The quick response (qr) codes payment global market report 2024from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Quick Response (QR) Codes Payment Market, 2024report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

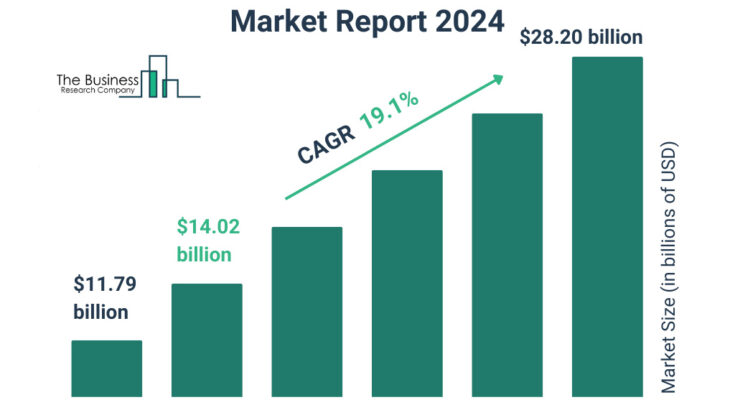

Market Size – The quick response (QR) codes payment market size has grown rapidly in recent years. It will grow from $11.79 billion in 2023 to $14.02 billion in 2024 at a compound annual growth rate (CAGR) of 18.9%. The growth in the historic period can be attributed to increased smartphone penetration, the rise of e-commerce, growing digitalization, changing consumer preferences, and regulatory support.

The quick response (QR) codes payment market size is expected to see rapid growth in the next few years. It will grow to $28.20 billion in 2028 at a compound annual growth rate (CAGR) of 19.1%. The growth in the forecast period can be attributed to the adoption of contactless payments, integration of QR code technology, expansion of mobile wallets, the emergence of new payment platforms, and demand for cashless transactions. Major trends in the forecast period include a shift towards cashless societies, the rise of QR code-based loyalty programs, the implementation of QR code menus in restaurants, QR code-based ticketing for events and transportation, and the utilization of QR codes for identity verification.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/quick-response-qr-codes-payment-global-market-report

Scope Of Quick Response (QR) Codes Payment MarketThe Business Research Company’s reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market’s historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Quick Response (QR) Codes Payment Market Overview

Market Drivers -Increasing smartphone penetration is expected to propel the growth of the quick response (QR) codes payment market going forward. Smartphone penetration refers to the percentage of individuals within a specific population who own and use smartphones, indicating the level of smartphone adoption within that group or region. Rising smartphone penetration is driven by increased affordability, technological advancements, and growing demand for mobile connectivity and functionality. Smartphones utilize QR codes for payments by scanning the code displayed at the point of sale, linking to the user’s payment app or digital wallet, and facilitating secure transactions. For instance, in April 2022, according to the Department of Telecommunications under the Ministry of Information and Communications, a Vietnam-based regulatory agency, Vietnam recorded 91.3 million smartphone subscribers in 2021. This figure increased by over 2 million at the end of March 2022, resulting in a total of 93.5 million subscribers, equivalent to 73.5% of the nation’s adult population. Therefore, the increasing smartphone penetration is driving the growth of the quick response (QR) codes payment market.

Market Trends – Major companies operating in the quick response (QR) code payment market focused on developing innovative products, such as QR code devices, to enhance the user experience and accelerate adoption. A QR code device is a tool or gadget capable of generating, displaying, or scanning QR codes. For instance, in February 2024, SuperUs, an India-based technology company, launched the Dynamic QR Code device, which is set to transform digital payments in India, seamlessly merging cash and checkout terminals to offer unmatched transaction experiences for businesses and customers. Positioned as a cost-effective solution, it removes the need for upfront expenses on hardware, software, and training. Additionally, it substantially cuts down on reconciliation costs, promising significant returns on investment for businesses.

The quick response (QR) codes payment market covered in this report is segmented –

1) By Offering: Solution, Services

2) By Payment Type: Push Payment, Pull Payment

3) By Transaction Channel: Face-To-Face, Remote

4) By End-Users: Restaurant, Retail And E-Commerce, E-Ticket Booking, Other End-Users

Get an inside scoop of the quick response (qr) codes payment market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=15911&type=smp

Regional Insights – Asia-Pacific was the largest region in the quick response (QR) codes payment market in 2023. The regions covered in the quick response (QR) codes payment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies – Major companies operating in the quick response (QR) codes payment market are Amazon.com Inc., Apple Inc., Google LLC, Samsung Electronics Co. Ltd., Alibaba Group Holding Limited, Tencent Holdings Limited, PayPal Holdings Inc., Fiserv Inc., Square Inc., Stripe Inc., MercadoLibre Inc., Dana Inc., PayU , OVO Energy Ltd., PT Gojek Indonesia , Adyen N.V., Worldpay Inc. , Klarna Bank AB, Grab Holdings Inc., Ingenico Group, One 97 Communications Paytm Ltd., Ant Financial Services Group, Payoneer Inc., Verifone Systems Inc., Twint AG, PhonePe Private Limited, Early Warning Services LLC

Table of Contents

- Executive Summary

- Quick Response (QR) Codes Payment Market Characteristics

- Quick Response (QR) Codes Payment Market Trends And Strategies

- Quick Response (QR) Codes Payment Market – Macro Economic Scenario

- Global Quick Response (QR) Codes Payment Market Size and Growth

…..

- Global Quick Response (QR) Codes Payment Market Competitive Benchmarking

- Global Quick Response (QR) Codes Payment Market Competitive Dashboard

- Key Mergers And Acquisitions In The Quick Response (QR) Codes Payment Market

- Quick Response (QR) Codes Payment Market Future Outlook and Potential Analysis

- Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/