What is the present valuation and projected CAGR of the renters insurance market?

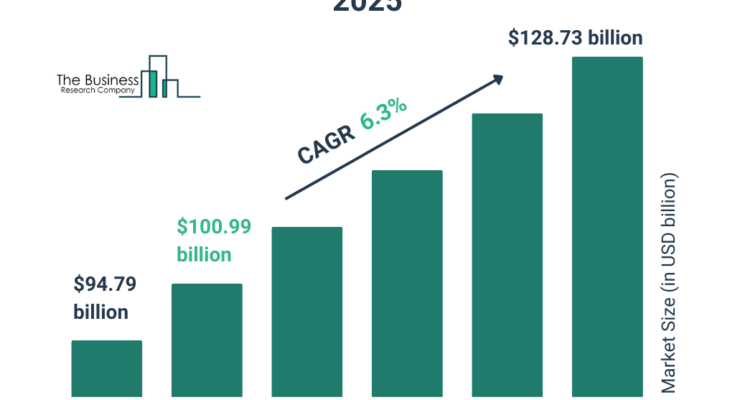

The renters insurance market size has grown strongly in recent years. It will grow from $94.79 $ billion in 2024 to $100.99 $ billion in 2025 at a compound annual growth rate (CAGR) of 6.5%. The growth in the historic period can be attributed to the increasing trend of urbanization, growing awareness about the benefits of renters insurance, high incidences of property damage, growing supply of rental properties, and legal requirements.

The renters insurance market size is expected to see strong growth in the next few years. It will grow to $128.73 $ billion in 2029 at a compound annual growth rate (CAGR) of 6.3%. The growth in the forecast period can be attributed to the growth of digital insurance platforms, awareness and education initiatives, integration with smart home technology, economic recovery and stability, and collaborations with real estate and property management firms. Major trends in the forecast period include growing demand for customizable policies, expansion of coverage options, increased focus on affordability, the rising importance of customer experience, sustainability, and green initiatives.

Get Your Free Sample of The Global Renters Insurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19677&type=smp

What key drivers have fueled the renters insurance market’s development over the years?

The increasing instances of natural disasters are expected to propel the growth of the renters insurance market going forward. Natural disasters are severe and sudden environmental events caused by natural processes of the earth that result in significant damage, disruption, and loss of life or property. The increasing frequency of natural disasters is primarily due to the effects of climate change and environmental degradation. Renters insurance provides financial protection for tenants against loss or damage to personal property and liability claims resulting from natural disasters, covering costs such as repairs, temporary relocation, and replacement of belongings. For instance, in March 2024, the United Nations Office for the Coordination of Humanitarian Affairs (OCHA), a US-based intergovernmental organization, reported that 399 natural hazards and disaster events occurred worldwide in 2023, slightly surpassing the 2022 average of 387 events. Therefore, the increasing instances of natural disasters are driving the growth of the renters insurance market.

What is the segmentation for the renters insurance market?

The renters insurancemarket covered in this report is segmented –

1) By Type: Property Coverage, Guest Medical Coverage, Family Liability Coverage

2) By Distribution Channels: Online, Offline

3) By Application: Apartment, Condo, Home

4) By End User: Business, Individuals

Subsegments:

1) Property Coverage: Personal Property Coverage, Replacement Cost Coverage, Actual Cash Value Coverage

2) Guest Medical Coverage: Medical Payments for Guests, Personal Injury Coverage, No-Fault Medical Payments

3) Family Liability Coverage: Personal Liability Coverage, Legal Defense Costs, Landlord-Related Liability Coverage

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/renters-insurance-global-market-report

Who are the most influential companies in the renters insurance market?

Major companies operating in the renters insurance market are State Farm Insurance, MetLife Inc., Nationwide Mutual Insurance Company, Allstate Property and Casualty Insurance Company., Liberty Mutual Insurance Company, Progressive Corporation, Chubb Limited, The Travelers Companies Inc., United Services Automobile Association (USAA), Hartford Financial Services, American Family Insurance Group (AFIG), Farmers Insurance Group, The Cincinnati Insurance Company, Mercury General Corporation, Amica Mutual Insurance Company, Westfield Insurance, Esurance, Grange Insurance, Edison Insurance Company, Intact Insurance Specialty Solutions, Root Inc., Lemonade Inc., Hippo Insurance Services, National General Insurance, SentryWest Insurance Services

What are the top industry trends projected to impact the renters insurance market?

Major companies operating in the renters insurance market are focusing on developing innovative solutions, such as artificial intelligence (AI)-powered renters insurance solutions, to enhance the customer experience. AI-powered renters insurance solutions leverage AI to automate underwriting, personalize coverage, and expedite claim processing for renters. For instance, in April 2024, Kanguro Insurance, a US-based insurance company, launched an innovative renter’s insurance solution for the Texas market. The new product offers several features to enhance the customer experience, including AI-driven policy creation, affordable premiums customized to customers’ needs, and a simplified claims process for greater convenience. The company has created a user-friendly claims process, making it easy for customers to handle their claims and ensuring that support is readily available when needed. The overall design of the renters insurance product demonstrates a tech-forward, customer-centric approach, prioritizing accessibility and affordability, including personalized premiums that suit customers’ budgets.

What are the major regional insights for the renters insurance market, and which region holds the top position?

North America was the largest region in the renters insurance market in 2024. The regions covered in the renters insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Renters Insurance Market Report 2025 Offer?

The renters insurance market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Renters insurance is a type of insurance policy designed for individuals who rent their living space, such as an apartment or house. It provides coverage for personal belongings against risks such as theft, fire, and water damage, and may also include liability protection for accidents occurring within the rented property. This service ensures that renters can recover financially from unexpected events that might damage or destroy their possessions.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19677

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model