Overview and Scope

Wealth management is the collaborative process of meeting affluent clients’ needs and desires by providing appropriate financial products and services.

Sizing and Forecast

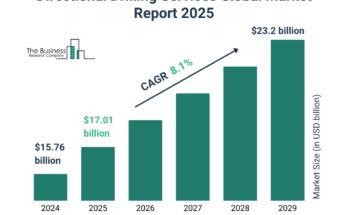

The wealth management market size has grown strongly in recent years. It will grow from $1900.34 billion in 2023 to $2033.05 billion in 2024 at a compound annual growth rate (CAGR) of 7.0%. The growth in the historic period can be attributed to strong emerging markets growth, growth in the number of high-net-worth individuals, digitization and increased internet penetration.

The wealth management market size is expected to see strong growth in the next few years. It will grow to $2678.8 billion in 2028 at a compound annual growth rate (CAGR) of 7.1%. The growth in the forecast period can be attributed to increasing retiree population, increasing wealth of high-net-worth individuals, rising demand for alternative investments, growth in individual investors investments and increase in internet penetration . Major trends in the forecast period include investing in deploying more ai applications for faster customer response, investing in cybersecurity technologies to enhance their security capabilities, offering hybrid services to increase service offerings, consider using robo advice to reduce the cost of fund management, consider investing in big data solutions to improve client acquisition and retention rates, adapt to the changing demographics to drive revenues, focus on offering ethical investing services, focus on providing personalized services and focus on partnerships, collaborations and acquisitions.

Order your report now for swift delivery, visit the link:

https://www.thebusinessresearchcompany.com/report/wealth-management-global-market-report

Segmentation & Regional Insights

The wealth management market covered in this report is segmented –

1) By Type Of Asset Class: Equity, Fixed Income, Alternative Assets, Other Asset class

2) By Advisory Mode: Human Advisory, Robo Advisory, Hybrid Advisory

3) By Type Of Wealth Manager: Private Banks, Investment Managers, Full-Service Wealth Managers, Stockbrokers, Other Type of Wealth Manager

3) By Enterprise Size: Large Enterprises, Medium and Small Enterprises

North America was the largest region in the wealth management market in 2023. Western Europe was the second largest region in the wealth management market. The regions covered in the wealth management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Intrigued to explore the contents? Secure your hands-on a free sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3577&type=smp

Major Driver Impacting Market Growth

Many wealth management firms are increasing spending on their cybersecurity solutions to prevent cyber-attacks. Cybersecurity refers to the set of techniques used to protect the integrity of the network and data from unauthorized access. It enables the strengthening of security levels of the firms and prevents the loss of highly sensitive client information. They are gaining prominence as they aid financial services companies, including wealth management firms, in identifying theft and fraud in investment transactions. For instance, according to a recent survey, 86% of financial services companies are planning to spend more time and resources on cybersecurity in the coming year.

Key Industry Players

Major companies operating in the wealth management market report are Morgan Stanley, Bank of America Corporation, UBS Group AG, Wells Fargo & Company, JPMorgan Chase & Co., Citigroup Inc., HSBC Holdings plc, The Goldman Sachs Group, Inc., Credit Suisse Group AG, BNP Paribas, Kotak Wealth Management, IIFL Wealth Management, Axis Bank Wealth Management, Edelweiss Wealth Management, Angel Broking, Avendus, AUM Capital, KW Wealth Advisors, Noah Holdings, AVIC Trust, CreditEase, Fosun International Limited, China Huarong Asset Management Company Limited, China International Capital Corporation, Goldman Sachs, Macquarie Asset Management, Hamilton Wealth Management, Professional Wealth, Minchin Moore, GFM Wealth Advisory, VISIS Private Wealth, Samsung Asset Management, Asset One, Bank Central Asia, Dolfin, Brewin Dolphin, Canaccord Genuity Wealth Management, Kingswood Group, HSBC, Barclays Wealth Management, Lloyds Banking Group, Santander, AFH Wealth Management, Devonshire Wealth Management, Alexander House Financial Services, St James’s Place Wealth Management, Quilter), Indosuez Wealth Management, Societe Generale, UniCredit, Intesa Sanpaolo, Deutsche Bank, Sparkassen, Commerzbank, ING-DiBa, Arcano Partners, BS Wealth Management, Sberbank, ATON, UBS, Wells Fargo, Vanguard, Charles Schwab, Fidelity, BNY Mellon Wealth Management, Northern Trust, Raymond James Financial, RBC Wealth Management, Bessemer Trust, Longview Wealth Management, Nicola Wealth, Steadyhand Investment management, Triasima Portfolio Management, WealthBar, Northwestern Mutual, Basham Ringe y correa s.c, Galicia abogadosare, Edward Jones, BTG Pactual, Monet Investimentos, Quilvest Wealth Management, Aiva, Credicorp, KPMG, Banco Safra, NBK Wealth Management, NOMW Capital, Middle East Financial Investment Company, Jadwa Investment, Arbah Capital, BMO Global Asset Management, AtaInvest, Akbank, Protiviti, Al Rajhi Capital, CI Capital, Griffon Capital, Pioneer Wealth Management, Investec Wealth Management, Rockfin Wealth Management, PSG Wealth, Citadel, Sanlam Private Wealth, Nedbank Wealth, Stone Wealth Management Noble Wealth Management (Pty) Ltd, NFB Private Wealth Management, NEXUS Investment Solution PLC, Brenthurst Wealth management, New Dawn Wealth Management, Alger

The wealth management market report table of contents includes:

1. Executive Summary

2. Wealth Management Market Characteristics

3. Wealth Management Product/Service Analysis -Product/Service Examples

4. Wealth Management Market Trends And Strategies

5. Wealth Management Market – Macro Economic Scenario

……………………..

68. Global Wealth Management Market Competitive Benchmarking

69. Global Wealth Management Market Competitive Dashboard

70. Key Mergers And Acquisitions In The Wealth Management Market

71. Wealth Management Market Future Outlook and Potential Analysis

72. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model