Get 20% OFF on all 2025 Global Market Reports until March 31st! Apply code FY25SAVE and grab your savings today!

What are the latest figures on the sales tax software market’s size and projected CAGR?

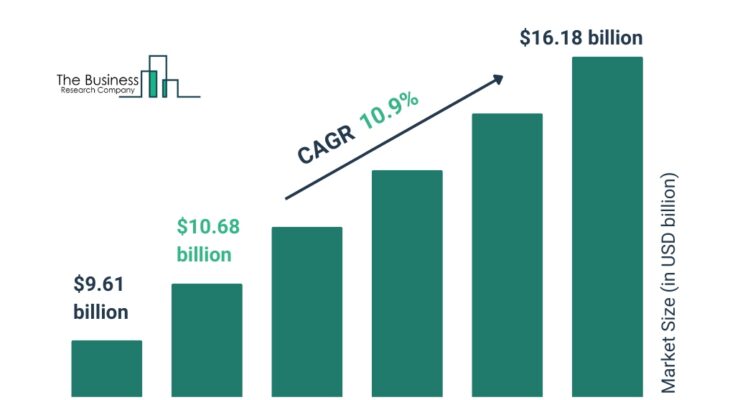

The sales tax software market size has grown rapidly in recent years. It will grow from $9.61 billion in 2024 to $10.68 billion in 2025 at a compound annual growth rate (CAGR) of 11.2%. The growth in the historic period can be attributed to increase in complexity of tax regulations, rise of e-commerce, globalization of trade, rise in demand for automation to reduce human errors, stricter government compliance requirements, growth in adoption of cloud-based solutions, and rise in need for real-time tax rate updates.

The sales tax software market size is expected to see rapid growth in the next few years. It will grow to $16.18 billion in 2029 at a compound annual growth rate (CAGR) of 10.9%. The growth in the forecast period can be attributed to increasing adoption of e-commerce and omnichannel retail, expanding global trade necessitating cross-border tax compliance, evolving tax regulations, rising demand for automation to reduce manual errors, rising focus on data security and compliance, and the growing preference for cloud-based solutions. Major trends in the forecast period include integration of AI-powered tax rate accuracy, adoption of real-time compliance updates, seamless ERP and e-commerce integrations, advanced exemption certificate management, adoption of blockchain-enabled audit trails, and enhanced user-friendly dashboards with predictive analytics.

Get Your Free Sample of The Global Sales Tax Software Market Report:

Sales Tax Software Market Outlook And Forecast Report 2025-2034 Sample

Which Market drivers have played a significant role in driving the sales tax software market?

The rise in digital transactions is expected to drive the growth of the sales tax software market going forward. Digital transactions are electronic exchanges of value using online or mobile platforms for secure and efficient payments. The rise in digital transactions is due to internet growth, smartphone usage, advanced payment technologies, and a shift towards cashless and contactless payment methods. Sales tax software is crucial in managing tax compliance for digital transactions, ensuring accuracy and efficiency in tax calculations across online platforms. For instance, in June 2024, according to Australia and New Zealand Banking Group, an Australia-based financial services company, in 2023, global non-cash transactions totaled 1.3 trillion and are expected to grow to 2.3 trillion by 2027. Therefore, the rise in digital transactions is driving the growth of the sales tax software market.

What are the key segments within the sales tax software market?

The sales tax software market covered in this report is segmented –

1) By Solution: Tax filings, Consumer Use Tax Management, Other Solutions

2) By Deployment: Cloud, On-Premises

3) By Application: Sales Tax Calculation And Reporting, Tax Audit And Compliance, Tax Exemption Management, Tax Return Preparation

4) By End-User: Information Technology (IT) And Telecom, Banking, Financial Services, And Insurance (BFSI), Healthcare, Transportation, Retail, Other End Users

Subsegments:

1) By Tax Filings: Automated Tax Calculation, Electronic Filing, Tax Compliance Reporting

2) By Consumer Use Tax Management: Use Tax Calculation, Exemption Certificate Management, Audit And Compliance Tracking

3) By Other Solutions: VAT And GST Compliance, Sales Tax Rate Management, Cross-Border Tax Management

Order your report now for swift delivery

Sales Tax Software Market Outlook And Forecast Report 2025-2034

Which key players are shaping the sales tax software market?

Major companies operating in the sales tax software market are Oracle Corporation, SAP Inc., Intuit Inc., Vertex Pharmaceuticals, Thomson Reuters, Wolters Kluwer N.V., Infor Inc., Zoho Corporation, Stripe Inc., Sage Group plc, Epicor Software Corporation, Xero Limited, Avalara, Taxify, Vertex Inc., Sovos Compliance, Gusto Inc., MYOB, Sage Intacct Inc., Acumatica Inc., Wave Accounting, Taxually, TaxJar

Which transformative trends will shape the sales tax software market landscape?

Major companies operating in the sales tax software market are focusing on developing advanced products, such as a cloud-based tax automation platform, to enhance user experience, streamline tax compliance processes, and ensure accuracy in tax calculations across diverse industries and jurisdictions. A cloud-based tax automation platform is a software solution hosted on the cloud that helps businesses streamline and automate tax-related processes, such as tax calculation, compliance, filing, reporting, and documentation. For instance, in May 2023, CereTax Inc., a US-based software company, launched its new user interface designed to simplify the sales tax automation process for businesses of all sizes. The new portal in CereTax’s cloud-based tax automation platform simplifies sales tax management by enabling users to handle tax calculations, rules, and detailed reporting easily. Designed for simplicity and efficiency, the interface enhances operational continuity for businesses. By focusing on flexibility and user experience, the portal elevates the platform’s capability to deliver advanced tax solutions while maintaining a user-centric approach.

How do regional factors impact the sales tax software market, and which region is the largest contributor?

North America was the largest region in the sales tax software market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the sales tax software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Sales Tax Software Market Report 2025 Offer?

The sales tax software market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Sales tax software is a digital solution designed to automate and streamline the sales tax compliance process for businesses. This software calculates applicable taxes, manages exemption certificates, and updates tax rates automatically, ensuring accurate and efficient adherence to national and local tax laws. It simplifies tax reporting, filing, and remittance complexities, reducing the risk of errors and penalties by integrating seamlessly with accounting and sales systems.

Purchase the exclusive report now to unlock valuable market insights:

Sales Tax Software Market Outlook And Forecast Report 2025-2034

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: The Business Research Company | LinkedIn

Twitter: The Business Research Company (@tbrc_info) on X

Facebook: The Business Research Company | London

YouTube: The Business Research Company

Blog: Comprehensive Analysis of the Workforce Optimization Market 2025-2034: Growth Rates, Trends, and Future Opportunities – Latest Global Market Insights

Healthcare Blog: Latest Healthcare Research Reports – By The Business Research Company

Global Market Model: Global Market Intelligence Database