What are the latest figures on the trade credit insurance market’s size and projected CAGR?

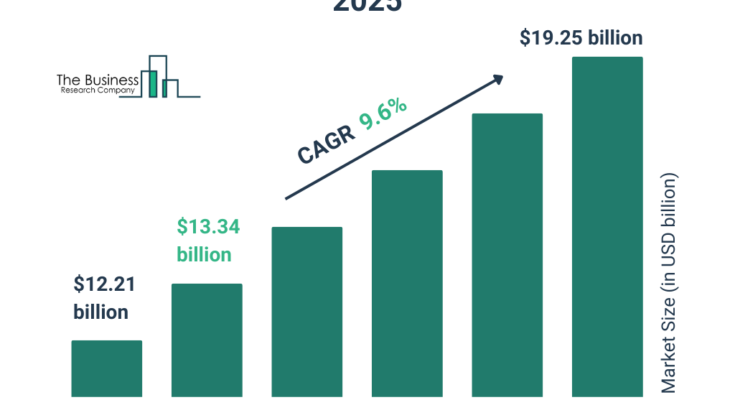

The trade credit insurance market size has grown strongly in recent years. It will grow from $12.21 billion in 2024 to $13.34 billion in 2025 at a compound annual growth rate (CAGR) of 9.3%. The growth in the historic period can be attributed to global economic uncertainty, market expansion and international trade growth, risk mitigation for small and medium enterprises (SMEs), compliance with regulatory requirements, access to financing and improved credit terms.

The trade credit insurance market size is expected to see strong growth in the next few years. It will grow to $19.25 billion in 2029 at a compound annual growth rate (CAGR) of 9.6%. The growth in the forecast period can be attributed to global trade volatility, increased focus on supply chain resilience, digitalization of trade finance, emergence of new market entrants, strategic risk management in a post-pandemic landscape. Major trends in the forecast period include blockchain technology for enhanced security, increased demand for non-cancellable policies, risk mitigation strategies for supply chain disruptions, evolving regulatory landscape, rise of parametric insurance solutions.

Get Your Free Sample of The Global Trade Credit Insurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9029&type=smp

Which major factors have contributed to the expansion of the trade credit insurance market?

A surge in the global import and export of goods and services is expected to propel the growth of the trade credit insurance market going forward. Exporting refers to selling products and services to a foreign country. Contrarily, importing is the act of acquiring goods and services from outside and bringing them into one’s own nation. Trade credit insurance is employed to shield trading companies’ receivables from credit concerns. Trade credit is a tool used by producers, importers, and exporters to simplify finance operations. Trade growth has therefore increased the demand for trade credit insurance. For instance, in October 2024, according to the World Trade Organization, a Switzerland-based international government organization, global goods trade is expected to grow by 2.7% in 2024, slightly higher than the previous estimate of 2.6%, according to WTO economists’ updated forecast from October 10. The volume of world merchandise trade is anticipated to rise by 3.0% in 2025. Therefore, a surge in the global import and export of goods and services is driving the growth of the trade credit insurance market.

How is the trade credit insurance market segmented?

The trade credit insurance market covered in this report is segmented –

1) By Component: Product, Services

2) By Coverages: Whole Turnover Coverage, Single Buyer Coverage

3) By Application: Domestic, Exports

4) By Industry Vertical: Food And Beverages, IT and Telecom, Metals And Mining, Healthcare, Energy And Utilities, Automotive, Other Industry Verticals

Subsegments:

1) By Product: Whole Turnover Insurance, Single Buyer Insurance, Political Risk Insurance, Export Credit Insurance

2) By Services: Risk Assessment Services, Claims Management Services, Debt Collection Services, Consulting And Advisory Services

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/trade-credit-insurance-global-market-report

Who are the top competitors in the trade credit insurance market?

Major companies operating in the trade credit insurance market include Export Development Canada, AXA SA, American International Group Inc., Chubb Limited, Liberty Mutual Insurance Company, Sompo Japan Insurance Inc., Mapfre S.A., Marsh & McLennan Companies Inc., Cesce SpA, QBE Insurance Group Limited, Markel Corporation, Aon plc, CNA Financial Corporation, Hannover Re, Willis Towers Watson Public Limited Company, Zurich Insurance Group AG, AmTrust Financial Services Inc., Tokio Marine HCC, Atradius N.V., Euler Hermes Aktiengesellschaft, Coface SA, CBL Insurance Limited, Credendo Group, Nexus Underwriting Management Limited, China Export & Credit Insurance Corporation (Sinosure), Sinosure, CNA Hardy

Which key trends are expected to influence the trade credit insurance market in the coming years?

Technology advancements have emerged as a key trend gaining popularity in the trade credit insurance market. Major companies operating in the trade credit insurance market are focused on developing new technological solutions to strengthen their position in the market. For instance, in April 2024, Allianz Trade, a France-based trade credit insurance company, launched next generation Trade Credit Insurance product, a B2B insurance product designed to cover the non-payment risks of trade receivables. This activates in the event a customer cannot pay under the terms of an agreed contract. It also offers a number of features like Enhanced product offerings with retrospective cover, CEND, and delayed effect cover. Improved user experience with streamlined documentation and online access. Expanded opportunities for international growth.

Which regional trends are influencing the trade credit insurance market, and which area dominates the industry?

The countries covered in the trade credit insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

What Does The Trade Credit Insurance Market Report 2025 Offer?

The trade credit insurance market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Trade credit insurance refers to a useful financial risk management strategy that protects the business from damages incurred as a result of unpaid trade-related obligations. Trade credit insurance protection is used for providing products and services against any non-payment or delays in trade credit payments resulting from commercial or political risks.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9029

About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model