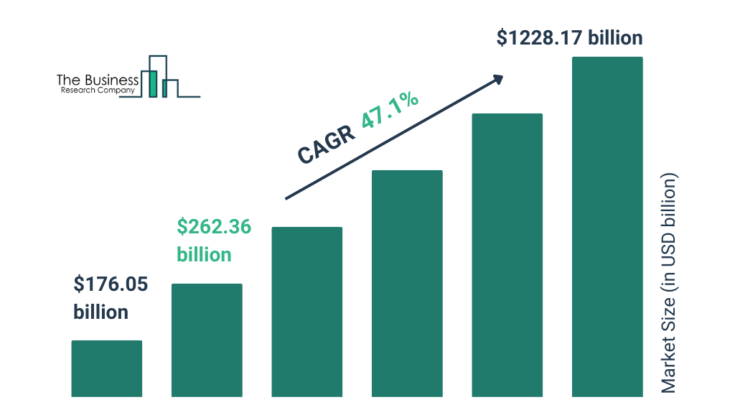

The neobanking market size has grown exponentially in recent years. It will grow from $176.05 billion in 2024 to $262.36 billion in 2025 at a compound annual growth rate (CAGR) of 49.0%. The growth in the historic period can be attributed to consumer demand for convenience, cost efficiency, regulatory environment, globalization and cross-border transactions, financial inclusion initiatives, leveraging big data.

The neobanking market size is expected to see exponential growth in the next few years. It will grow to $1228.17 billion in 2029 at a compound annual growth rate (CAGR) of 47.1%. The growth in the forecast period can be attributed to open banking initiatives, embedded finance, rise of challenger banks, expansion of product offerings, expansion beyond core banking services. Major trends in the forecast period include integration of open banking platforms, partnerships with fintech and tech giants, AI and machine learning in personalized finance, virtual and contactless banking features, customer-centric approach.

Get Your Free Sample of The Global Neobanking Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7061&type=smp

What are the key drivers behind the rapid expansion of the neobanking market?

The growing demand for digitalization among banking institutions across the globe is contributing to the growth of the neobanking market. Digital banking describes the digitalization of all banking procedures and the substitution of the bank’s physical location with a continual online presence, which eliminates the need for consumers to visit a branch. Traditional financial services are being automated by digital banking. Customers of a bank can access banking services and products online or through an electronic platform thanks to digital banking. Neobanking aids in digitizing banks by enabling financial organizations to do business online without physical locations and offering digital versions of all banking services. Neobanks provide highly personalized services at lower prices by utilizing technology such as artificial intelligence (AI), automation, and cloud computing. For instance, according to Softtek, a Mexico-based information technology company digital banking is expected to generate about $8.646 billion by 2025. Thus, the growing demand for digitalization in the banking sector is expected to propel the growth of the neobanking market.

What is the segmentation for the neobanking market?

The neobanking market covered in this report is segmented –

1) By Account Type: Business Account, Savings Account

2) By Service: Mobile Banking, Payments And Money Transfer, Checking/Savings Account, Loans, Other Services

3) By Application: Enterprises, Personal, Other Application

Subsegments:

1) By Business Account: Sole Proprietorship Accounts, Partnership Accounts, Corporate Accounts, Freelancer Accounts

2) By Savings Account: Regular Savings Accounts, High-Interest Savings Accounts, Goal-Based Savings Accounts, Joint Savings Accounts

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/neobanking-global-market-report

Who are the most influential companies in the neobanking market?

Major companies operating in the neobanking market include Webank Inc., Nubank, Chime Financial Inc., SoFi Technologies Inc., Green Dot Corporation, Robinhood Markets Inc., Revolut Ltd., Upgrade Inc., Monzo Bank Ltd., Aspiration Inc., N26 GmbH, Starling Bank Ltd., Ubank Limited, Bunq BV, Daylight Financial Corp, Vivid Money GmbH, Monese Ltd., Varo Money Inc., Current Financial Inc., Acorns Grow Inc.

What are the most influential trends expected to drive the neobanking market forward?

Technological Advancement is a key trend propelling the neobanking market. Artificial intelligence is used in neobanking services and solutions to improve efficiency. AI can provide consumers with highly personalized solutions and logical reminders and notifications that will help them save money and enjoy more ease. It helps in credit decisions, risk management, trading and personalized services. For instance, in July 2024, BranchX, an India-based pioneering neobank, has made headlines by becoming India’s first neobank to launch personal loans through the Open Network for Digital Commerce (ONDC). This initiative aims to enhance financial inclusion for India’s vast population, particularly targeting the emerging middle class, young professionals, small business owners, and entrepreneurs who often face challenges in accessing traditional loans.

What are the major regional insights for the neobanking market, and which region holds the top position?

The countries covered in the neobanking market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

What Does The Neobanking Market Report 2025 Offer?

The neobanking market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

The neobanking refer to digital banks with no physical locations that provide a broad range of financial services to target tech-savvy clients primarily. Neobanking offers services including payments, debit cards, money transfers, lending, and more that are mostly digital and mobile in nature.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7061

About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model