds, Corporations

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/mutual-fund-assets-global-market-report

Which companies dominate the mutual fund assets market?

Major companies operating in the mutual fund assets market are JPMorgan Chase & Co., Citigroup Inc., Morgan Stanley, BNP Paribas Asset Management Holding, Goldman Sachs Group Inc., Charles Schwab & Co. Inc., BlackRock Inc., Principal Financial Group Inc., Ameriprise Financial Inc., State Street Corporation, Franklin Resources Inc., Capital Group Companies Inc., The Vanguard Group Inc., Amundi Asset Management US Inc., Legg Mason Inc., Janus Henderson Group plc, Federated Hermes Inc., OppenheimerFunds Inc., Massachusetts Financial Services Company, Eaton Vance Corp., Pacific Investment Management Company LLC, Dimensional Fund Advisors LP, Wellington Management Company LLP, AllianceBernstein L.P., Dodge & Cox, Teachers Insurance and Annuity Association of America (TIAA), Putnam Investments LLC

How will evolving trends contribute to the growth of the mutual fund assets market?

Major companies operating in the mutual fund assets market are focusing on diversifying their mutual fund assets to include emerging sectors with high growth potential. Investing in niche areas, such as sustainable technologies or innovative industries, can attract investors looking for high returns and future-proof investments. For instance, in June 2024, Mirae Asset Mutual Fund, an India-based company that provides investment services, launched the Mirae Asset Nifty EV and New Age Automotive ETF (Exchange Traded Fund), India’s first exchange-traded fund dedicated exclusively to the electric vehicle (EV) and new age automotive industries. The ETF seeks to offer investors long-term capital growth by primarily investing in stocks of companies engaged in the dynamic automotive sector. This includes firms specializing in electric and hybrid vehicles, battery technologies, and automotive parts. The fund will track the performance of the Nifty EV and New Age Automotive Total Return Index.

What are the key regional dynamics of the mutual fund assets market, and which region leads in market share?

North America was the largest region in the mutual fund assets market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the mutual fund assets market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Mutual Fund Assets Market Report 2025 Offer?

The mutual fund assets market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Mutual fund assets refer to the total value of the investments held within a mutual fund. These assets are composed of various securities and financial instruments that the fund manages on behalf of its investors. The value of mutual fund assets fluctuates based on the performance of the underlying investments and market conditions.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18684

About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model