What Does the Payment as a Service Market Size Analysis Reveal?

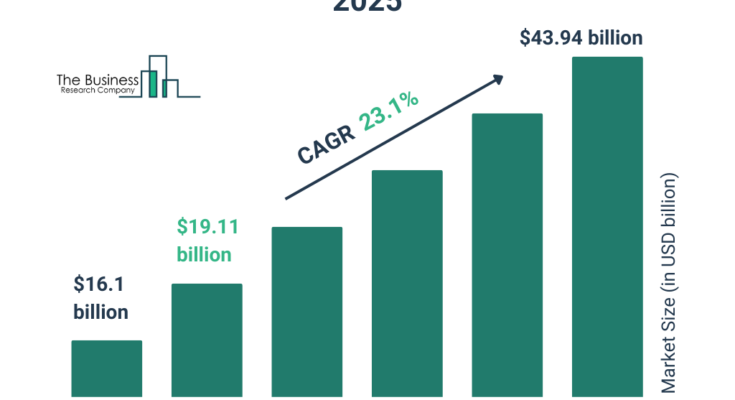

The payment as a service market size has shown rapid growth in recent years. From $16.1 billion in 2024, the market is projected to reach $19.11 billion in 2025, with a notable compound annual growth rate (CAGR) of 18.7%. Factors contributing to this historical growth include regulatory changes, shifts in consumer preferences, cost efficiency, security concerns, and the rise of the API economy.

Furthermore, the market size is predicted to reach $43.94 billion by 2029, growing at a CAGR of 23.1%. The forecasted growth can be linked to rapid developments in emerging markets, environmental sustainability efforts, the prevalence of real-time payments, and enhanced data privacy measures, among other factors. Market trends expected to impact the forecast period growth include digitalization of transactions, advancements in mobile and cloud technology, strategic partnerships, and the integration of blockchain and cryptocurrency.

Get Your Free Sample of The Global Payment as a Service Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=8858&type=smp

What are the Key Drivers for the Payment-as-a-Service Market?

The increasing adoption of cashless transactions worldwide serves as a major driver for the payment as a service market. Thanks to payment as a service technology and cloud-based platforms, banks and credit unions can swiftly broaden and modernize their payment capabilities without significant investments. This growth is evidenced in a report by the European Central Bank, where the number of contactless card payments increased by 24.3% in the first half of 2023, contributing to the expansion of the payment as a service market.

What Are the Major Segments in the Payment as a Service Market?

The payment as a service market involves numerous segments, including:

1) By Service: Professional Services, Managed Services

2) By Component: Platform, Services

3) By Vertical: Retail, Hospitality, Media and Entertainment, Healthcare, Banking, Financial Services, and Insurance (BFSI), Other Verticals

Order Your Payment as a Service Market Report Now For Swift Delivery:

https://www.thebusinessresearchcompany.com/report/payment-as-a-service-global-market-report

Which Companies are Major Players in the Payment as a Service Market?

Notable companies operating in the payment as a service market include Aurus Inc., Total System Services Inc., Ingenico Group SA, Paystand Inc., Mindgate Solutions Private Limited, VoPay International Inc., Agile Payments LLC, Route Mobile Limited, Arcus Financial Intelligence Inc., ACE Software Solutions Inc., StyloPAY Inc., FacilitaPay LLC, PaySky Holding SAL, International Business Machines Corporation., Radar Payments B.V., First Data Corporation, Paysafe Group Limited, Verifone Inc., Alpha Fintech Inc., First American Payment Systems LLC, Pineapple Payments LLC, PPRO Financial Ltd., Valitor hf., Fidelity National Information Services Inc., Helcim Inc., RAMP Holdings Inc., Jeeves Information Systems AB, Revolut Ltd., Ravelin Technology Limited.

What Trends are Shaping the Payment as a Service Market?

In the payment-as-a-service market, technological advancements play a crucial role in shaping the landscape. Companies are keen on introducing new technologies to strengthen their market position. For instance, Stripe, an Ireland-based financial services and software company, launched Stripe Financial Connections in May 2022, enabling businesses to connect directly with customers’ bank accounts, enhancing payment success rates and improving customer experience through data insights.

Which Regions are Seeing the Fastest Growth in the Payment as a Service Market?

In 2024, North America held the largest share in the payment as a service market, with Asia-Pacific expected to witness the fastest growth in the forecast period. The report covers regions such as Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

What Does The Payment as a Service Market Report 2025 Offer?

Payments as a Service (PaaS) is a service platform that provides platforms and develops opportunities to offer payment options and generate revenue. It is used by banks, payment providers, and other financial institutions to provide their customers with advanced payment products and services without heavy investment costs. The Payment as a Service Market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Purchase the Exclusive Report Now to Unlock Valuable Market Insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=8858

About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead. Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model