What are the recent trends in market size and growth for the venture capital market?

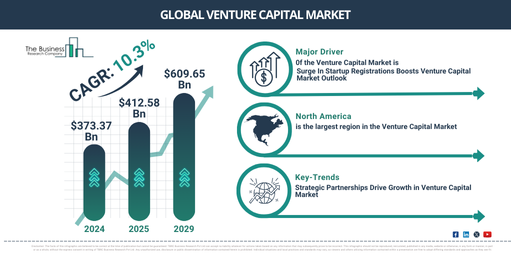

The venture capital market size has grown rapidly in recent years. It will grow from $373.37 $ billion in 2024 to $412.58 $ billion in 2025 at a compound annual growth rate (CAGR) of 10.5%. The growth in the historic period can be attributed to favorable economic conditions, high demand for new products and services, successful exits, globalization, government policies, and incentives.

The venture capital market size is expected to see rapid growth in the next few years. It will grow to $609.65 $ billion in 2029 at a compound annual growth rate (CAGR) of 10.3%. The growth in the forecast period can be attributed to sustainability and ESG trends, shifts in consumer behavior, increased global investment, regulatory developments, and growth in the size and structure of venture capital funds. Major trends in the forecast period include technological innovation, digital transformation, advancements in data analytics and AI tools, fintech innovations, and green technology.

Get Your Free Sample of The Global Venture Capital Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19750&type=smp

How have varous drivers impacted the growth of the venture capital market?

An increasing number of startups is expected to propel the growth of the venture capital market going forward. Startups are newly established companies or ventures that aim to develop unique products or services, often characterized by innovation and high growth potential. The number of startups are increasing due to lower entry barriers, availability of funding, a growing entrepreneurial culture, and the rise of supportive ecosystems. Venture capital provides crucial funding and support for the increasing number of startups, enabling them to scale rapidly, innovate, and bring their products or services to market. For instance, in February 2024, according to The Greater Birmingham Chambers of Commerce, a UK-based business support and networking organization, there was a notable increase in new company registrations, reaching 900,006 in 2023, up from 805,141 in 2022, marking an 11.8% growth. This surge brings the total number of registered companies in the UK to an all-time high of 5,476,772. Therefore, the increasing number of startups will drive the growth of the venture capital market.

What are the primary segments of the venture capital market?

The venture capitalmarket covered in this report is segmented –

1) By Type: Local Investors, International Investors

2) By Fund Size: Under $50 Million, $50 Million to $100 Million, $100 Million to $250 Million, $250 Million to $500 Million, $500 Million to $1 Billion, Above $1 Billion

3) By Industry: Real Estate, Financial Services, Food And Beverages, Healthcare, Transport And Logistics, Information Technology (IT) And IT-enabled Services (ITeS), Education, Other Industries

Subsegments:

1) By Local Investors: Angel Investors, Seed Investors, Corporate Venture Capital (CVC), Family Offices, Local Venture Capital Firms

2) By International Investors: Global Venture Capital Firms, Sovereign Wealth Funds, International Angel Networks, Cross-Border Investment Funds, Multinational Corporations (MNCs) Investing In Startups

Order your report now for swift delivery

https://www.thebusinessresearchcompany.com/report/venture-capital-global-market-report

Which firms are leading the venture capital market?

Major companies operating in the venture capital market are Sequoia Capital Operations LLC, Insight Partners LLC, Tiger Global Management LLC, New Enterprise Associates Inc., Accel Partners LLC, IDG Capital Partners, General Catalyst Group LLC, Benchmark Capital Partners L.P., Seedcamp LLP, Index Ventures LLP, Kleiner Perkins Caufield & Byers LLC, GGV Capital LLC, Greylock Partners LLC, Healthcare Royalty Partners LLC, Redpoint Ventures LLC, HV Holtzbrinck Ventures Adviser GmbH, AAC Capital Partners Limited, Balderton Capital LLP, Nexus Venture Partners LLC, DST Global Ltd., 360 Capital Partners S.A., LocalGlobe LLP, Point Nine Management GmbH, Atlantic Labs GmbH, Union Square Ventures LLC

How will industry trends affect the trajectory of the venture capital market?

Major companies operating in the venture capital market are adopting a strategic partnership approach to enhance their investment opportunities, leverage complementary expertise, and accelerate the growth and success of their portfolio companies. A strategic partnership typically refers to a collaborative relationship between two or more organizations where they combine their resources, expertise, and efforts to achieve common goals or objectives. For instance, in December 2023, Nokia Corporation, a Finland-based company in telecommunications, IT, and consumer electronics, partnered with America’s Frontier Fund (AFF), Roadrunner Venture Studios (RVS) and Celesta Capital to accelerate the commercialization of Nokia Bell Labs’ advanced technologies. This collaboration will focus on innovations in 5G/6G, semiconductor design, AI, sensors, and quantum computing, with AFF and RVS driving venture development and investment, while Celesta Capital scales and accelerates Nokia-backed ventures. Nokia Bell Labs, renowned for its pivotal technological contributions like the transistor, solar cell, and advancements in communications and computing, will spearhead this initiative.

Which geographic trends are shaping the venture capital market, and which region has the highest market share?

North America was the largest region in the venture capital market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the venture capital market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Does The Venture Capital Market Report 2025 Offer?

The venture capital market research report from The Business Research Company offers global market size, growth rate, regional shares, competitor analysis, detailed segments, trends, and opportunities.

Venture capital refers to a form of private equity investment where investors provide funding to early-stage or high-growth companies with the potential for significant returns. This capital is typically used to support the development, expansion, or commercialization of innovative products or services, and in exchange, investors often receive equity stakes in the company.

Purchase the exclusive report now to unlock valuable market insights:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19750

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model