stockbroking market share, stockbroking market report, stockbroking market trends, stockbroking market size, stockbroking market forecast, stockbrokingIndustry overview

What are the recent trends in market size and growth for the stockbroking market?

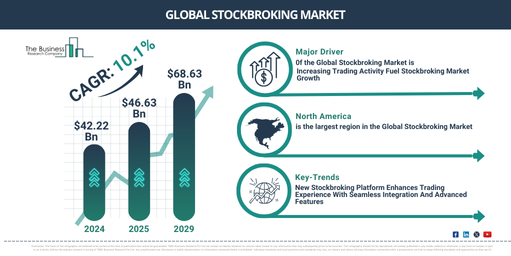

The stockbroking market size has grown rapidly in recent years. It will grow from $42.22 billion in 2024 to $46.63 billion in 2025 at a compound annual growth rate (CAGR) of 10.4%. The growth in the historic period can be attributed to the globalization of financial markets, the rise of retail investors, financial innovation, the proliferation of the Internet, and increased financial literacy.

The stockbroking market size is expected to see rapid growth in the next few years. It will grow to $68.63 billion in 2029 at a compound annual growth rate (CAGR) of 10.1%. The growth in the forecast period can be attributed to rising adoption of mobile trading apps, expansion of robo-advisory services, sustainable investing, regulatory changes, and increasing focus on cybersecurity. Major trends in the forecast period include integration of artificial intelligence and machine learning, increasing involvement in blockchain technology, sustainable investing, financial inclusion, and increasing collaboration and integration with fintech companies.

Get Your Free Sample of The Global Stockbroking Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18745&type=smp

How have varous drivers impacted the growth of the stockbroking market?

The increasing trading activity is expected to propel the growth of the stockbroking market going forward. Trading involves buying and selling financial instruments, commodities, or goods to generate profit in various markets, such as stocks, forex, and commodities. The rising trading activity is fueled by economic fluctuations, improved trading platforms, and increased investor participation. Stockbroking facilitates trading by providing access to markets, investment advice, and the execution of buy and sell orders for investors. For instance, in December 2023, according to the Office for National Statistics, a UK-based government department, in 2022, the proportion of UK quoted shares held by overseas investors reached a record high of 57.7%, up from 56.3% in 2020, continuing the long-term trend of increasing foreign ownership. Therefore, the increasing trading activity is driving the growth of the stockbroking market.

What are the primary segments of the stockbroking market?

The stockbroking market covered in this report is segmented –

1) By Trading Type: Short-Term Trading, Long-Term Trading

2) By Type Of Broker: Full-Service Brokers, Discount Brokers, Robo-Advisors

3) By Mode: Offline, Online

4) By Services: Order Execution, Advisory, Discretionary, Other Services

5) By End User: Retail Investor, Institutional Investor

Subsegments:

1) By Short-Term Trading: Day Trading, Swing Trading, Scalping, High-Frequency Trading (HFT), Position Trading, Options And Futures Trading, Margin Trading

2) By Long-Term Trading: Buy And Hold, Value Investing, Dividend Investing, Growth Investing, Index Investing, Real Estate Investment Trusts (REITs), ETFs (Exchange-Traded Funds), Mutual Fund Investing

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/stockbroking-global-market-report

Which firms are leading the stockbroking market?

Major companies operating in the stockbroking market are JPMorgan Chase & Co, Citigroup Inc., Wells Fargo & Company, Morgan Stanley, BNP Paribas SA, The Goldman Sachs Group Inc., UBS Group AG, Barclays Bank plc, Fidelity Investments, Charles Schwab Corporation, Credit Suisse Group AG, Merrill, Nomura Holdings Inc., LPL Financial Holdings Inc., RBC Capital Markets, T. Rowe Price Investment Services Inc., Interactive Brokers Inc., IG Group Holdings plc, Oppenheimer Holdings Inc., Hargreaves Lansdown plc, The Vanguard Group Inc., TradeStation, Canaccord Genuity Group Inc.

How willIndustry trends affect the trajectory of the stockbroking market?

Major companies operating in the stockbroking market are focused on developing innovative solutions, such as stockbroking platforms, to gain a competitive edge. A stockbroking platform refers to an online service that facilitates the buying and selling of securities, manages investment portfolios, and provides market information. For instance, in August 2023, PhonePe Private Limited, an India-based software company, launched the stockbroking platform Share(dot)Market. The platform features seamless integration with the PhonePe app, allowing users to trade stocks directly from their accounts. It offers user-friendly tools for tracking investments, real-time market data, and personalized recommendations, enhancing the overall trading experience.

Which geographic trends are shaping the stockbroking market, and which region has the highest market share?

North America was the largest region in the stockbroking market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the stockbroking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Stockbroking Market Report 2025 Offer?

The stockbroking market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Stockbroking is a financial service that involves the buying and selling of securities, such as stocks and bonds, on behalf of clients. Stockbrokers provide essential services, including investment advice, trade execution, and portfolio management. They assist clients in making informed investment decisions and navigating the complexities of financial markets to optimize their returns and achieve their financial objectives.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18745

About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights fromIndustry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model