The property & casualty reinsurance global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Property & Casualty Reinsurance Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size –

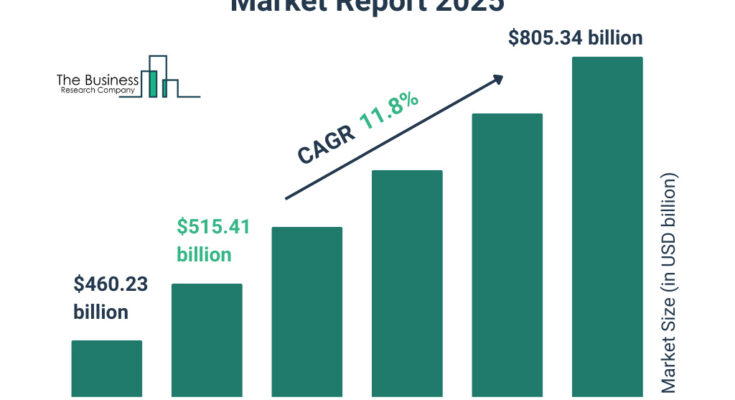

The property & casualty reinsurance market size has grown rapidly in recent years. It will grow from $406.48 billion in 2023 to $457.22 billion in 2024 at a compound annual growth rate (CAGR) of 12.5%. The growth in the historic period can be attributed to economic growth and asset accumulation, regulatory requirements and compliance, globalization and increased business risks, natural disasters and catastrophic events, legal liability concerns..

The property & casualty reinsurance market size is expected to see rapid growth in the next few years. It will grow to $728.71 billion in 2028 at a compound annual growth rate (CAGR) of 12.4%. The growth in the forecast period can be attributed to climate change and extreme weather events, cybersecurity risks and data breaches, global economic trends and trade risks, liability concerns in the digital age, pandemic and public health risks.. Major trends in the forecast period include customer-centric solutions, integration of iot devices, rise of parametric insurance, collaboration with ecosystem partners, pandemic preparedness..

Order your report now for swift delivery @

https://www.thebusinessresearchcompany.com/report/property-and-casualty-reinsurance-global-market-report

Scope Of Property & Casualty Reinsurance Market

The Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Property & Casualty Reinsurance Market Overview

Market Drivers –

The rise in the number of natural calamities is expected to propel the growth of the property and casualty reinsurance market in the coming years. Natural calamities are the result of natural hazards, such as earthquakes, floods, cyclones, hurricanes, volcanic eruptions, or landslides, which negatively impact the environment and cause property damage, loss of life, or other negative effects. Reinsurance enables property and casualty insurers to mitigate the risks associated with concentrated natural disasters. Hence, the rise in natural calamities will boost the property & casualty reinsurance market. For instance, in 2022, according to a report issued by Forbes, a US-based business magazine that covers a broad range of topics related to business, finance, technology, entrepreneurship, and other areas, The US experienced 18 climate disasters that caused over $1 billion in damage. These 18 weather disasters cost the country $175.2 billion in damage and resulted in 474 fatalities. Therefore, a rise in the number of natural calamities is driving the property & casualty reinsurance market.

Market Trends –

Product innovation is the key trend gaining popularity in the property and casualty reinsurance market. Major companies operating in the property and casualty reinsurance market are focused on developing innovative products to strengthen their position in the market. For instance, in September 2021, Ascot Group, a UK-based specialty insurance and reinsurance company, launched Ascot Reinsurance’s platform for global reinsurance underwriting and ceded risk solutions. This platform serves as a central entry point for all of Ascot’s reinsurance offerings, including improved client services, claims, treaty, and facultative solutions, and claims management.

The property & casualty reinsurance market covered in this report is segmented –

1) By Type: Direct Selling, Intermediary Selling

2) By Mode: Online, Offline

3) By Application: Small Reinsurers, Midsized Reinsurers

4) By End-User: Life And Health Reinsurance, Non-Life Or Property And Casualty Reinsurance

Get an inside scoop of the property & casualty reinsurance market, Request now for Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=9644&type=smp

Regional Insights –

North America was the largest region in the property and casualty reinsurance market in 2023. The regions covered in the property & casualty reinsurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Key Companies –

Major companies operating in the property & casualty reinsurance market report are Barents Re Reinsurance Company Inc., Berkshire Hathaway Inc., BMS Group Limited, China Reinsurance Corporation, Everest Re Group Ltd., Hannover Re SE, Society of Lloyd’s, Munich Reinsurance Company, PartnerRe Ltd., Reinsurance Group of America Incorporated, SCOR SE, Swiss Reinsurance Company Ltd., AXA XL, MAPFRE Insurance, IRB-Brasil Resseguros S.A., Transatlantic Reinsurance Company, Arch Capital Group Ltd., AXIS Capital Holdings Limited, RenaissanceRe Holdings Ltd., Validus Holdings Ltd., Aspen Insurance Holdings Limited, Endurance Specialty Holdings Ltd., Alleghany Corporation, Markel Corporation, Fairfax Financial Holdings Limited, White Mountains Insurance Group Ltd., Korean Reinsurance Company, Transatlantic Holdings Inc., Arch Reinsurance Company, Endurance Reinsurance Corporation of America .

Table of Contents

1. Executive Summary

2. Property & Casualty Reinsurance Market Report Structure

3. Property & Casualty Reinsurance Market Trends And Strategies

4. Property & Casualty Reinsurance Market – Macro Economic Scenario

5. Property & Casualty Reinsurance Market Size And Growth

…..

27. Property & Casualty Reinsurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model