What is the present valuation and projected CAGR of the reverse mortgage market?

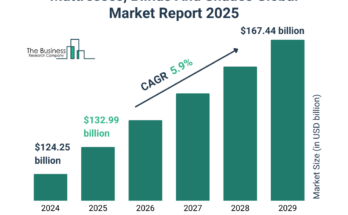

The reverse mortgage market size has grown strongly in recent years. It will grow from $1.79 billion in 2024 to $1.92 billion in 2025 at a compound annual growth rate (CAGR) of 7.6%. The growth in the historic period can be attributed to an increase in the aging population, a rise in home values, a rise in low-interest rates, increased financial awareness, a rise in desire for supplemental retirement income, a rise in homeownership trends, and a rise in government-backed loan programs.

The reverse mortgage market size is expected to see strong growth in the next few years. It will grow to $2.54 billion in 2029 at a compound annual growth rate (CAGR) of 7.2%. The growth in the forecast period can be attributed to rising demand for retirement income solutions, growing interest in financial literacy programs, rising demand for customized financial solutions, rising demand for long-term care funding solutions, and rising popularity of home sharing and equity release options. Major trends in the forecast period include the integration of virtual reality for property valuation, the development of online educational platforms for consumer awareness, enhanced cybersecurity measures, blockchain technology for secure transactions, and artificial intelligence in loan processing.

Get Your Free Sample of The Global Reverse Mortgage Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=21562&type=smp

What key drivers have fueled the reverse mortgage market’s development over the years?

The increasing home values are expected to drive the growth of the reverse mortgage market going forward. Home values refer to the current market price of a property based on factors such as location, condition, and demand, while equity is the difference between the home’s market value and the outstanding mortgage balance, representing the portion owned by the homeowner. Increasing home values and equity are driven by factors such as low interest rates, strong demand in desirable locations, economic growth, and improvements in local infrastructure and amenities. Home values directly influence the equity available for reverse mortgages, as higher home values result in greater equity that can be accessed by homeowners through these financial products. For instance, in December 2024, according to the House of Commons Library, a UK-based government agency, it was reported that house prices increased by 3.4% between October 2023 and October 2024. Additionally, on a seasonally adjusted basis, the average house prices experienced a 0.5% rise from September to October 2024. Therefore, the increasing home values are driving the growth of the reverse mortgage market.

What is the segmentation for the reverse mortgage market?

The reverse mortgage market covered in this report is segmented –

1) By Type: Home Equity Conversion Mortgages (HECMs), Single-Purpose Reverse Mortgages, Proprietary Reverse Mortgages

2) By Application: Debt, Health Care Related, Renovations, Income Supplement, Living Expenses

3) By End-User: Seniors, Retirees, Homeowners

Subsegments:

1) By Home Equity Conversion Mortgages (HECMs): Fixed-Rate HECMs, Adjustable-Rate HECMs, HECM for Purchase (H4P)

2) By Single-Purpose Reverse Mortgages: Government-Sponsored Programs, Non-Profit Sponsored Programs

3) By Proprietary Reverse Mortgages: Jumbo Reverse Mortgages, Private Lender Products

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/reverse-mortgage-global-market-report

Who are the most influential companies in the reverse mortgage market?

Major companies operating in the reverse mortgage market are Fairway Independent Mortgage Corporation, HomeBridge Financial Services Inc., New American Funding, Movement Mortgage LLC, PHH Mortgage Corporation, American Pacific Mortgage Corporation, The Federal Savings Bank, American Financial Network Inc., Bay Equity LLC, Plaza Home Mortgage Inc., Open Mortgage, Longbridge Financial LLC, Land Home Financial Services Inc., Homestead Funding Corp., Mutual Of Omaha Mortgage, Salem Five Mortgage Company LLC, LeaderOne Financial Corporation, HighTechLending Inc., Advisors Mortgage Group LLC, Radius Financial Group Inc., South River Mortgage LLC, Guild Holdings Company, All Reverse Mortgage Inc.

What are the top industry trends projected to impact the reverse mortgage market?

Major companies operating in the reverse mortgage market are focusing on developing innovative solutions, such as customizable products, improving digital platforms for better customer experience, and expanding loan options to cater to different financial needs. For instance, in April 2024, Portfolio+ Inc., a Canada-based software company, launched the Portfolio+ reverse mortgage product. This innovative solution aims to empower financial institutions to meet the growing demand for reverse mortgages, allowing homeowners aged 55 and older to access tax-free equity in their homes. The product features customizable terms and interest rates, enabling lenders to tailor offerings to individual client needs, and ensures seamless end-to-end processing from origination to funding.

What are the major regional insights for the reverse mortgage market, and which region holds the top position?

North America was the largest region in the reverse mortgage market in 2024. The regions covered in the reverse mortgage market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Reverse Mortgage Market Report 2025 Offer?

The reverse mortgage market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

A reverse mortgage is a type of loan available to homeowners, typically age 62 or older, that allows them to convert part of their home equity into cash without having to sell the property. The loan is repaid when the homeowner moves out, sells the home, or passes away.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=21562

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model