What is the current market size and future outlook for the vehicle as a service market?

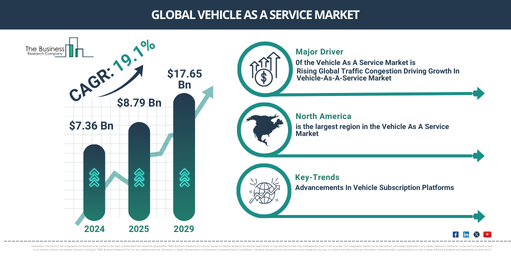

The vehicle as a service market size has grown rapidly in recent years. It will grow from $7.36 $ billion in 2024 to $8.79 $ billion in 2025 at a compound annual growth rate (CAGR) of 19.4%. The growth in the historic period can be attributed to supportive policies and incentives for electric vehicles and shared mobility services, rising adoption of electric vehicles, rising disposable incomes, expansion of VaaS services in emerging markets, increasing public awareness and acceptance of shared mobility solutions.

The vehicle as a service market size is expected to see rapid growth in the next few years. It will grow to $17.65 $ billion in 2029 at a compound annual growth rate (CAGR) of 19.1%. The growth in the forecast period can be attributed to rising demand for mobility solutions, growing awareness of environmental issues, increasing urban population density, growth of ride-sharing services, increasing popularity of vehicle subscription services. Major trends in the forecast period include innovations in vehicle connectivity, integration of VaaS solutions, development and deployment of autonomous vehicles, integration with smartphones and digital payment systems, utilization of big data and analytics.

Get Your Free Sample of The Global Vehicle As A Service Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19747&type=smp

How has the vehicle as a service market evolved, and what factors have shaped its growth?

The rising global traffic congestion and jams are expected to propel the growth of the vehicle-as-a service market going forward. Traffic congestion refers to the condition where vehicles on a road network experience delays due to excessive volume, resulting in slower speeds and longer travel times. Rising global traffic congestion and jams are primarily due to increasing urbanization, population growth, inadequate infrastructure development, and a growing number of vehicles on the road. Vehicle-as-a-Service (VaaS) can alleviate traffic congestion and jams by promoting shared mobility and reducing the number of individual vehicles on the road, leading to more efficient and optimized transportation. For instance, in January 2024, according to a report published by INRIX, a US-based provider of real-time traffic information and connected driving services, traffic congestion worsened in 98 of the top 100 urban areas in 2023 compared to the previous year. 71 of these cities experienced double-digit percentage increases in traffic delays in 2022. Additionally, drivers in New York City lost an average of 101 hours to traffic jams in 2023, resulting in economic losses exceeding $9.1 billion due to wasted time. Therefore, rising global traffic congestion and traffic jams will drive the growth of the vehicle as a service market.

What are the major segments of the vehicle as a service market?

The vehicle as a servicemarket covered in this report is segmented –

1) By Service Type: Subscription Management, Asset Management, Vehicle And Status Monitoring Service, Other Service Types

2) By Engine: Electric, IC Engine

3) By Vehicle: Passenger Cars, Trucks, Utility Trailers, Motorcycles

4) By Service Provider: Automotive Original Equipment Manufacturer (OEM), Auto Dealerships, Auto Tech Startups, Car Subscription Software Providers

5) By End-User: Enterprise Users, Private Users

Subsegments:

1) Subscription Management: Fleet Subscription Services, Short-Term Subscription Services

2) Asset Management: Vehicle Tracking and Maintenance, Inventory Management

3) Vehicle And Status Monitoring Service: Real-Time Monitoring, Diagnostic Services

4) Other Service Types: Route Optimization, Customer Support Services

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/vehicle-as-a-service-global-market-report

Which companies dominate the vehicle as a service market?

Major companies operating in the vehicle as a service market are Volkswagen AG, Toyota Motor Corporation, Tata Group, Ford Motor Company, Mercedes-Benz Group, General Motors, Bayerische Motoren Werke AG (BMW Group), Hyundai Motor Group, Accenture Plc, AB Volvo, Porsche AG, Uber Technologies Inc., AutoNation, Nokia Corporation, DiDi Chuxing, LeasePlan Corporation NV, Hertz Corporation, Orange Business Services, Lyft Inc., Sixt SE, Kelsian Group, CarNext B.V., Zoomcar, Cluno GmbH, Bipi

How will evolving trends contribute to the growth of the vehicle as a service market?

Major companies operating in the vehicle as a service market are developing flexible and personalized mobility technologies, such as vehicle subscription platforms, to enhance their service offerings and attract new customers by leveraging existing expertise and infrastructure. A vehicle subscription platform is a service that allows customers to access a range of vehicles on a flexible, short-term basis, typically including insurance, maintenance, and other costs within a single monthly fee. For instance, in June 2022, Santander Consumer Finance, a Spain-based finance company, launched its technology platform, Ulity. The unique feature of the platform is its white-label SaaS technology, expertly crafted by Santander Consumer Finance to streamline the development of vehicle subscription-based solutions within the mobility service sector. This platform enables automotive brands, private transport companies, car rental services, leasing firms, large corporations, and auto marketplaces to swiftly and cost-effectively enter the vehicle subscription market, expand their business reach, and attract new customers, all without the need to invest in developing their own solution.

What are the key regional dynamics of the vehicle as a service market, and which region leads in market share?

North America was the largest region in the vehicle as a service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the vehicle as a service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Vehicle As A Service Market Report 2025 Offer?

The vehicle as a service market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Vehicle as a Service (VaaS) refers to a business model where vehicles are offered to customers as a service rather than as a product to be purchased. This model encompasses a range of transportation solutions that are typically subscription-based or pay-per-use. VaaS is designed to provide a more flexible and user-friendly approach to transportation, leveraging technology to meet evolving mobility needs.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19747

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model